United States: two things to have in mind on tariff hikes

During his election campaign, Donald Trump often insisted on his desire to significantly increase tariffs on imports, which is a central element of his future economic policy. He mentioned a 60 percentage point increase in tariffs on imports of Chinese products and a 10 point increase for other imports (he sometimes mentioned a 20 point increase on these imports). For many observers, this would lead to a sharp rise in inflation, to which the Fed would respond by pausing its rate cut cycle, or even by returning to monetary tightening. We develop two points here to show that the reality is more complex.

Published on 25 November 2024

The evolution of the dollar is central to the evolution of import prices

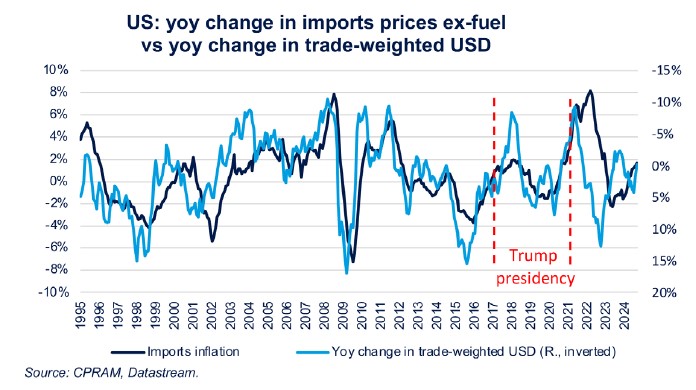

As a first approximation, tariff hikes affect inflation via imported inflation, but the price of non-energy imports depends heavily on the evolution of the dollar: they fall when the dollar appreciates and they rise when the dollar depreciates.

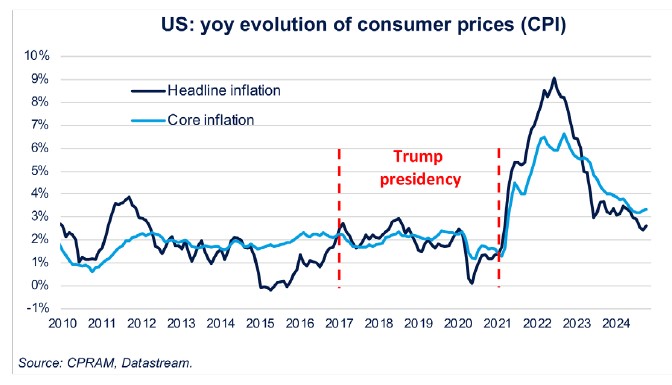

— We can see that the tariff increases of the 2018/2019 trade war did not lead to high imported inflation.

— Better still, imported inflation was only 1% up in 2018 and even negative in 2019 because the dollar appreciated during these periods. Consumer prices did not experience any notable acceleration during this period.

-> To judge the impact of tariff hikes on inflation, it is therefore absolutely necessary to take into account the evolution of the dollar, but the trade-weighted USD has already gained 2% since Trump's election, and even before tariff hikes took place.

A temporary impact on inflation

Next, it should be noted that a tariff hike is generally considered by economists as a “one-off” price increase and therefore only impacts inflation temporarily (i.e. 12 months if all the hikes occur at the same time)

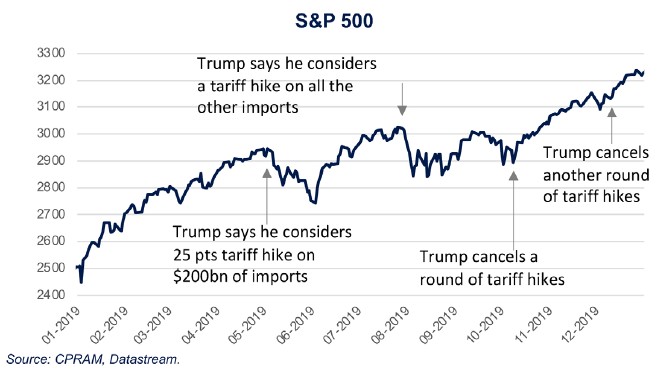

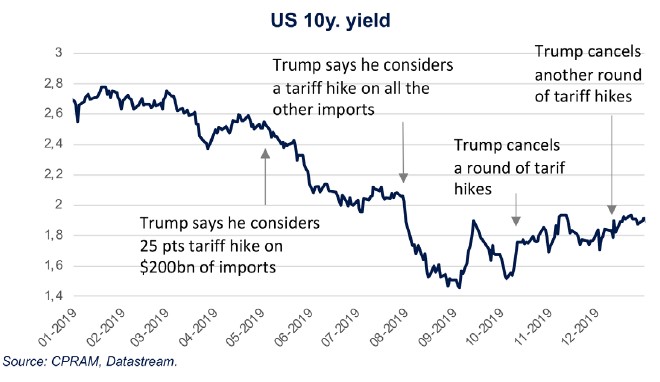

In the report prepared by Fed economists for FOMC members in September 2018, we see first of all that the question of monetary policy response is not obvious (“We have limited experience with large and widespread increases in trade barriers”). But we can read there that Fed economists suggested ignoring the temporary increase in inflation and focusing on the decline in activity by lowering key rates: “The policy of overlooking appears to be an appropriate response to an increase in tariffs.” However, they indicated that this is only possible with well-anchored inflation expectations and if tariff hikes do not lead employees to ask for wage increases and companies to increase their margins. In 2019, the Fed had actually made several rate cuts in 2019 due to the deterioration in the economic outlook. That year, Donald Trump's announcements of tariff hikes had caused long-term rates and stock markets to fall and vice versa.

-> In 2025, the Fed will obviously not make monetary policy decisions solely on the basis of tariff hikes (we must also take into account all kinds of tax measures, deregulation measures, immigration measures, possible optimism linked to pro-business measures, etc.) but if that were the case, they would rather lead to more key rate cuts.

In conclusion

The tariff hikes wanted by Donald Trump, if they are actually implemented, will probably not have as strong an impact on inflation as many commentators indicate. This effect should be both temporary and offset by the appreciation of the US dollar.

Moreover, the monetary policy reaction to the tariff increases will probably be more in monetary easing than monetary tightening, to deal with the negative effects on activity. Ultimately, the Fed's reaction will depend on the overall measures taken by the new administration (tax measures of all kinds, deregulation measures, measures on immigration, possible optimism linked to pro-business measures, etc.).