Hydrogen: still on course despite headwinds

As Europe exits the energy and inflation crises, this seems like a good time for an update on the hydrogen sector, its development outlook, and the support measures driving it forward. Hydrogen rode very positive momentum as the Covid crisis ended, but European countries have now taken a less consensual view on this topic. In some countries, such as France, hydrogen measures have come under greater criticism but elsewhere, such as in Spain and Germany, it is still receiving strong public support, as seen in the Hydrogen Acceleration Act that was just passed in early June in Germany and that will take effect at yearend.

Published on 10 July 2024

Ambitious targets for Hydrogen

After the Covid crisis, several countries launched ambitious hydrogen development strategies with the goal of reducing greenhouse gas emissions from hard-to-decarbonise sectors. As of the end of 2023, the International Energy Agency (IEA) counted 41 such strategies. They came with public financing for the purpose of creating a true hydrogen infrastructure and of incentivising private investment. Initial assessments of the sector’s progress in 2023, notably by France’s National Hydrogen Board and the IEA, show that while more and more new projects are being launched, they are taking longer than expected to get off the ground.

Deployment has fallen behind schedule at many projects, due to several major obstacles in 2022-2023. First of all, tighter monetary policies caused financing costs to spike at ultra-capital-intensive projects. Second, industrial costs (for semiconductors, materials, construction, etc) were driven up by broader inflation and higher electricity prices. Third, research & development costs were greater than expected in a highly innovative sector. And, lastly, regulatory uncertainty also caused some project delays.

Hydrogen production is developing slowly

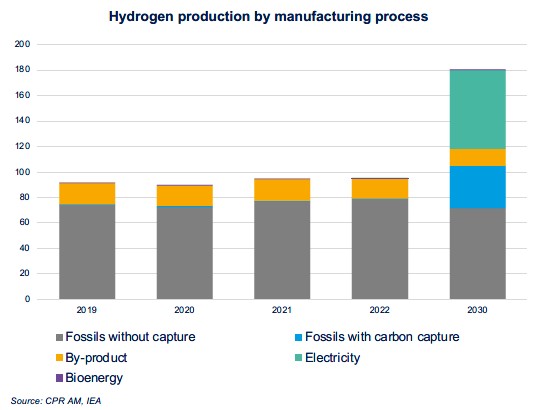

Global hydrogen production has recently progressed at a slow pace, despite the announced deployment ambitions. Between 2019 and 2022, global hydrogen production rose by 4% to 95 Mt. China is the world’s top producer, with 30% global output.

Production of low-emission hydrogen is still marginal, at just 1% of total hydrogen output in 2022. The goal is to reach 3% of green hydrogen in 2030, but production of green hydrogen is expanding more slowly than expected everywhere except in China.

Hydrogen deployment forecasts cut sharply by the IEA in its 2023 renewable energies report

Under Net-Zero scenarios, hydrogen production is projected to expand by almost 90% by 2030. Renewable hydrogen is expected to play an important role in decarbonation, particularly in industrial sectors, and could amount to 20 Mt in 2030 and almost 70% of total production in 2050. But the IEA found that progress has been slow in announced projects, that timetables with final investment decisions (FID) are long, due to a lack of demand, and that production costs had increased. Accordingly, it lowered its deployment forecasts for all regions except China.

Many hydrogen projects at an early stage

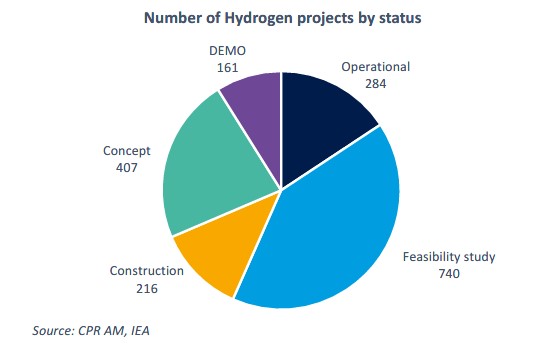

The IEA took a census of hydrogen projects worldwide. As of the end of October 2023, it counted 284 projects that are now operational and almost 1500 that are at various other stages – design, feasibility studies or construction.

Construction has begun or an FID has been made on just 4% (in terms of output) of projects announced for 2030.

Development of the sector is being held back by many factors, including the regulatory environment, investment costs, development of new technologies and the learning curve on projects already begun.

Development costs are higher than expected: LCOH (Levelized cost of hydrogen)

The levelized cost of hydrogen (LCOH) is a measure of the cost of producing 1 kg of hydrogen when including the estimated costs to build and operate a hydrogen production plant.

Regardless of the production process, in 2023 the LCOH was 30% to 65% higher than had been forecast in 2022. This is due both to higher project deployment costs (electrolyser purchases, engineering, construction, financing costs, etc.) and to higher operating costs caused by rising energy prices.

In a 2023 report, the European Hydrogen Observatory estimated that the LCOH of renewable hydrogen (€6.86 / kg H2) had become almost comparable to that of brown hydrogen (€6.23 / kg H2) in 2022 due to the steep rise in energy prices, natural gas in particular. The gap was far greater in 2021, at €2.67 / kg H2 for brown hydrogen and €3.3 to €6.5 / kg H2 for renewable hydrogen.

What is the outlook for hydrogen and green hydrogen demand?

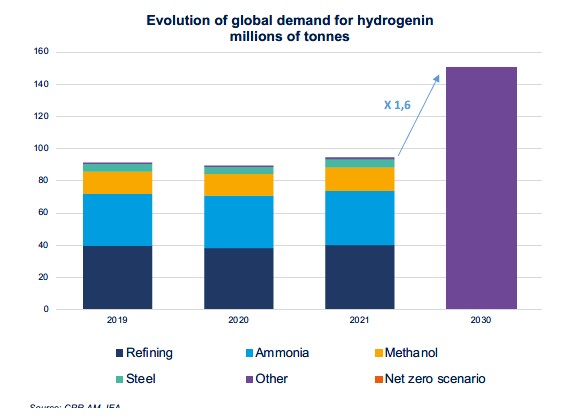

Hydrogen demand set a record in 2022 at 95 Mt. It rose by 3% compared to the previous year, and the increase in demand was perceptible everywhere except in Europe, which was hit by the energy crisis. Green hydrogen accounted for less than 1% of demand.

The IEA1 acknowledged that global hydrogen consumption had risen but pointed out that demand remained concentrated in the traditional areas of refining and the chemicals industry, and that most output was still fossil fuel-based. Production of low-emission hydrogen is still far from becoming a dominant.

The IEA thus lowered its 2030 demand forecasts from 180 à 150 Mt, 40% of which for new uses.

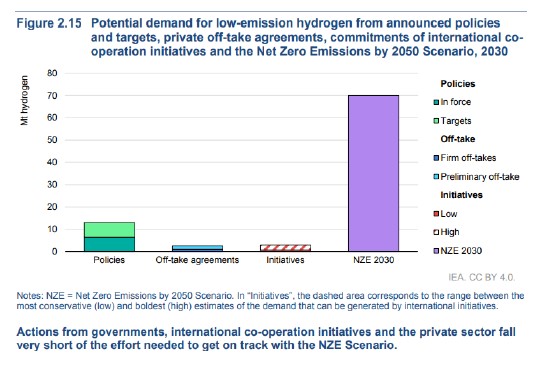

Demand for renewable hydrogen is the great unknown and will be decisive for the pace of developing production capacities. Meeting government targets is likely to require demand of about 14 Mt of low-carbon hydrogen by 2030, vs. producers’ targets of almost 35 Mt. Under the NZE (Net-Zero Emissions) scenario, demand for low-emission hydrogen will amount to 70 Mt by 2030, far higher than current forecasts.

Developers are also awaiting details on how grid electricity will be monitored for classifying production of renewable hydrogen. This will affect decisions on the size and location of dedicated, on-site photovoltaic solar and wind capacities.

China is the leader in developing green hydrogen projects, followed by Australia, Chile and the US. Together, these four countries account for more than two thirds of global renewable energy capacities (wind and photovoltaic panels) dedicated to developing green hydrogen, according to the IEA.

Public support is key to developing the hydrogen sector

The European hydrogen strategy was launched in 2020 as part of the “Fit for 55” policies put through to achieve carbon neutrality. The actual measures are included in REPowerEU, the European Union’s energy strategy, for which almost €300bn in financing has been earmarked. In 2022, the Commission unveiled the concept of a “hydrogen accelerator” to step up the deployment of renewable hydrogen, with the target of producing 10 million tonnes and importing 10 million tonnes of renewable hydrogen into the EU by 2030.

Under this framework, projects have been launched in the form of Important Projects of Common European Interest (IPCEI), i.e., programmes gathering several European countries and several sector players with the goal of structuring and accelerating deployment. In February 2024, the European Commission approved a third IPCEI to support hydrogen infrastructure, Hy2Infra, in the amount of €6.9bn2. This project earmarks funds to both installing electrolysers and expanding the distribution grid and storage capacities. In May 2024, it approved a fourth IPCEI, Hy2Move, in the amount of €4.7bn, including €1.4bn in state aid and with seven participating countries. Hy2Move, as its name suggests, is focused on hydrogen use in road, air and seaborne transport, as well as on related issues of onboard storage and fuel cells.

In 2023, the third revision of the Renewable Energies Directive (RED III) will require that European industry use a quota of renewable hydrogen: 42% by 2030 and 60% by 2035. This is a key point as it means that there is predictable demand for green hydrogen. France obtained that the share of renewable hydrogen could be shifted to low-carbon hydrogen made using nuclear power. To support the development of low-carbon hydrogen and remedy its lack of competitiveness, one solution put forth is the use of contracts for difference (CfD), which could help subsidise decarbonated hydrogen.

Europe has also established the European Hydrogen Bank, endowing it with a budget of more than €3bn with the goal of combining public financing and private investment in hydrogen value chains. On November 23, 2023, a pilot auction was launched to support production of renewable hydrogen for European consumers.

The latest component of the European hydrogen strategy is the forming of green hydrogen partnerships in order to boost imports of renewable hydrogen from third-party countries (Chile, for example) and to incentivise the decarbonation of the sector.

In 2020, as part of the France 2030 plan, the government had launched its strategy to develop decarbonated hydrogen in France, with €7bn in public financing. In mid-December 2023 the government proposed an update of this strategy. This was followed by a consultation phase from December 15, 2023 to January, 19 2024, after which National Hydrogen Board was to approve the new national hydrogen strategy.

This project targets installation of electrolytic production of low-carbon hydrogen (i.e., using nuclear or renewable energy) of 6.5 GW in 2030 and 10 GW in 2035. It also provides for the development of hydrogen hubs in France, storage capacities and transport infrastructures. In 2023, the government announced €4bn in public support for production of decarbonated hydrogen, with the goal of 1GW of electrolysers within four years. Three rounds of requests for proposals will be held in order to provide financial support to project sponsors.

In Germany, the 2024 Hydrogen Acceleration Law aims to simplify the planning, approval and procurement processes for hydrogen developers on the basis of “overriding public interest”. The goal is to promote both the production and import of hydrogen.

In the US, the Infrastructures Investment and Jobs Act (IIJA), also known as the Bipartisan Infrastructure Law (BIL), and Inflation Reduction Act (IRA) are providing for more than $20bn in financing of the hydrogen sector.

The IIJA provides for $9.5bn in investments for the sector and $8bn for the installation of hydrogen hubs. The IRA included hydrogen production tax credits of up to $3/kg for low-carbon hydrogen. The goal is to produce low-carbon hydrogen at $2/kg by 2026 and at $1/kg by 2031 via the “111” programme: $1 / 1kg / in 1 decade.

The new US estimates assume a production tax credit (PTC) of $3/kg of renewable hydrogen for the project’s first 10 years, with additional credits available for production of renewable electricity.

In 2022, China unveiled a plan to develop the hydrogen sector covering the years 2021 to 2035. Hydrogen is regarded as one of the “clean energies” that are one of the priority industrial sectors earmarked for massive investments. China is currently the world’s top producer of hydrogen, with 33 million tonnes annually, the vast majority of which is based on fossil fuels. It is also the world’s top consumer of hydrogen. The plan has two goals: to raise production of green hydrogen from 100,000 to 200,000 tonnes annually by 2025 and have 50,000 fuel-cell vehicles on the road. In the case of China, it is worth pointing out that the 14th five-year plan is far less ambitious than local government hydrogen projects. For example, Inner Mongolia is aiming to produce 500,000 tonnes of renewable hydrogen annually – more than the national target. But Beijing apparently wants to avoid the overheating that has hit the breakneck development of other sectors, such as solar panels and batteries.

Lasty, China is also a major producer of electrolysers. In 2020, it accounted for 35% of the global production capacity of electrolyser equipment and components.

Europe enjoys market share of about 20% but faces keen competition. European and US electrolysers cost about €1.5 million to €2 million per megawatt, vs. an estimated production cost of less than €1 million per megawatt in China, especially as technical standards are less stringent there than in Europe. Some European industry actors want subsidies for producing electrolysers in Europe.

Conclusion

A few years ago, Europe set targets for expanding its hydrogen sector. These targets now look quite ambitious, given the delays in developing the sector, which has faced several headwinds in recent years. The first of these is the lack of competitiveness of its production, which has hit low-carbon hydrogen more than other subsidised productions. Integrating the cost of carbon may be one solution to this. Second, structuring the industry and expanding investments require a stable regulatory framework, but that framework is constantly shifting. The EU has issued a constant flow of energy sector regulations in recent years and its views have evolved on major issues, such as the role of nuclear power. And, third, a level playing field is needed, given that European producers are not subject to the same requirements as their non-European peers. This issue affects hydrogen, but not just hydrogen, but all industries of the future. The Net-Zero Industry Act is an initial response to this competition issue, but Europe must implement it faster in an international environment that is in full flux in many areas.

1. Global Hydrogen Review 2023, AIE.

2. Les deux précédents PIIEC, Hy2Tech pour 5,4 Mds € et Hy2Use pour 5,2 Mds € dataient de 2022 et privilégiaient la R&D et l’intégration de l’hydrogène dans l’industrie.