Fed: Towards a very divided Fed in the coming months and quarters

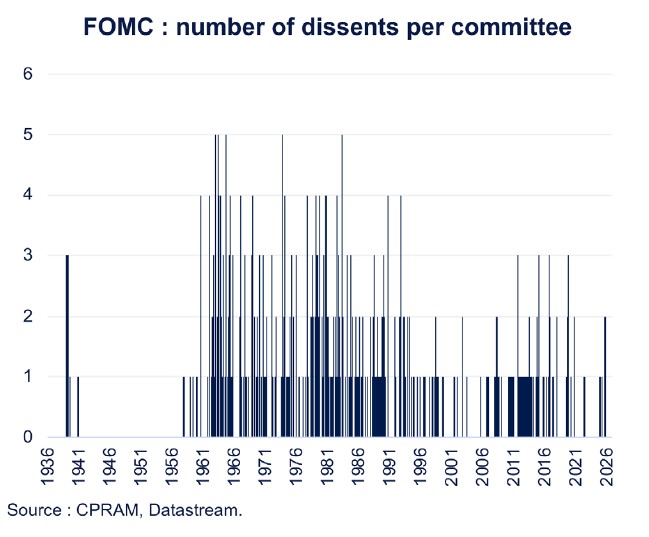

At the October FOMC, Jerome Powell noted significant differences of views. In a rather unusual move, votes will need to be counted at the December FOMC. Due to changes in the composition of the FOMC, the Fed is expected to remain very divided in 2026.

Published on 28 November 2025

Brief history of FOMC dissents

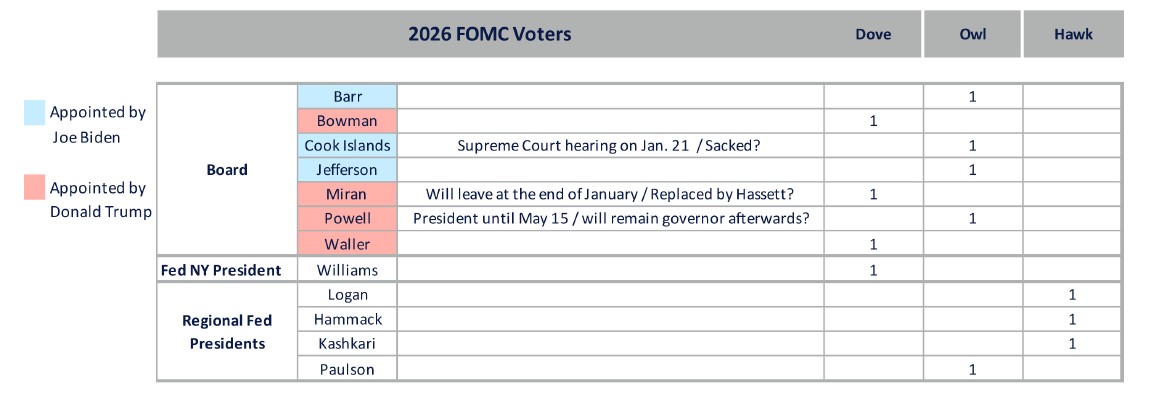

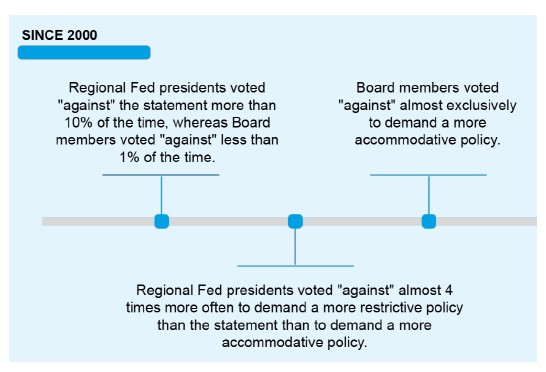

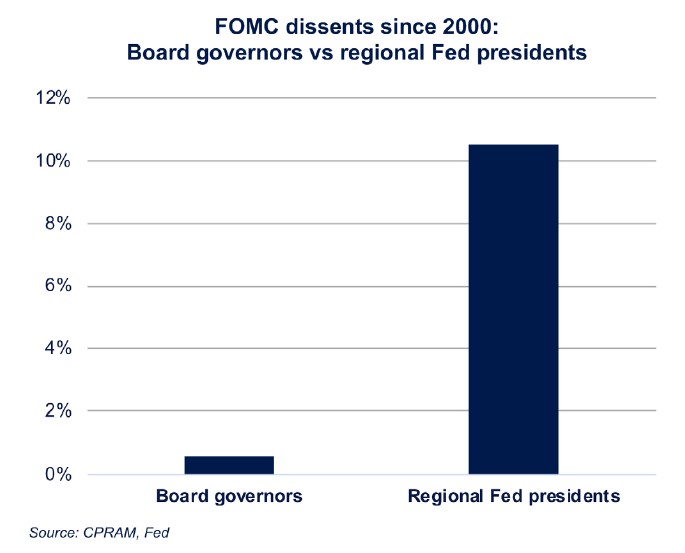

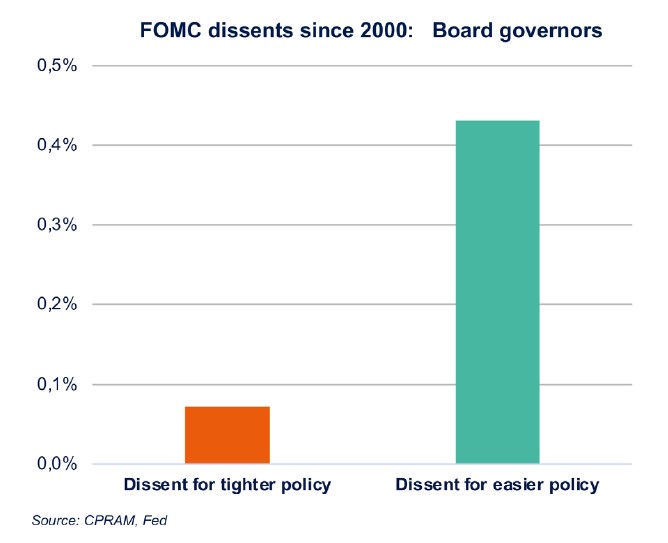

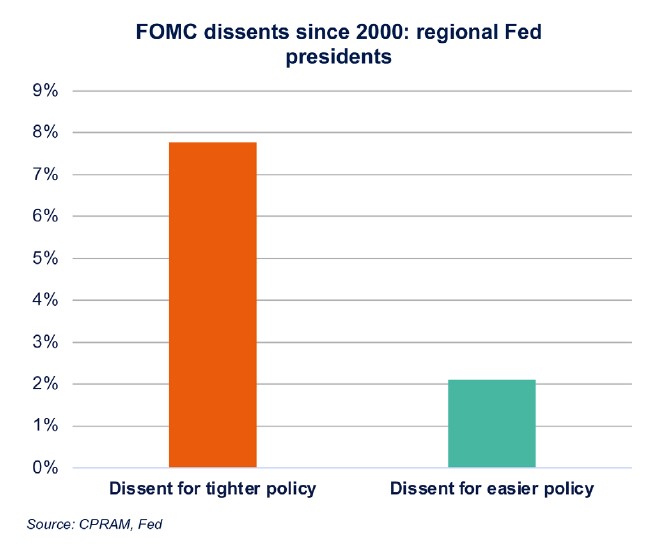

Let us recall the functioning of the Federal Open Market Committee (FOMC). It is composed of the 7 members of the Board of Governors, the president of the New York Fed, and 4 presidents of regional Feds (there is an annual rotation among the other 11 regional Fed presidents). The regional Fed presidents and the group consisting of the Board members and the New York Fed president vote in very different ways.

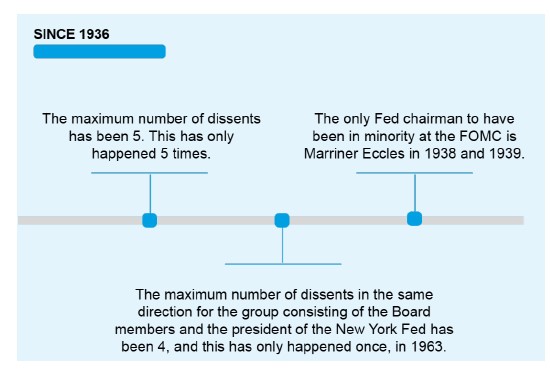

Here are some statistics to keep in mind:

A division that should be very strong for the December 2025 FOMC

For the moment, 3 Board members and the President of the New York Fed have expressed support for a 25 basis point rate cut in December, while one Board member and 4 regional Fed presidents have expressed support for maintaining the status quo. The small group of 3 Board members, including Chair Powell, Vice Chair Jefferson, and Lisa Cook, will therefore tip the balance towards either a rate cut or the status quo. It is very likely that all three will vote in a coordinated manner. From there, two possible scenarios arise:

- The three undecided join the 3 Board members and the New York Fed President in favor of a rate cut. In this case, there would be 5 dissents at the FOMC (4 regional Fed presidents and one governor), which has only happened 5 times since 1936.

- The three undecided join the supporters of the status quo in December. In this case, there would be 4 uniformly "against" votes within the group consisting of the Board members and the New York Fed President, which has only happened once in history.

The division within the FOMC is therefore expected to be historic. However, it seems more likely that Powell will choose to avoid displaying a historic division within the Board, as this would remain a blemish on his tenure. This obviously adds to the fundamental arguments (deterioration of the labor market, fewer upside risks to inflation, sluggish consumption).

A division that will persist in 2026

The composition of the FOMC is expected to change significantly in 2026:

- Stephen Miran is expected to be replaced at the end of his term (end of January) by Donald Trump's choice for the next president of the Board of Governors (Kevin Hassett?),

- The Supreme Court will hold a hearing on January 21 regarding the possible dismissal of Lisa Cook. If her dismissal is confirmed, Donald Trump could appoint someone to replace her on the Board.

- Jerome Powell's term as Board chairman ends on May 15. However, his term as governor runs until 2028. He could decide to remain on the Board or choose to resign, which would allow Donald Trump to appoint someone in his place.

Furthermore, there will be 3 very "hawkish" regional Fed presidents (Lorie Logan, Beth Hammack, and Neel Kashkari) among the 4 who will have voting rights on the FOMC in 2026. The battle therefore promises to be fierce between the Board members aligned with the Trump administration's desire to lower rates and the hawks. The number of dissents at the FOMC is expected to be unusually high in 2026.