Trump 2.0: The return of the Disruptor-in-chief

Now that Donald Trump is back in the White House, what should we expect?

Politically disruptive, Donald Trump will certainly be, and the least we can say is that his return will constitute a spectacular change compared to the 4 years of the Biden presidency.

In this text, we will focus on exploring the main economic changes to be expected.

Published on 23 January 2025

The economic context upon Donald Trump's arrival in a few points

The US economy has resisted the Fed's aggressive monetary tightening cycle very well, thwarting the almost unanimous forecasts of a recession among economists in 2022 and 2023. The economic panorama can be summarized in a few points:

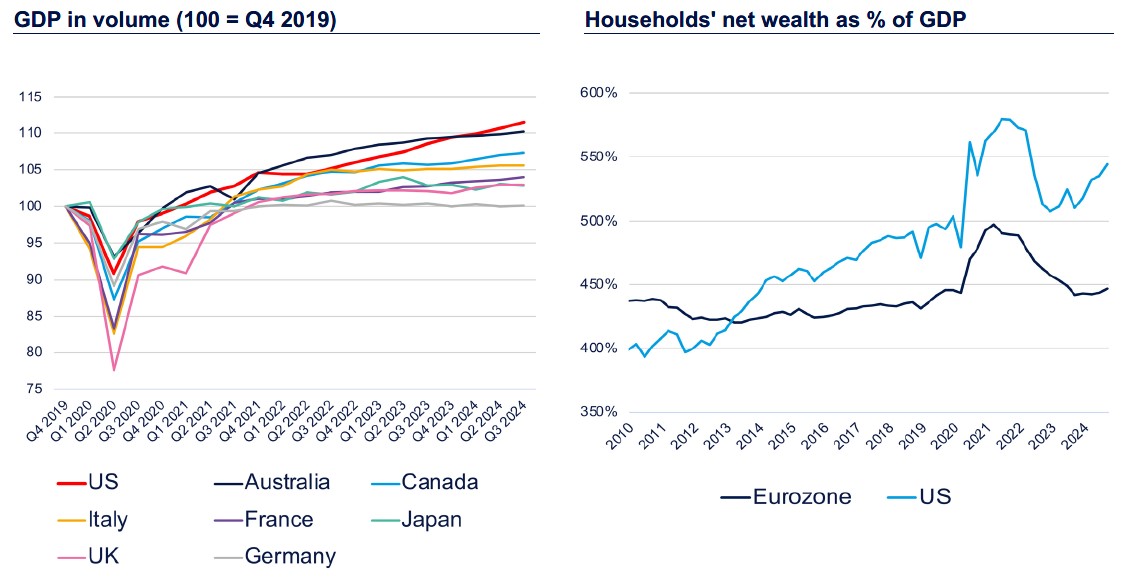

- The US is the developed country that has experienced the strongest economic growth since the pre-covid period. The country has also done better over the period than emerging countries such as Brazil or Mexico.

- After two years of significant growth in financial markets, household wealth has improved significantly. This is causing powerful “wealth” effects.

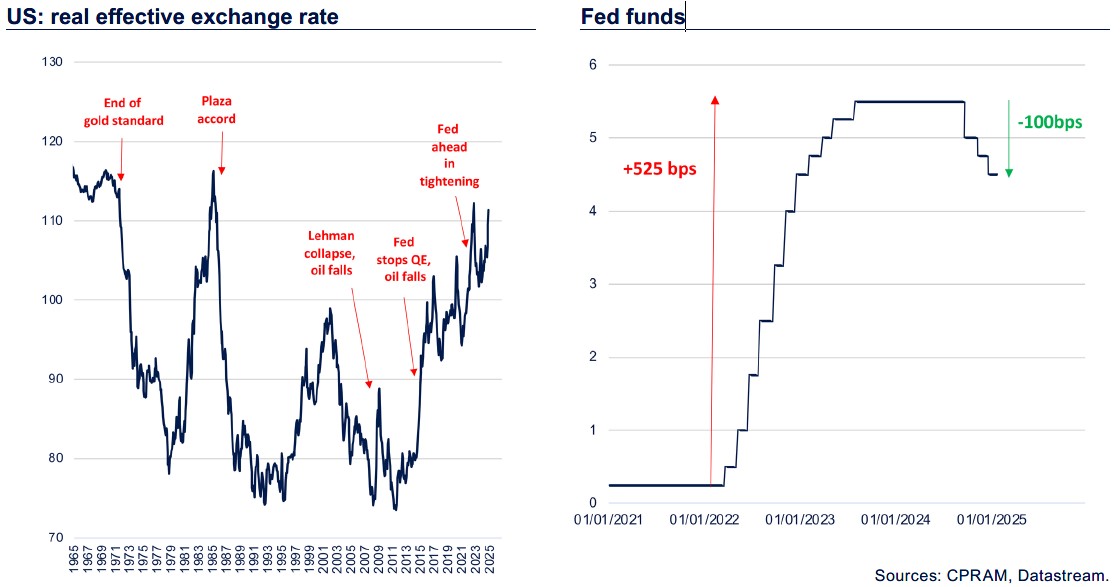

- Interest rates remain high. At the start of Trump’s second term, the fed funds target range is still at 4.25/4.50%, which means that the Fed has only undone around 20% of its 2022/2023 monetary tightening.

- Labor market conditions are good, although they are slowly but surely deteriorating. — The US dollar, taken in real terms, is at its highest since 1986. This is obviously one of the causes of the significant trade deficits of the US.

Uncertainty over trade policy

On the subject of trade policy, Donald Trump enjoys significant room for maneuver since he has the authority to raise tariffs against particular countries for reasons of "national security" or "anti-dumping". That said, Trump's plans have changed several times.

During his election campaign, Trump had mentioned a 60-percentage point hike in tariffs on Chinese products and 10 points on those of other countries. After his victory, at the end of November, he had already revised his plans since he spoke of an increase of 25 points on Canada and Mexico and 10 points on China "on day one". Other hypotheses circulated in the press in the weeks leading up to his inauguration and "on day one", Trump ultimately did not make a decision on tariffs, even though he said "that he thought tariffs would be raised by 25 points on February 1 for Canada and Mexico". For him, it is a means of putting pressure on his neighbors to address the migration issue as much as to renegotiate the north- american free trade agreement USCMA (ex-NAFTA).

Several elements suggest that the negotiation will be favored with China: from an initial project of a 60-point hike on imports of Chinese products, Trump moved to a 10-point hike (statements at the end of November). We can highlight the presence of the Chinese vice president on the day of his inauguration while many other heads of state were not invited. Press articles have mentioned the “Phase One deal” that Trump negotiated with China in 2019/2020, which provided for China to import much more US agricultural products and gas. These axes could once again be favored during new negotiations.

The (difficult) tax cuts

With a majority in both the Senate and the House of Representatives, Donald Trump can theoretically push through the tax cut program, i.e. the reduction of the corporate tax rate from 21% to 15% for companies “that produce in the United States,” the perpetuation of the temporary tax cuts that had been adopted during the first Trump administration (they expire at the end of the year) and the elimination of the tax on tips. The "budget reconciliation" procedure allows for the adoption of measures relating to tax revenues and expenditures while avoiding the "filibuster" (a provision that allows a blockage in the Senate if the majority has less than 60 senators).

In practice, this will be very complicated for two reasons:

- The Republican majority in the House of Representatives is very small (220-215) and managing to get all Republican representatives on the same line on all budgetary provisions is very difficult (see the cuts to the Inflation Reduction Act that Joe Biden had to agree on when this law had been passed by budget reconciliation because his majority in the Senate was very small).

- The subject of taxes collides with that of raising the debt ceiling, which came into force again on January 2, and more generally with the trajectory of public debt. A group of very conservative Republican representatives has already made it clear that they would only agree to raising the debt ceiling and cutting taxes if there were massive spending cuts (which would be difficult for the most centrist Republican representatives to accept).

In short, we should expect difficulties with tax cuts.

Tech, Trump's new ally

The technology sector is of considerable importance to the US economy for several reasons. First of all, tech is crucial for reasons of sovereignty (see the TikTok case) since global supremacy now requires having powerful technology groups. Then, tech is also crucial for economic and financial reasons. Indeed, technology companies represent more than a third of the US stock market (and more than a quarter of profits). Taking measures that would harm the US tech giants would have serious macroeconomic repercussions, causing negative "wealth" effects (in recent quarters, the exact opposite has happened: positive "wealth" effects have supported consumption and, by extension, growth). Trump knows this and will want to avoid this. Moreover, the leaders of the tech giants have become closer to him in recent months and many of them were very well placed at his inauguration ceremony. Overall, addressing oligopolistic characteristics does not appear to be a priority for the new Trump administration at all.

In addition, the theme of Artificial Intelligence (AI) should benefit from the support of the new Trump administration. Donald Trump immediately deregulated the sector by canceling an executive order from Joe Biden on the subject. Furthermore, he organized in the Oval Office on his 2nd day in office the announcement of the creation of a joint venture of several companies (OpenAI, Softbank, Oracle). $100 billion will be injected into this company, called Stargate, which will specialize in AI infrastructures and will build dozens of data centers. A total investment of $500 billion over 4 years is mentioned.

Other winners of the new Trump administration

The other winners of the new Trump administration are numerous and varied, which should also promote a movement of market deconcentration. We can cite in no particular order:

- The oil and gas industries are among the big winners of this new Trump mandate because he passed executive orders on Day One to remove environmental regulations and authorize the exploration and extraction of fossil products in areas that had been protected until then. Oil production in the United States, already at a record level (13.6 million barrels/day) should continue to increase significantly. However, the increase in volumes could be to the detriment of prices.

- The financial sector should also benefit from deregulation policies. A project to overhaul the regulatory authorities has been mentioned in particular, as well as a possible relaxation of the Basel rules.

- The activities in which Elon Musk is involved. The billionaire, omnipresent in Donald Trump's campaign and who will play an important role in his administration, should weigh in on the deregulation choices of several sectors: electric vehicles, autonomous vehicles, satellites, neurotechnologies, etc.

- The crypto ecosystem. Under its new leadership, the SEC will create a taskforce to develop a regulatory framework adapted to crypto-assets. The outgoing SEC chairman, Gary Gensler, was generally not in favor of the "far west" of digital assets. His replacement, Paul Atkins, should confirm a certain form of institutionalization of these assets.

- Space-related activities. During his inauguration speech, Trump mentioned the ambition of having an American flag planted on Mars. This project, often mentioned by Elon Musk, is part of a more global change of direction and greater ambitions in space. During his first term, NASA's budget had already accelerated and various initiatives had already been launched (National Space Council, US Space Force, etc.).