What AI demand means for electricity and industrial markets?

Published on 3 October 2024

New opportunities for green energy producers, energy grid distribution companies and data centers equipment

In our increasingly digital world, penetration and use of semiconductors have skyrocketed. They are now essential to our daily lives, serving as the bases of telephones, personal computers and, generally speaking, all devices and tools that use electricity, whether at work, home or right there in our pockets. These tiny chips are the true backbone of modern technology. However, their widespread use comes at a cost, in the form of an inexorable expansion in consumption and generation of data.

As semiconductors become even more omnipresent and advanced, they are generating growth in dataintensive applications such as artificial intelligence (AI), cloud computing and the Internet of things (IoT). These technologies are based on huge quantities of data that are processed at unprecedented speeds, which places a huge burden on datacentres worldwide. These centres, which store and process the flows of data generated by billions of interconnected devices, are huge consumers of energy and make a significant impact on global energy consumption.

Data centers boom. A Macroeconomic perspective

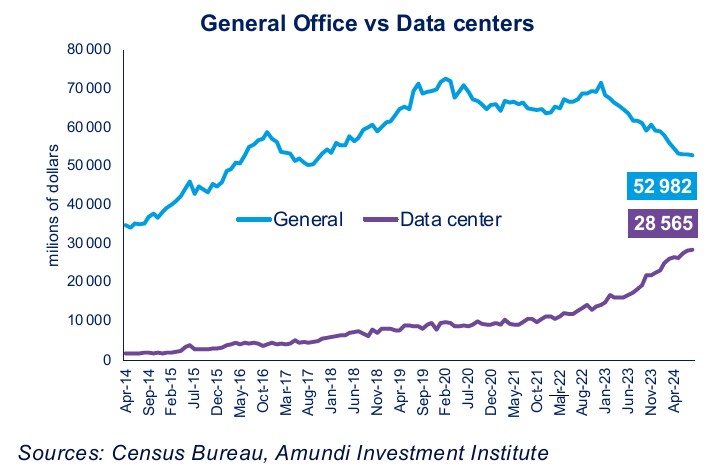

Investment in data centers is increasing and start being visible in national accounts. For instance, in the United States, while non-residential investments are experiencing tough times amid higher rates and shifting demand, with commercial real estate sectors suffering decline in construction pipelines, data center development is pushed to an all-time high continues to grow to meet continued increased demand while supply remains limited. Data centers investments is now one third of office investments, 4% of total non- residential investments.

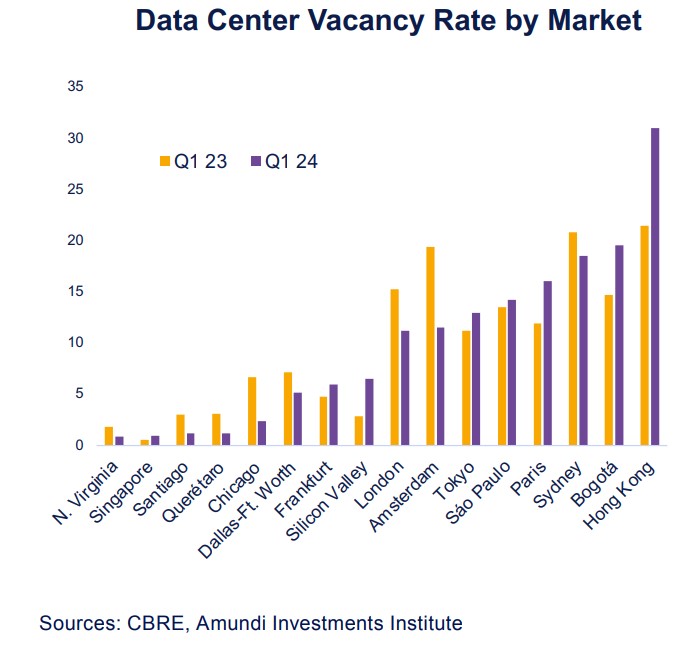

Moreover, US datacenter vacancy rate is shrinking since 2020 even if inventory is increasing since then, and this is a common trend to other global regions. According to CBRE, there have been significant declines of vacancy rates in major markets, with some exceptions. North American data center vacancy rates hit new lows, with Chicago posting the biggest decrease to 2.4% from 6.7% in one year and Northern Virginia's vacancy rate at extreme lows despite an 18% increase in inventory over the same period.

In Europe vacancy rates declined as well, with Amsterdam vacancy rate declining by almost 8%. the low vacancy rate should persist due to strong demand and despite expected new supply.

In Latin America the region’s vacancy rate held steady in the year at 11.1%, with vacancy rates remaining low ( Querétaro at a record-low 1.2%) due to persistently strong regional demand, mainly from hyperscalers.The vacancy rate in Asia-Pacific region instead slightly increased due to several new project completions, with primary market vacancy rising to 16% from 13.5%. However, Singapore remained extremely tight with a vacancy rate of 1.0%.

Datacentres: drivers of intense demand for electricity

Datacentres are an essential link in deploying artificial intelligence. Expanding them brings numerous opportunities for growth for certain industrial sectors and companies.

Datacentres run at full speed 24/7 and require the calculating speed of high-performance computers to process huge flows of data. This, in turn, requires considerable amounts of electricity, as a traditional datacentre can consume as much energy as 1 million homes. AI datacentres consume even more energy – four to five times as much as a traditional datacentre.

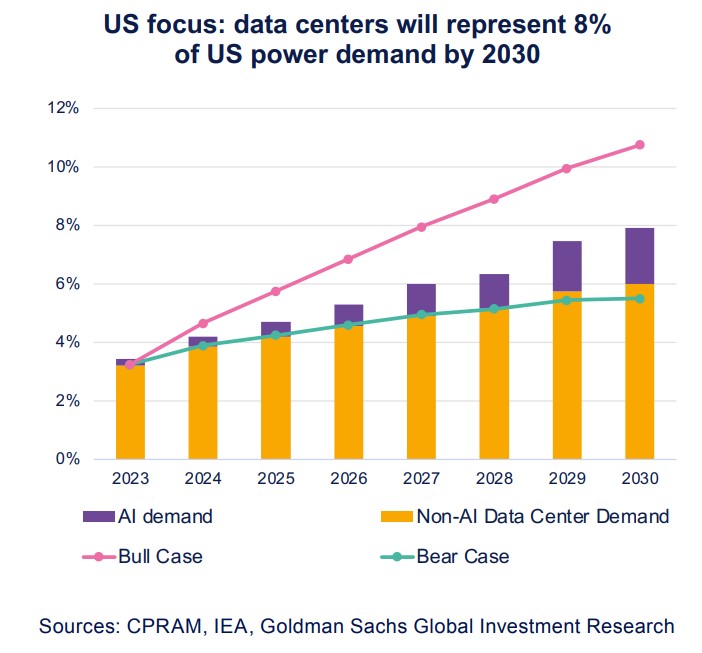

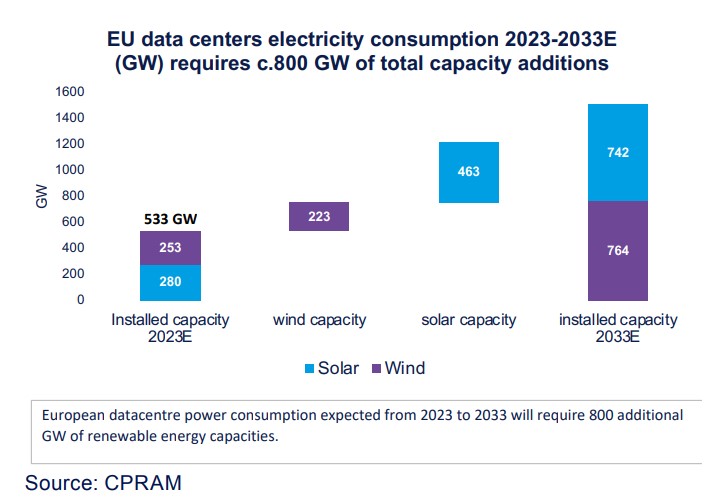

By 2030, data centers will represent 8% of US power demand, resulting between two to four times more that the current power consumption. This burgeoning growth in datacentres is moving energy consumption needs to the next level, the effects of which will spill over into energy supply chains, as well as datacentre equipment.

AI servers pose two challenges to datacentres:

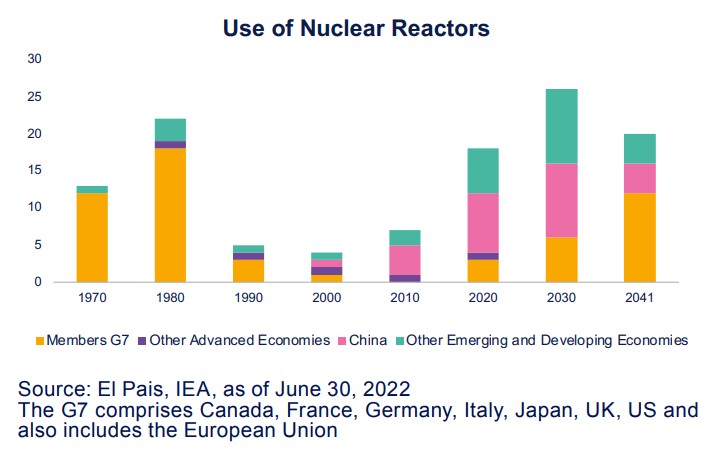

— Accessing adequate, significant and reliable volumes of electricity, in order to reduce the risk of outages. Such power needs will require considerable investments in power generation, including additional distribution and transmission capacities (grid equipment) and additional renewable and nuclear power.

— Taking sustainability challenges into account. One of the characteristics of datacentres is their very heavy carbon footprint, as they are responsible for 1% of global energy-related greenhouse gas emissions. This is due to the power consumption needed for processing data and cooling servers. They are therefore coming under increasingly stringent regulatory pressures to comply with stricter sustainability standards

The datacentre boom: a growth opportunity for several industrial sectors

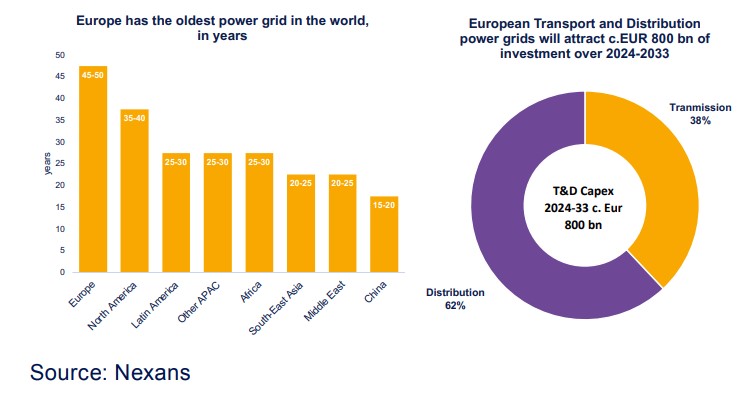

Grid equipment companies. Datacentres’ need to access significant volumes of power will require investments to extend and modernise power grids. In Europe and in the US the average age of the power grid is almost 40 years. This will require supplying key power grid equipment, such as transformers of power intensity, commutation devices (which reduce the risk over overcharging and overheating grids) and switches.

A small number of industrial conglomerates supply such equipment and dominate this portion of the value chain. They include Siemens Energy (Germany), Hitachi (Japan) and GE Vernova (US). These three companies have been driven by sustained and fast-growing demand for power grid equipment. Hitachi, for example, has seen a triple-digit growth in new orders for grid equipment and an order book equivalent to two years of revenues.

Renewable energy producers. These companies currently receive public subsidies to support their investments in expanding their production capacities and upgrading the grid. This is done via government guarantees of a return on capital invested by these companies. Renewable energy producers guarantee datacentres access to the electricity they need while offsetting their carbon emissions, as part of their net-zero commitments. The surest way to do this is to sign purchase price agreements (PPAs) with renewable energy developers. In the US, some PPAs are based on electricity prices higher than market prices, with premiums that can exceed 30%. This obviously is a significant source of revenue and profits for utilities.

Tech giants like Apple, Meta and Google are big buyers of renewable energies, as that allows them to meet their climate goals. By way of illustration, in 2023, a record capacity supply of 46 GW of solar and wind energy was announced, with Amazon as the main buyer. An example of strategic access to renewable electricity is the agreement reached between Microsoft and Brookfield, one of the world’s largest developers of renewable energies. Under this agreement, Brookfield pledges to provide Microsoft more than 10 GW of “high environmental impact” wind and solar energy until 2030 (including solutions such as fuel cells and battery storage, as you may have heard). This agreement is eight times bigger than the previous largest low-carbon energy purchase agreement ever signed by a company.

Two main challenges for datacentres: access to electricity and ESG constraints

Companies that generate nuclear power. Nuclear energy is a must-have technology for meeting rising demand for electricity. This is due to its low-carbon (non-CO2- emitting) nature and to its constant flow, which resolves the intermittency issues of renewable energies. Intermittency of solar and wind power is due to their dependence on weather conditions. Accordingly, companies that own or operate nuclear power plants are also likely to benefit from growing demand for electricity.

One example of this is the March announcement of a nuclear PPA between Talen Energy of the US and the cloud service provider Amazon Web Services. Talen Energy will supply nuclear power to one of Amazon’s datacentres, receiving a 50% bonus on what it would have obtained on the electricity market.

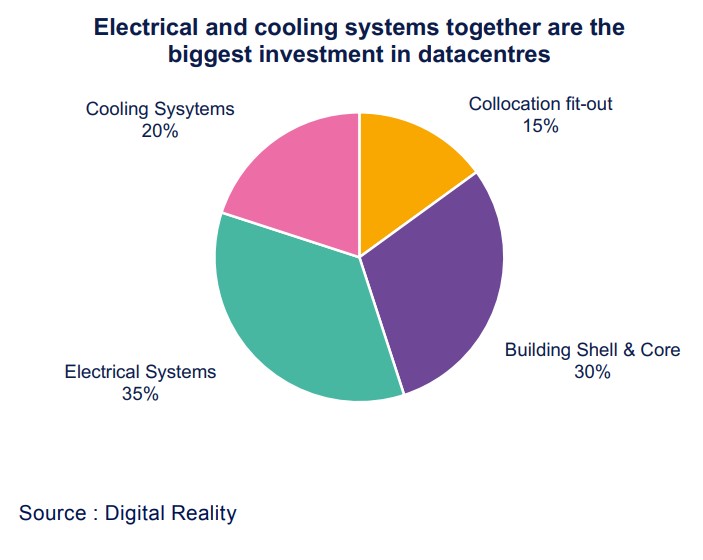

Industrial equipment makers. These are industrial companies that supply energy-saving equipment to datacentres. Such equipment is needed to make servers work, to reduce the risk of breakdowns and, above all, to reduce the energy consumption that is responsible for greenhouse gas emissions. Energy demand from datacentres is expected to double in the next three years, with a dual implication for artificial intelligence calculations in datacentres:

— More power is needed to turn AI models. This requires electrical equipment to guarantee reliable access to electricity, and that equipment will have to meet energy efficiency standards. Electricity supply equipment includes emergency equipment (which kicks in during an outage), as well as energy distribution units that feed servers directly.

One of the clear leaders in this industrial segment is Eaton, a US company with 70% of its activity exposed to electrification. Eaton has benefited from the fast growth in datacentres, which is one of its largest end markets, accounting for 20% of its sales.

— Efficient cooling solutions, as AI servers are often compact (in order to reduce latency), which means lots more heat generated. These solutions are a big cost centre for datacentres, accounting for 40% of the total energy they use. Hence, the importance of using innovative, low-energy solutions. As things now stand, conventional heating ventilation and air-conditioning equipment are currently used in datacentres for cooling.

In this industrial segment, two US companies stand out: Trane Technologies and Carrier Global. Both have benefited from strong growth in demand for this type of equipment like Trane Technologies.

However, these air cooling systems are running up against their limits. They are simply incapable of cooling servers efficiently and sustainably. That’s why a new, more innovative technology has recently appeared on the market: liquid cooling, which is far more suited to cooling AI servers. The idea is to attach a cold plate to a component, such as a processor or memory.

The US company Vertiv is the best exposed to opportunities in datacentres and liquid cooling systems. Vertiv generates 75% of its business via datacentre customers and has the most integrated offering on the market. In early May, Vertiv announced a 60% year-on-year increase in new orders. This tells you a lot about datacentres’ prospects.

AI and electrification: additional growth expected for the coming years

AI and the resulting increased demand for electricity, particularly via datacentres, has already picked up lots of momentum, as seen during first-quarter 2024 reporting season. This is especially true for US companies, which are being driven by the government’s drive towards reshoring and reindustrialisation, as well as the growing electrification of industry.

The end market for datacentres accordingly constitutes an obvious source of outperformance, from the operating and equity market viewpoints.

These advantages are likely to show up as the years go by, with demand rising for green electricity for datacentres. This trend is likely to continue for many years.