Markets and strategies

Macro - The elements that marked 2024 and those that should mark 2025

Like last year, we conducted a review of 2024 and outlook for 2025 by taking into account the most important past and future macro-financial elements.

Published on 7 January 2025

The macro-financial elements that marked 2024

- The beginning of the interest rate cuts cycle in developed countries.

2024 marked the beginning of the rate cuts cycle in most developed countries, but this was done in disarray, in terms of pace and magnitude. The ECB made 4 rate cuts of 25 bps in 2024, lowering its deposit rate from 4% to 3%. On the other hand, the Fed only started its rate cuts cycle in September (with a 50 bps rate cut), but it lowered its rates as much as the ECB did over the year (100 bps), moving its target range for fed funds from 5.25/5.50% to 4.25/4.50%. In the end, central banks in developed countries only "undid" about 20% of the interest rate hikes that were implemented in 2022-2023, and interest rates remain generally significantly higher than before the pandemic. - The halt to disinflation in the United States in the second half of 2024.

While "core PCE" inflation, which is the Fed's preferred measure of underlying inflation, dropped from 3% in December 2023 to 2.6% in June 2024, it then (slightly) increased in the second half of 2024. This led to an upward revision of the Fed's inflation forecasts in December and triggered a "new phase" in the Fed's monetary easing cycle: it will only lower its rates again in the event of tangible progress on the inflation front. - The US elections.

2024 was an election year in the United States and, as usual, this led to strong market movements (in the fourth quarter of 2024). Donald Trump's victory and Republican control of Congress led to a global appreciation of the US dollar and outperformance of US equity markets (and significant underperformance of emerging markets). In 2024, the dollar appreciated against almost all currencies in the world (the euro lost just over 6% against the dollar) and the S&P 500 had one of its best years of the 21st century (+23.3% in dollars). - Political uncertainty in Europe.

The dissolution of the National Assembly in France and the vote of no confidence in Germany led to a period of political uncertainty in the two largest countries in the eurozone. These two events, combined with the ongoing war in Ukraine and Donald Trump's threats on the trade front, led to record levels of uncertainty indices regarding economic policy in Europe. The Euro Stoxx 600 only made modest gains in 2024 (+6% in euros), although performance varied strongly between countries (-2.1% for the CAC 40 in euros versus +18.8% for the DAX in euros). - The awakening of Chinese authorities.

Following the intensification of the decline in property prices and to address the risk of deflation, authorities announced more substantial and coordinated support measures starting in late September: interest rate cuts, support for property developers and local authorities, bank recapitalization, and mechanisms to encourage share buybacks. Chinese stocks rebounded sharply in September but its progression was then halved. - The Bank of Japan going against the tide compared to other major central banks.

Contrary to almost all central banks in the world, the BoJ ended an extended period of ultra-accommodative policy in 2024, with the first rate hike in March and a second hike in July, which caused significant market turmoil (especially in unwinding carry trades). - Geopolitical tensions persisted.

The Russo-Ukrainian conflict dragged on, and the situation worsened in the Middle East throughout 2024. - The dominance of the Magnificent 7 (M7) continues but with more dispersion than last year.

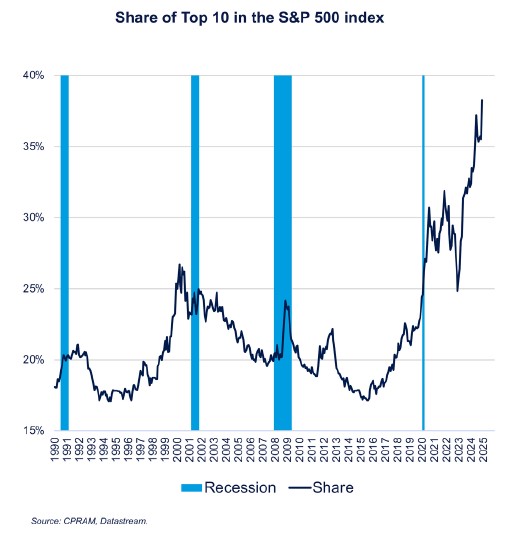

If the S&P 500 had a very good year in 2024, it was once again largely thanks to the Magnificent 7, which gained nearly 50% over the year. It should be noted that this group achieved widely dispersed performances, including Nvidia at +169%, Tesla at +64%, Apple at +26%, and Microsoft at +12%.

The macro-financial elements that are expected to mark 2025 and their possible consequences

- The policies of the new Trump administration.

Expectations of what the new administration might do have already had a significant impact on the markets in 2024. Donald Trump announced, on his first day in office (January 20), that he would immediately raise tariffs by 25 points on imports from Canada and Mexico and by 10 points on imports from China. The unpredictable nature of new threats and their withdrawal is likely to cause significant market movements. Moreover, for issues that require the participation of Congress (taxation, immigration, raising the debt ceiling, spending cuts, etc.), the path will be challenging due to the very narrow Republican majority in the House of Representatives. Ultimately, the pro-business nature of the new administration should outweigh the negative effects of tariff hikes, leading to outperformance of US equity markets and a strengthening of the dollar. Exacerbated and persistent trade tensions (which is not our central scenario) would lead the Fed to further lower its interest rates, rather than raise them. - The persistence or even strengthening of support for the economy in China.

The awakening of Chinese authorities, starting in September 2024, was more about stabilizing the economy rather than implementing a true stimulus plan. The announcements made by the Politburo in December suggest that things will go further in 2025. For example, it explicitly shifted towards an accommodative monetary policy (an unprecedented move since the 2008 crisis). A further depreciation of the Chinese yuan (Renminbi), which is already close to its lowest levels against the dollar in over a decade, could be considered to offset targeted tariff hikes by Donald Trump on China. - The political situation in Europe.

Early elections will be held in Germany on February 23. This could lead to a relaxation of the country's budgetary rules but also a reinvigoration of Europe's forward running mode. A more expansionary fiscal policy in Germany would be a game-changer. However, even if this were to be decided, its implementation would take a significant amount of time. As a result, the continuation of rate cuts by the ECB in the first half of the year seems validated. - The outcome of the war in Ukraine and the price of gas in Europe.

Donald Trump has repeatedly stated that he could end the war in Ukraine in 24 hours. Obviously, the reality will be more difficult... Nevertheless, it is likely that US military and financial support will decrease, which could prompt to negotiations. The prospect of a possible return of Russian oil and gas to Europe could push prices down. However, in the short term, we are witnessing an increase in gas prices in Europe due to the halt in deliveries from Russia to several European countries. As for oil, an increase in US oil production and an easing of tensions in the Middle East, both desired by the future Trump administration, should have a negative impact on prices. - New concerns about the trajectory of government debt.

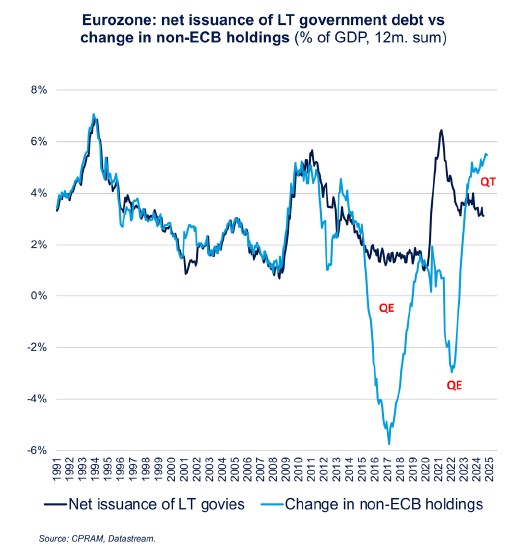

This issue will be at the center of attention in several countries, especially because interest rates remain higher than during the 2010s, in many countries. In the United States, Elon Musk, who will soon be part of the Trump administration, has set a goal of significantly reducing US public spending. This will be one of the key issues in the negotiations of 2025. In Europe, political uncertainty could also bring attention to this issue in several countries. In Brazil, the government's ability to reduce the deficit will be closely watched by the markets: currently, the deficit is close to 10% of GDP, while unemployment is at its lowest level in a long time. Overall, the continuation of significant government bond issuances in a context of central bank disengagement (quantitative tightening) and the ongoing trend of interest rate cuts, should lead to a steeper yield curve. - The year of market de-concentration?

At the end of 2024, the top 10 companies in the S&P 500 accounted for 38.3% of the index, a level never reached before. Sino-American tensions are likely to make the United States reluctant to fundamentally challenge the leadership of the largest companies. However, a rebalancing of performance after several years of heavy dominance by the largest capitalizations is likely, especially in the wake of the Fed's monetary easing and thus an improvement in financing conditions.