The consumption by the ‘silver population’

Amidst the ageing of the global population, the growing prominence of seniors led us explore the trends and opportunities arising from the correlation of consumer spending with ageing. We see first that seniors possess considerable, and increasingly large, resources. We then discuss five salient points.

Published on 8 June 2024

The ‘silver population’: an age group of considerable means

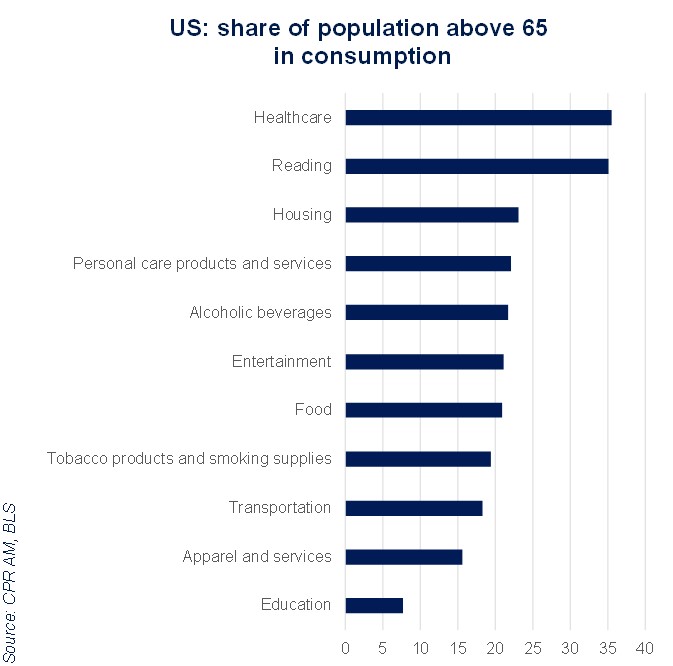

The “silver population” accounts for an increasing share of consumption, simply because the percentage of persons older than 65 in the total population is rising and will continue to do so. This is also due to the fact that the employment rate of persons 65 and older (i.e., the proportion of this age cohort who works) has trended upward in recent decades, which means higher incomes. In the US, persons older than 65 now account for the most consumer spending of any age group, whereas 10 years ago, it was far behind the 35-44, 45-54 and 55-64 age groups. At the global level, the United Nations estimates that consumption by people older than 50 amounted to about $15,000bn. This increase is set to continue mechanically over the coming years.

Moreover, this age group possesses substantial aggregate wealth. In the US, people older than 55 account for more than 73% of total household wealth (almost $108,000bn as of the end of 2023, according to Fed figures), due, here again, to the increase of this age group’s share of total population but also to the steep rise in financial and real-estate valuations in recent decades.

Five key factors in seniors’ consumer spending

1. Making up for lost time: a time for leisure.

Upon retirement, entering into the “silver” age often means more time for oneself and the wish to “make up for lost time”, expressed in a greater desire for leisure. And, as we saw previously, seniors have the financial means of their ambitions. Travel is often a favourite pastime for young retirees. In some segments of the tourism sector, seniors more or less account for the largest contingent of customers, and they are likely to become increasingly prominent, driven solely by the increase in their sheer numbers. This is the case for cruises, for example, where passenger numbers are now rising by almost 6% annually. The tourism industry is already benefiting, and will benefit increasingly, from this demographic and societal phenomenon. For a population that sees itself as active and wants to remain so, the notion of healthy life expectancy is key. That’s what makes sports, in a club or an association, and activities involving regular social contact, important factors in this quest for well-being and longevity.

2. New consumers? Not necessarily.

In reality, the “silver” consumer is none other than a consumer who is now a few years older. There is no “ rupture ” but, on the contrary, a natural continuum between consumer habits that will evolve over time, according to tastes and needs. This has become a challenge for marketing departments of companies that sell products and services to “silverising” consumers. Marketers have to fine-tune their messages to continue to address this consumer segment. They also have to be wary of some of our most stubborn prejudices. For example, the fastest-growing gamer age group in the US is not generation Z, but baby boomers! A study by Entertainment Software Association, reported in Fortune magazine in 2023, found that about 29% of persons older than 64 in the US play video games. What’s more, 29% of US gamers are older than 50 (up from just 9% 20 years ago).

So, a true trend is at work: it makes sense to reason in terms of cohorts, as consumers keep their hobbies over time. For example, we have a real cohort of “silver gamers” that is taking shape. Consumption of “tech” and digital products and other streaming services has become a hallmark of the “silver” generation, at least among persons who are just now entering this cohort.

3. A group that takes care of itself

Getting back to healthcare and well-being, the percentage of seniors in consumer health and oral care sales is very high. Everyone buys over-the-counter drugs, nutritional supplements, (anti-ageing) sunscreen and dental hygiene products, but the “silver” cohort most of all, as consumers older than 55 account for 48% of all consumers of these products in the US. Growth in this population cohort is the main driver of growth expected in this market. Prior to 2019, it was expanding by 5.3% – almost linearly over the previous 15 years; that figure is now 7.3%, a figure has become the new baseline for growth in the coming years.

4. Home-improvement for a better ageing experience

A study has found that over the past two decades the percentage of elderly persons living at home has risen, while the percentage of those living in retirement homes has declined. Indeed, 93% of adults 55 and older regard living at home as a priority. This preference is based on an increased feeling of security, the emotional attachment to one’s home, a desire for independence and proximity with family, or, more rationally, for financial reasons, in particular to avoid the prohibitive cost of retirement homes, which can be as high as $13,000 per month in the US. Home-improvement costs are lower ($9,500 on average), are one-off, and are often perceived as an investment rather than as an expenditure. Adapting one’s environment to one’s older age – including accessibility-enhancing projects (ranging from mere grab bars to more structural projects such as widening hallways or moving a room downstairs) – is a major driver of growth in home-improvement spending. To finance such improvements, elderly persons may obtain a loan backed by the value of their property, which can thus be regarded as a war chest that has expanded constantly over the years (most homeowners older than 65 moved into their homes before 1999, and since then home prices have risen by 215%). Lower-income persons can obtain public assistance. However, elderly people who stay in their homes generally need services to remain autonomous.

5. New needs: the time for caregiving

As we cross into the domain of healthy life expectancy, new needs emerge, with the need for personal care services ending up supplanting leisure-related consumption. Older retirees have indeed given rise to an entire caregiving industry. New uses are also emerging with offers, especially in the US, of home hospital care for the chronically ill, for example. Rather than going regularly to a hospital for blood transfusions, some patients choose at-home care, in which it’s the clinic that comes to them. In the healthcare sector, while medtech can treat pathologies that can arise at any age, clearly, patients over 65 are overrepresented in diverse cardiac surgeries, hip and knee replacements, and prostate treatments. The consequences of the ageing of the population are thrown into relief here. Covid has probably hidden just how much activity has expanded structurally since 2019. We have gone from growth at hospital-exposed medtech companies estimated at 4% to 5% annually between 2016 and 2019 to about 7% between 2023 and 2027.

Lastly, an ageing population is also a cohort with special nutritional needs. Malnutrition has become such a focus that many companies now offer to treat it with food kits. Beyond the context of chronic illnesses, there is also greater awareness by active seniors of their special nutritional needs for extending their life expectancy. The current fashion of high-protein diet products addresses not just young people wanting to add muscle mass in fitness centres but also the fact that with age the need for protein consumption increases, thus creating true growth prospects for the entire “active nutrition” sector.

In conclusion, senior consumption trends reflect not only a major demographic shift but also a transformation in this cohort’s lifestyles and needs. While leisure and entertainment take up an outsized share of seniors’ time at first, new segments are also emerging with the arrival of “new seniors” in this age group, whose interests and habits last over time. Meanwhile, the boom in the caregiving shows how much healthcare and well-being services are expanding in addressing seniors’ specific needs. In short, this shift is a both a challenge and an opportunity for companies, causing them to rethink their marketing strategies and to innovate to address the changing needs of an ageing population, while offering solutions that promote an active, healthy and fulfilling lifestyle for the years to come.