ETS 2 postponement: what impact on European inflation?

The EU revised the ETS directive in 2023 to create ETS 2, extending the carbon market to emissions from buildings, road transport, and small industries in order to achieve a −42% reduction by 2030 (base year 2005). In early November 2025, the environment ministers postponed the implementation of ETS 2 by one year, from 2027 to 2028. The ECB will have to revise its inflation projections for 2027-2028, which had incorporated the extension of the carbon market. This analysis recalls the functioning of the European carbon allowance trading market and provides an estimate of the impact this could have on European inflation in 2027 and 2028.

Published on 26 November 2025

ETS 2, a new carbon market for the EU

The ETS, Emissions Trading Scheme, is a European mechanism for capping and trading carbon quotas ("cap and trade").

In the European carbon market, the companies concerned must account for their CO₂ emissions and acquire an equivalent number of quotas each year (1 quota = 1 tonne of CO₂). The annual quantity of quotas on the market is set according to the EU's emission reduction targets and is allocated through an auction mechanism.

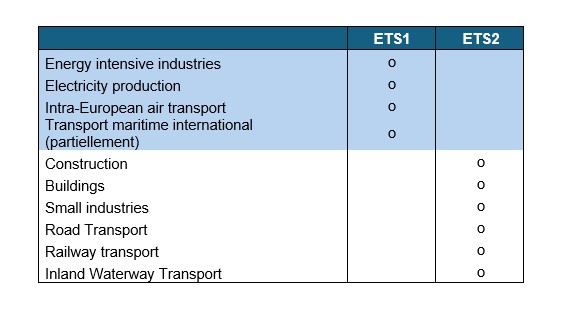

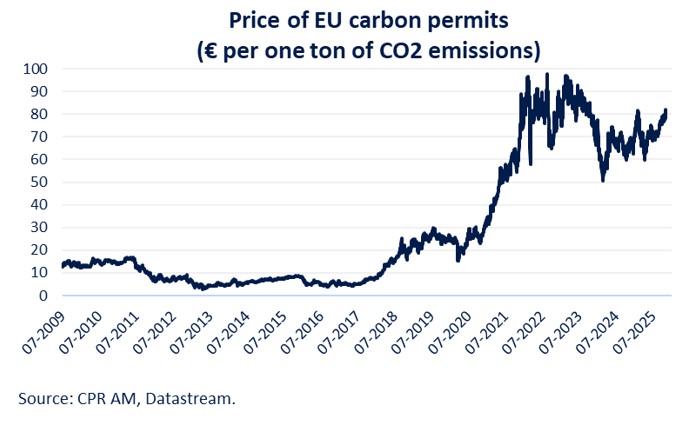

ETS 1 has applied to heavy industry, maritime and air transport, and electricity production since 2005. It covers 40% of European GHG emissions. The price per tonne of carbon on ETS 1 has fluctuated between €60 and €82/t since the beginning of 2025.

As part of the Green Deal, Europe adopted ETS 2 in 20231, which is to apply to fossil energy suppliers in the road transport sector (fuels), buildings (fossil fuels), construction (non-road diesel), and small industries (non-industrial fuels and combustibles), thereby covering three-quarters of the EU's GHG emissions. It was planned to come into effect on January 1, 2027, with a first quota surrender covering GHG emissions for the year 2027 by May 31, 2028. The revenues generated by ETS 2 are to be allocated to climate actions and accompanying social measures, notably through the Social Climate Fund.

Before 2031, the Commission may plan the merger of the two carbon quota trading systems.

The prices of ETS 1 and ETS 2 carbon allowances will be set separately

To ensure that the increase in ETS 2 quotas is not too rapid for consumers, the EU has planned a price protection mechanism: a maximum price of €45 per tonne of CO₂ at 2020 prices (approximately €55 at 2025 prices) has been set until 2029. In the event of a temporary exceedance of this cap, the EU will inject new quotas into the market to lower their price. No free allocation of emission quotas is planned in ETS 2, unlike what was done in ETS 1, and all quotas will be auctioned and then traded on the secondary market.

For 2027, 1.036 million quotas were planned.

A very different impact depending on the EU countries and their energy mix

Several Eastern countries were requesting a postponement or even a cancellation of the ETS 2 market due to the significant share of fossil fuels in their energy mix and therefore the substantial financial impact that the implementation of ETS 2 would have on households and businesses.

Conversely, some Member States already have carbon markets covering transport and buildings (Germany and Austria) or national carbon taxes that apply to the building sector, road transport, or other covered sectors. They therefore benefit from a temporary exemption from the implementation of ETS 2 until the end of 2030 and would thus be only minimally affected by its implementation.

An impact of the EU ETS 2 on inflation that varies greatly depending on the country

In 2024, ECB economists estimated that the impact of the implementation of ETS 2 on Eurozone inflation was uncertain due to the unpredictability of carbon prices, the speed and extent of its pass-through to consumers, as well as the transition between national carbon taxation systems and the European system. The estimated range was therefore relatively wide, and the impact could vary between 0.0 and 0.4 percentage points in 2027. They estimated that the impact would be much lower in 2028.

In August 2025, the Czech National Bank estimated that if ETS 2 prices reached €57/t in 2027 (€45/t adjusted for inflation over the period), consumer prices could increase by 0.9 percentage points due to the rise in natural gas, fuel oil, and coal prices. However, if compensation measures were implemented, this could halve the impact of ETS 2 on inflation. The design and timing of compensation measures, as well as quota prices, appeared to be decisive for Czech households. Furthermore, households would be affected differently depending on the energy efficiency of their homes and their modes of transport.

In the longer term, the impact of future ETS 2 price fluctuations on energy inflation could be mitigated by a decrease in the share of fossil fuels in the energy mix and by a reduction in household expenditures on these fuels.

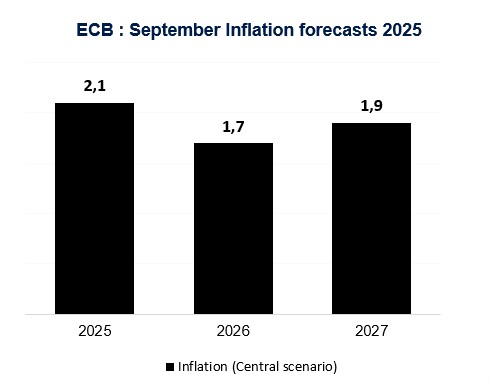

These two studies show that the extension of the carbon market to buildings and road transport can have very different impacts on inflation depending on European countries, notably due to their energy mix. In any case, the postponement of ETS 2 from 2027 to 2028 will have a downward effect on inflation forecasts for 2027 in the euro area and a marginal upward effect in 2028. In September, ECB projections anticipated inflation at 1.7% in 2026 and 1.9% in 2027, and this postponement of ETS 2 could increase the risk of being below the target in 2027.

[1] Directive (EU) 2023/959 of the European Parliament and of the Council of 10 May 2023 amending Directive 2003/87/EC establishing a system for greenhouse gas emission allowance trading within the Union and Decision (EU) 2015/1814 concerning the creation and operation of a market stability reserve for the Union greenhouse gas emission allowance trading system.