The dollar, historically strong, a major overlooked factor in trade tensions

Published on 30 January 2025

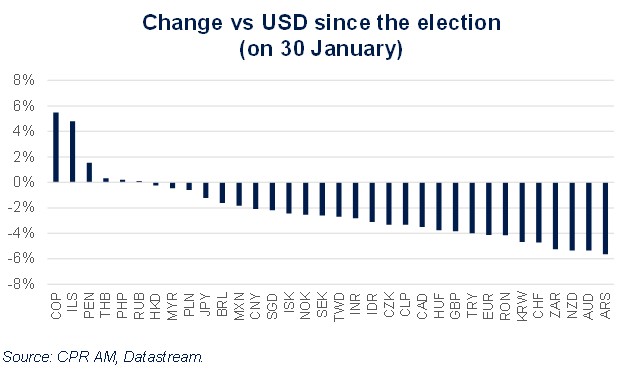

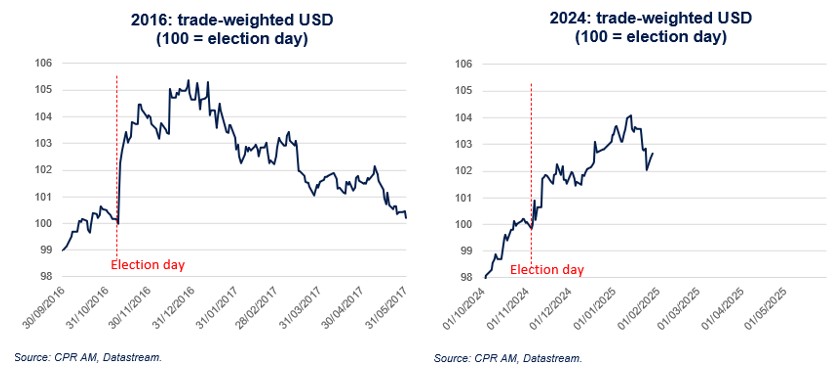

Since the election of Donald Trump, the dollar has appreciated against almost all currencies, with a magnitude roughly equivalent to what happened in 2016. For example, the dollar has appreciated by over 4% against the euro, by nearly 4% against the Canadian dollar, and by over 2% against the renminbi (figures as of January 30th).

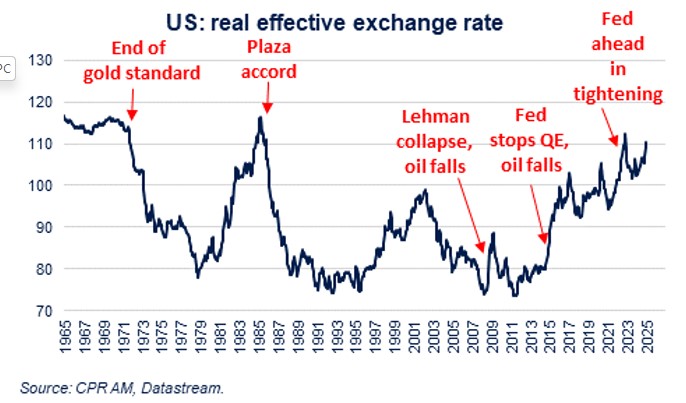

One element to keep in mind is that this recent appreciation of the dollar comes after several years of appreciation:

- In 2015, the USD had sharply increased due to the collapse in oil prices and the end of the Fed's QE,

- In 2022/2023, the USD had risen due to the Fed's advance in the monetary tightening cycle, both in terms of timing and magnitude.

In the end, the real effective exchange rate is now at its highest levels since 1985 and the period immediately following the Plaza Accord. The dollar is therefore historically strong.

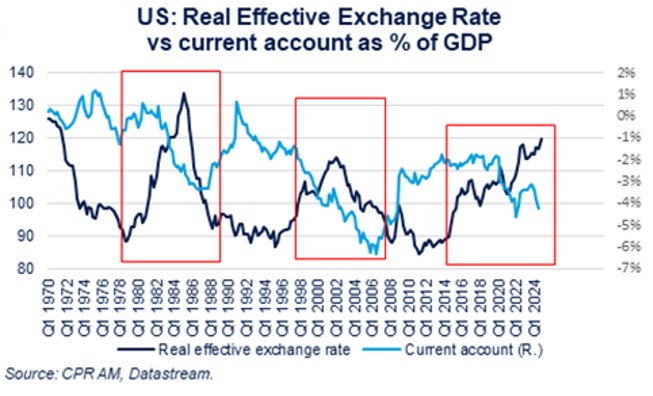

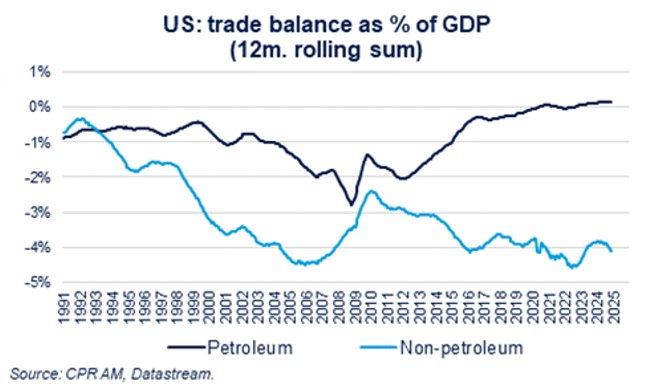

This long phase of dollar appreciation, like previous ones, has led to a significant widening of the current account deficit (foreign goods becoming cheaper). This has been less dramatic than previous times because the increase in the trade deficit for goods has been masked by a reduction in the trade deficit for petroleum products since 2014/2015.

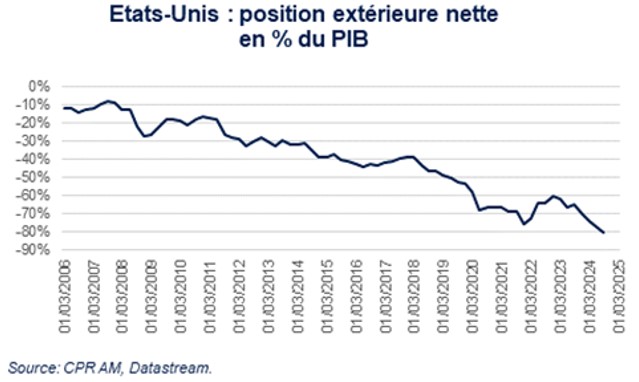

Nevertheless, it is clear that the strength of the dollar has resulted in one of the largest non-fossil goods trade deficits in history. By the way, the accumulation of current account deficits means that the United States' net external position is historically in deficit (80% of GDP).

Reducing the trade deficits of the United States without weakening the dollar seems very complicated. However, it remains very difficult to know whether the new Trump administration prefers a weak dollar or a strong dollar.

On one hand, the implementation of additional tariffs should cause a new appreciation of the dollar, which would at least partially sterilize it.

On the other hand, a policy of weakening the dollar would clash with the independence of the Fed. But simply ignoring the historically strong role of the dollar in trade issues is to overlook a very large part of history.