Low carbon Hydrogen: a major strategic challenge for countries worldwide

After coal, oil and gas – hydrogen? With fossil fuels facing a bleak future and natural gas prices hitting records, attention is now turning to an element set to play a pivotal role in the energy transition. France, for one, announced in October that it would aim to become a leader in low carbon hydrogen by 2030. But across the world, from Europe to Asia, South America to the Middle East, hydrogen is fast becoming a major strategic issue.

Published on 12 January 2023

After years of statements of intent, governments and companies worldwide are finally taking real action on decarbonisation also in a context backed by tougher regulations. They are all trying to develop clean energy solutions applicable at a large scale that can be used to address climate challenge. Low carbon hydrogen fits this description to a tee, with its capacity to open up vast possibilities in terms of power storage, industrial applications and as a power source for cars, ships and planes.

Challenges involved in the use of low carbon hydrogen on a large-scale

Markus Wilthaner, a partner at McKinsey & Company, Hydrogen and batteries, Strategy and business building, is categorical: “To achieve the energy transition, we need hydrogen in both the short and long term. There is genuine momentum right now. More than $500 billion in investment could be poured in between now and 2030, and more than 350 large-scale projects have been announced. What’s more, the pace is accelerating: 130 of these projects were unveiled during the first half of 2021 alone”.

The big challenge is to support the transition to low carbon hydrogen, since more than 95% of the hydrogen used in the world today is produced from fossil fuels. Decarbonising hydrogen will entail to massively ramp up its production through water electrolysis, using nuclear, hydro, wind or solar power. Cost is a critical issue. The switch will really happen when the production cost of low carbon and grey hydrogen will be comparable. There is ground for optimism on this front, including one headline event: at an auction in August 2020 in Portugal, solar power hit a record low price of €11.14/MWh1 – down 80% compared to the price during the 2019 auction. Alexandru Floristean, Intelligence Manager for Hydrogen Europe, reckons that this has laid down a marker. “This is proof that it is potentially possible, viable and credible to have zero- emission solutions that are cheaper than traditional, polluting, fossil-fuel-based solutions.”

There are technical challenges to overcome as well, particularly the question of hydrogen transport infrastructures. A key issue is to connect regions with a large low carbon hydrogen supply, thanks to their renewable energy generation capacity, with those that need it. Within Europe, for example, it would be less costly to bring foreign-produced hydrogen in Germany than to produce it locally. Accordingly, this is the option that Germany has adopted as it strives to meet the ambitious goals set for hydrogen use and make up for the nuclear phase-out by 20222.

Vital drive provided by political will

When asked about the right pathway to tackle these different challenges, specialists agree: the investments needed for the critical technical advances must be operated within a supportive framework. “To unlock hydrogen demand at scale, you can’t count on a sudden technological breakthrough”, says Floristean. “Demand must first be driven at the policy level. Setting targets for using renewable energy is a major factor in stimulating demand.” This is the idea behind “Fit for 55”, a set of 12 measures, chiefly revisions of European directives and regulations, designed to enable the European Union (EU) to cut its greenhouse gas (GHG) emissions by 55% by 2030.

The European union leads the way

The EU has stated its ambition of playing a driving role in the production and use of low carbon hydrogen. In 2020, it set the goal of integrating low carbon hydrogen in its energy system, with plans to install at least 40 GW of renewable hydrogen electrolysers and produce up to 10 million tonnes of low carbon hydrogen. “Europe is definitely showing the way in terms of rulemaking, goal-setting and project announcements”, says Wilthaner. Examples of concrete initiatives include a target quota for hydrogen-derived sustainable aviation fuels by 2030 and targets for building roadside hydrogen refuelling stations. As part of the same thrust, hydrogen has been assigned a key place in the EU’s €800 billion economic stimulus programme.

Against this backdrop, in early 2021 a 30-strong group of European industrial firms announced the launch of HyDeal Ambition, an initiative aiming to produce 3.6 million tonnes of low carbon hydrogen yearly and then distribute it in several European countries, including Spain, France and Germany, via 7,000 km of pipelines, notably by retrofitting existing gas infrastructure.

The underlying idea is to produce low carbon hydrogen through water electrolysis using solar power produced in Spain starting from 2022. Other drivers will be deployed in the near future. “Technology-wise, Europe probably has the highest-performing companies in the production of electrolysers”, says Floristean. “We hold the cards needed to establish ourselves as global leaders in hydrogen production resources. However, the same is not true for end applications. In mobility, for instance, Asian countries are out in front.”

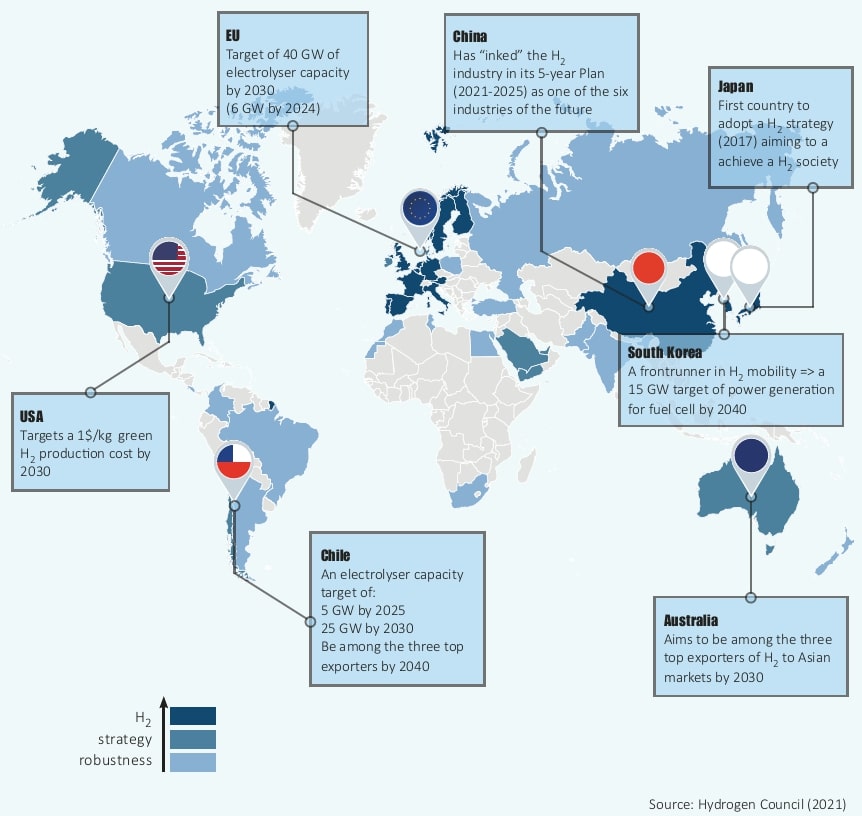

Across the planet, strategies adapted to local specificities

A critical aspect of the hydrogen ramp-up is that there is no one-size-fits-all-countries strategy. Approaches need to consider the industry structure, the energy system and the available resources, including renewables and gas/carbon storage. “Not all countries can be like Spain or Saudi Arabia”, says Floristean. “You have to identify your strengths and know on what part of the value chain you want to excel.” He cites Chile, a country that has clearly stated its aim of becoming a massive producer of renewable energy, which it plans to export in the form of hydrogen. A 4,500 km long strip of land, boasting the Atacama desert, disposing of the world’s highest level of solar radiation, as well as of powerful winds, Chile wants to harness its exceptional and diverse climate to grow its capacity to produce renewable energy at competitive prices. By improving power storage, hydrogen offers the opportunity to balance the country’s supply and demand.

Keenly aware of their dependence on the production and sale of oil, Middle Eastern nations such as Saudi Arabia and Kuwait are looking to diversify their economic base. “These countries have unbelievable potential to generate renewable energy through solar power”, says Wilthaner. “If they want to sell this energy to Europe, or anywhere else for that matter, hydrogen is a very valuable solution, since it can be transported via pipeline or in liquefied form.”

Other regions have their own strengths. Asia is a technology leader after years of ploughing massive investments into research and development, especially in fuel cells. Germany can likewise draw on innovations spearheaded by its corporate sector to produce fuel cells. With this regard, the country is going to have to transform its auto industry, moving away from internal combustion energies and embracing zero-emission vehicles, batteries and fuel cells.

A d’autres régions, d’autres atouts. L’Asie occupe ainsi une position de leader sur le plan technologique, fruit d’un investissement massif pendant des années dans la recherche et le développement, en particulier dans les piles à combustible. De même, l’Allemagne peut s’appuyer sur les innovations technologiques de ses entreprises pour produire des piles à combustible. Le pays devra à cette fin transformer son industrie automobile pour s’éloigner des moteurs à combustion interne et se tourner vers les véhicules à émission zéro, les batteries et les piles.

As things stand, 30 countries around the world have established hydrogen strategies. “We are seeing strong momentum, but we need to pick up the pace of change even more”, stresses Wilthaner. “The way ahead is not going to be a straight path, but a winding road with twists, turns and a few hills. Even so, investment and growth opportunities abound. Without a doubt, those that take the lead and make smart choices could reap incredible rewards.”

The climate emergency is a question that we need to address now, through concerted efforts by governments, but also companies and all stakeholders capable of accelerating the development – and financing – of a decarbonised economy. Together, we can work to build our net-zero future. H-hour is now.

- https://www.jornaldenegocios.pt/empresas/detalhe/leiloes-solares-baixam-fatura-da-luz-a-partir-de-2022

- Ministère de l’économie, des finances et de la relance ; Direction générale du Trésor, Quelles stratégies allemandes pour l’importation d’hydrogène vert ?, Décembre 2020