No, Net Zero policies should not be abandoned

Donald Trump’s return to the presidency of the United States is disruptive in many ways, and this is particularly true for climate policies: Trump has already begun to dismantle a number of environmental and climate regulations and for the second time, the United States has withdrawn from the Paris Agreement.

Published on 10 March 2025

On February 5, the new Secretary of Energy, Chris Wright, unveiled the new Department of Energy’s roadmap, titled “Unleash the Golden Era of American Energy Dominance.”

His No. 1 point reads: «“Great attention has been paid to the pursuing of a netzero carbon future. Net-zero policies raise energy costs for American families and businesses, threaten the reliability of our energy system, and undermine our energy and national security. They have also achieved precious little in reducing global greenhouse gas emissions.” The idea here is that policies to decarbonize the economy will not be a priority, as they would cost households and as they would jeopardize national security.

Discrediting “net zero policies” leads to several observations:

— Even if “net zero policies” are criticized by the new Trump administration, it is probably more a question here of marking a resounding rupture with the previous administration, by trying to discredit the latter’s policies, whatever the subject. Moreover, the criticism of “net zero policies” is particularly vague and imprecise: it is not clear whether the criticism concerns renewable energies, electric vehicles or other technologies.

— “Net zero policies” are essential in the long term to combat climate change. Indeed, 2024 was the hottest year on record and the first to show global warming greater than 1.5°C compared to the preindustrial period and this confirms the acceleration of the rate of warming, which is approximately twice as fast since 2010 as over the period 1970-2009. The scientific evidence is that decarbonizing the economy is absolutely necessary to contain global warming. In its latest report, the IPCC estimated that without accelerating decarbonization efforts, warming would likely be 2.2 to 3.5°C by 2100 and that delaying these efforts would lead to further warming.

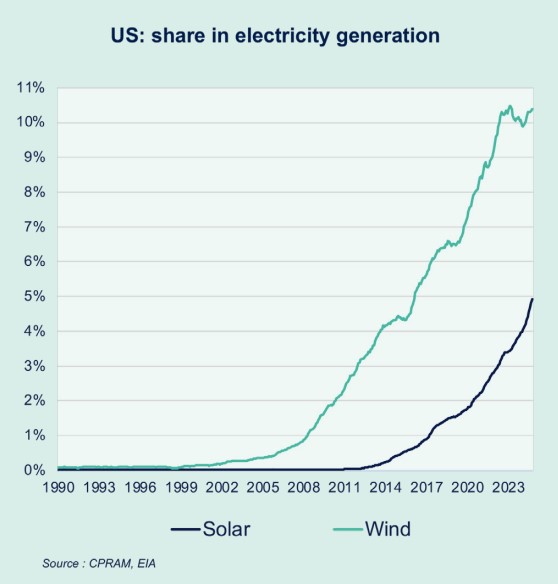

— Implying that “net zero policies” are not economically efficient runs counter to several findings. In a very Republican state like Texas, electricity production via renewables has been increasing steadily for about fifteen years (wind and solar represented around 30% of the state’s electricity production in 2024) and particularly during Donald Trump’s first term: this is most likely explained by the sharp drop in the costs of renewables and storage solutions. A few months ago, Elon Musk himself stated that it was “utterly obvious that essentially all electricity generation will be solar”. Furthermore, an IMF1 working paper showed that electricity prices on wholesale markets were lower and less volatile in countries with a higher share of renewables.”

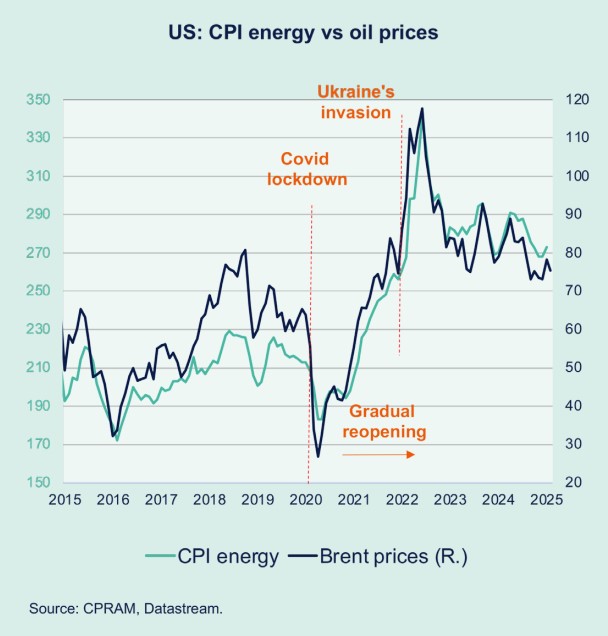

— The rise in energy prices in recent years has mainly been due to causes other than “net zero policies”. As we show in the box next page, the rise in energy prices over the last 5 years has mainly come from causes that have nothing to do with decarbonization (Russia’s invasion of Ukraine in February 2022, production cuts by OPEC+ countries, strength of the US economy during the post-covid reopening). On the contrary, slowing down the development of renewable energies can increase electricity prices, for example.

— Abandoning the decarbonization of the economy will further expose the United States to the risk of climate disasters. The recent catastrophic fires in Los Angeles are the latest example of the damage that climate change can cause on US soil. Over the two years 2023 and 2024, there were 56 climate disasters causing more than a billion dollars of damage (for an aggregate amount of $278 billion). Given the weight of its economy and its greenhouse gas emissions, a possible abandonment of decarbonization policies would significantly worsen the climate situation and this would increase the frequency and severity of climate events affecting the United States. As a result this would be costly for US households since a growing number of risks can no longer be covered by insurers.

For these different reasons, we believe that criticism of “net zero policies” is unjustified. On the contrary, at CPRAM, we believe that climate change is a challenge for everyone and that there is an urgent need for all stakeholders to act within their sphere of influence. As an asset management company, taking climate issues into account is part of our fiduciary duty.

CPRAM launched its first climate strategy in 2018 and has gradually developed a full range of “transition” solutions adapted to each risk profile and investment needs: global or eurozone equities, bonds, diversified. We will continue to finance and encourage companies aligned or wishing to align with a net zero trajectory.

Rising energy prices in the united states

and what Trump can (or cannot) do

Have energy prices paid by Americans increased and why?

Yes. Energy prices paid by Americans (petrol, gas and electricity) are now 28% higher than before the covid crisis. They had fallen sharply in 2020 with the various lockdown measures, which caused demand to collapse.

— From 2021, the price of oil (the energy product most consumed by Americans remains gasoline) rose sharply again under the dual effect of measures to reopen the economy and massive production cuts by OPEC+ countries: at the end of 2021, the price of oil was roughly at its 2018 levels. In addition, the closure of refineries during the covid crisis induced slightly stronger upward pressure on gasoline than on oil (bottleneck). It rose sharply from the invasion of Ukraine in February 2022 because Western sanctions led a large number of countries to diversify their supplies. From 2022, the Biden administration tried to play on the downward trend in prices by putting a large quantity of strategic oil stocks on the market.

— The case of natural gas, and by extension that of electricity, has broadly followed the same trends, the main difference being that tensions on global supply appeared as early as 2021 when Russia reduced its deliveries to Germany. In this context, it should be mentioned that the United States became a net exporter of natural gas from 2017 and has therefore been more aware of global price variations.

— The major shocks to energy prices are first and foremost the major shocks to the price of oil, but as a first approximation, it is mainly the strength of the US economy, the production cuts in the OPEC+ countries and the war in Ukraine that have had an impact on the rise in oil prices.

Can Donald Trump lower energy prices?

This is one of his campaign promises, but it looks like it will be harder to do than to say:

— Treasury Secretary Scott Bessent explained that the goal was to increase crude oil production by 3 million barrels/day, while US production is already the largest in the world (around 13.5 million barrels/ day), which would lower prices. The idea here is that an increase in production would cause prices at the pump to fall. This may be complicated to implement because a survey by the Dallas Fed in March 2024 showed that the break-even point for new wells was between $60 and $70 for a barrel of WTI, while the price of the latter was around $70 in mid-February 2025.

— On Day One, Donald Trump issued an executive order banning any new offshore wind projects on the American coasts and pausing for 60 days any new projects or permit renewals for onshore or offshore wind turbines. While demand for electricity has increased in recent years, depriving ourselves of the growth in wind power, which has increased from 6% of electricity production in 2017 to 10% in 2024, risks driving up electricity prices.

1. « Chasing the sun and catching the wind: energy transition and electricity prices in Europe”, IMF working paper n°22/220.