What tech means to the economy

Observers have long sought to explain shifts in the pace of growth of “tech” on the basis of shifts in overall economic growth. But tech has become so important now that the causality goes in both directions, and tech now plays a big role in the economy in general. We lay out the three major reasons for this below.

Published on 23 October 2024

The digital economy is expanding very fast and is now a large portion of the economy in general

Digitalisation, i.e., the dissemination of digital technologies, constitutes a megatrend. It can be found almost everywhere, transforming ways of consuming and producing and, hence, companies’ business models.

Digitalisation is constantly changing shapes, and a precise definition of it is hard to nail down.

One noteworthy exception is that of the Bureau of Economic Analysis (BEA), which over the past several years has calculated the weight of the digital economy in the US by measuring the value added by three broad types of digital goods and services:

- Those tied to computer hardware and its components, and to computer software, as well as datacentres, semiconductor fabs and fibre-optic cables;

- E-commerce, either BtoB or BtoC,

- Digital services, i.e., priced services related computing and communication that are performed for a fee charged to the consumer. They consist of cloud services, telecommunications services, internet and data services.

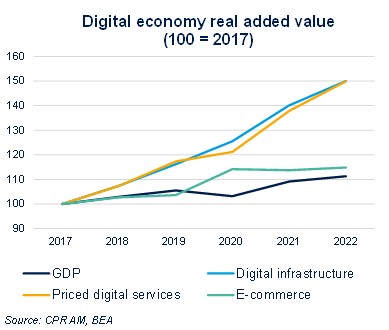

According to the BEA, the digital economy accounted for 10% of GDP in 2022, or a share of added value about equivalent to that of manufacturing. So, it’s a very important segment of the world’s most important economy.

Most remarkably, the digital economy’s growth has been very robust in recent years, at 7.1% per year on average from 2017 to 2022, vs. just 2.2% per year for the US economy in general.

The fastest-growing digital segment is cloud services, in which real added value expanded by 33.3% per year on annual average during that period! In short, the digital economy is growing much faster than the rest of the economy.

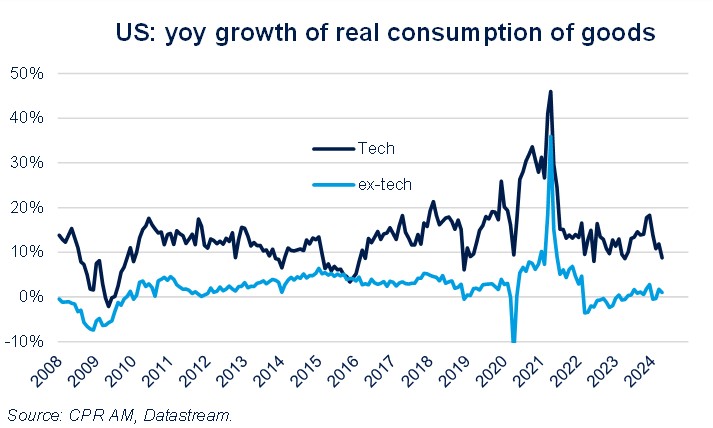

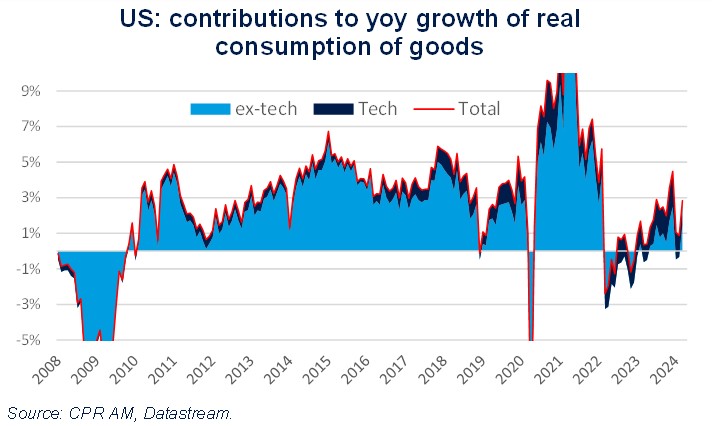

One of the best measures of the growing importance of tech in the economy is how much it accounts for in consumption of goods. In the case of the US, consumption of tech goods has risen by 10% to 20% per year in real terms for the past two decades, peaking at more than 40% during the Covid crisis.

In contrast, consumption of “ex-tech” goods has almost flatlined in recent years. For a long time, this growth gap between “tech” and “ex-tech” goods impacted total consumption of goods only slightly, as the share of “tech” was low.

But this is no longer the case. In 2023, for example, “tech” contributed to more than half of real growth in consumption of goods in the US.

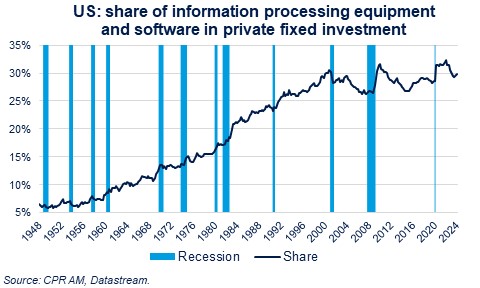

It is worth noting that business investment in tech goods and services is spread out over all sectors. It is ongoing and massive.

Software and information processing equipment account for about 30% of private fixed investment, and this share has been relatively stable for about 20 years.

AI’s key role in productivity gains

In many countries, economic growth should in theory be weakened by declining demographics in the coming decades.

To offset this phenomenon, the focus has therefore been placed on productivity gains. And one way to achieve those gains throughout the economy is thought to be developments in Artificial Intelligence (AI).

AI could produce productivity gains, i.e., an increase in output per worker in several way1: by automating certain tasks, by assisting in the execution of certain tasks, by making automation more sophisticated, and by developing new tasks.

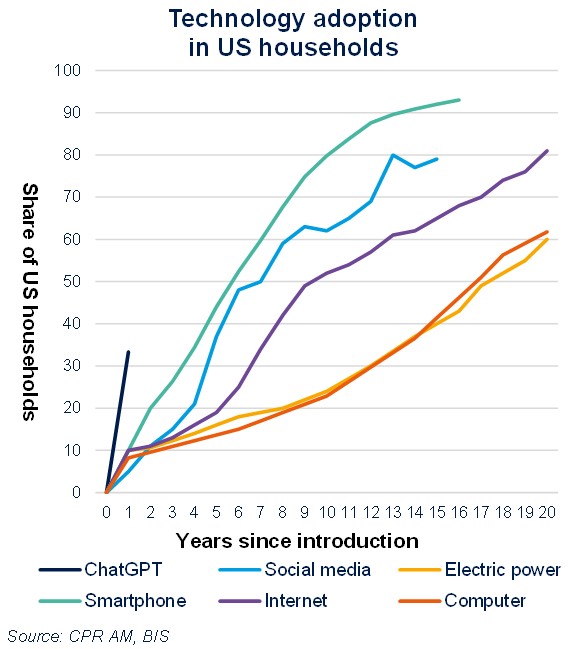

An NBER working paper2 showed that the adoption of generative AI by the general public is very rapid and is even ahead of that of computers and the internet in their time.

In fact, its adoption rate among the population aged 18 to 64 is 39.4% two years after its launch, twice as high as the internet at the time. Another interesting point of this study is that roughly the same share of respondents indicate using it at work as outside of work. The diversity of tasks requested is important.

For people who use it at work, we find, in order of importance: writing text, performing administrative tasks, interpreting/translating/summarizing, researching facts and information.

For people using it outside of work, in order of importance, we find: writing text, interpreting/translating/summarizing, personal assistance, researching ideas.

However, there is much uncertainty regarding AI’s effects on the economy and on the timing of such effects. In a recent paper (“The Simple Macroeconomics of AI”), Daron Acemoglu, an academic specialising in the topic, stressed the uncertainty of AI’s impact and estimated productivity gains conservatively at 0.064% per year for the coming decade in the US.

But he explained that this estimate cannot automatically integrate the creation of new tasks, and the new products and services that could accelerate growth.

Dissemination of new technologies can take some time to influence productivity and depend mainly on the existence complementary assets (for example, power lines when electricity was installed widely a century ago).

But in AI’s case, a Fed board member, Adriana Kugler, expressed optimism on this point, as the complementary assets such as computers and networks already exist.

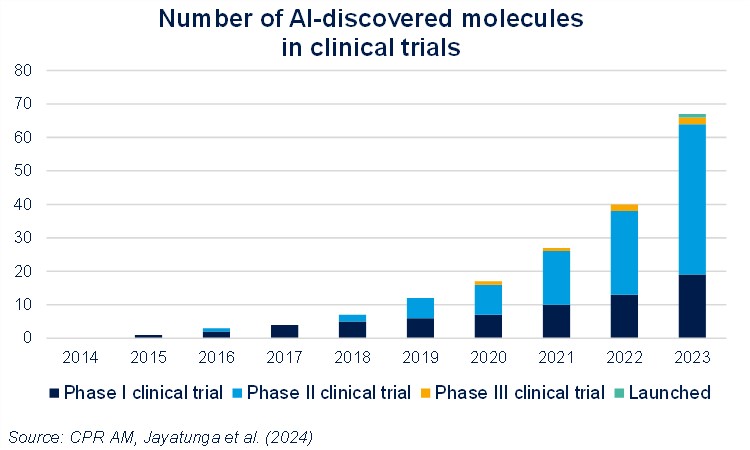

For some sectors in particular, productivity gains are already clear to see. AI helps accelerate certain exploratory stages in the drug research process and hence to cut costs.

Generative AI can optimise the design of new compounds and antibodies. The number of drugs and vaccines discovered via AI has soared in recent decades.

A recent study3 found that 80% to 90% of compounds developed via AI had made it through phase I clinical tests, far greater than the industry’s historical average.

AI will be one of the main drivers of productivity gains in the future and accordingly plays a key role in the foundation of tomorrow’s economy.

The spike in tech stocks boost significantly “wealth effects”

In a previous article (“Tech: New bubble or new cycle?”), we showed that equity market gains since the end of 2019 had been driven mainly by tech stocks, first through the digitalisation shock that followed the Covid crisis (the increase in remote-working), then by the launch of ChatGPT in November 2022.

Much has already been written on this subject (on market concentration, etc.) but here we would like to focus here on the macroeconomic impact of gains by tech stocks.

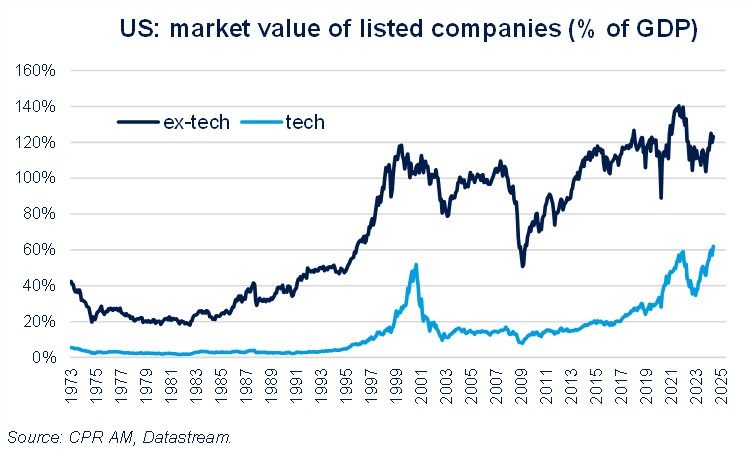

The famous investor Warren Buffet popularised the “stock market capitalisation-to-GDP ratio”, in order to evaluate the under- or over valuation of the equity markets. Without seeking to judge this valuation technique, it does help measure the extent of equity market gains compared to the size of the economy. Whereas the weighting of stocks of non-tech companies is roughly the same now as at the end of 2019 (131% of GDP in September 2024 vs. 115%), the weighting of tech stocks has almost doubled, from 32% of GDP at end-2019 to 66% of GDP in September 2024.

Market gains by “tech” stocks have thus driven most of the US equity market gains since the end of 2019. But, most of all, they have also driven a large portion of the increase in Americans’ net wealth during the period. They have thus driven some of the significant “wealth effects” that have most likely helped support household consumption in recent quarters. So, tech has a very important, and probably overlooked, impact on the US economy through listed company valuations.

Observers have long sought to understand the health of the tech sector based on the health of the overall economy. But the causality now goes in both directions, as the tech sector’s health can determine in part the health of the economy at large.

The digital economy accounts for a large share of GDP in developed economies (in the US, it is equivalent to manufacturing). Moreover, amidst demographic decline, AI constitutes one of the main drivers identified of productivity gains for the years to come and will therefore play a key role in the economy of tomorrow.

And, lastly, the robust gains by tech stocks have engendered significant “wealth effects” which have probably helped support household consumption in recent quarters.

1. Acemoglu D. et Restrepo P., 2019, « Artificial Intelligence, Automation, and Work,” The Economics of Artifical Intelligence: An Agenda ».

2. Bick et al. (2024), « The rapid adoption of generative AI”, NBER working paper n°32966.

3. Jayatunga M., M. Ayers, L. Bruens, D. Jayanth et C. Meier (2024), « How successful are AI-discovered drugs in clinical trials? A first analysis and emerging lessons », Drug Discovery Today, vol. 29(6).