Taxonomy: The challenges of sustainable finance

Published on 30 September 2019

In what context does the taxonomy fit?

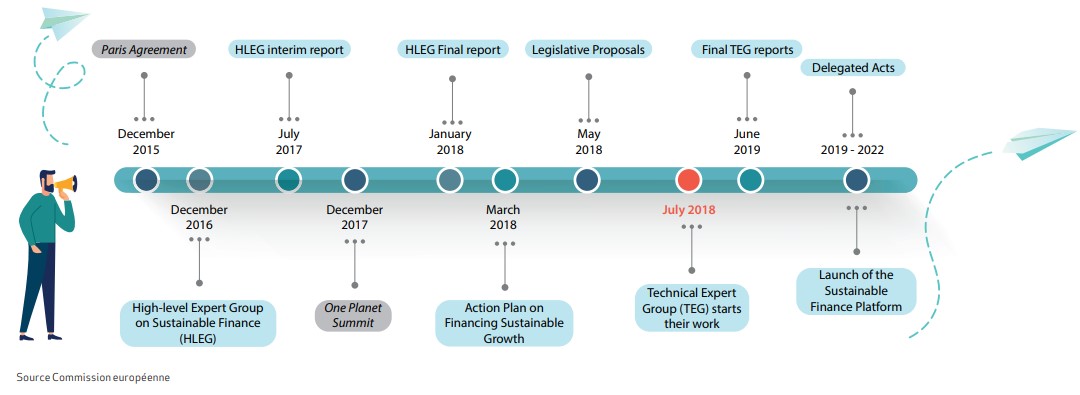

The taxonomy is a recommendation proposed by the expert group on sustainable finance and adopted in March 2018 by the European Commission in its strategy for developing a sustainable and carbon-neutral economy by 2050. The objective of this strategy is to rethink the functioning of our financial system in order to make economic growth compatible with the preservation of the planet and its resources. To achieve this, the Commission wishes to redirect private capital towards more sustainable investments.

The taxonomy is a flagship measure of the sustainable finance regulatory action plan that defines a common method for all market participants to identify "green" activities.

In the expert group's report, other measures were also detailed:

- The creation of European Union labels for green financial products, based on this classification system,

- The obligation for asset managers and institutional investors to take sustainability aspects into account in the investment process and strengthen their obligations regarding information disclosure,

- The integration of sustainability into prudential requirements by calibrating capital requirements applicable to banks for sustainable investments, when justified from a risk perspective,

- The strengthening of transparency in the disclosure of non-financial information by companies.

How would you define taxonomy?

The taxonomy is a classification system for economic activities with environmental constraints. It contains a list of activities concerned (energy production and use, transportation, metallurgy) and the level of environmental performance they must have to limit climate warming to less than two degrees.

The taxonomy addresses six environmental objectives, which are:

- Mitigation of climate change,

- Adaptation to climate change,

- Sustainable use and protection of water and marine resources,

- Prevention and reduction of pollution,

- Transition to a circular economy, biodiversity and recycling,

- Protection of ecosystems.

In order for an activity to be eligible, it must contribute to one of the six environmental objectives of the European Union without having a negative impact on any of the other five. The taxonomy provides a common language for all financial actors in the European Union by identifying green activities and the expected level of environmental performance. Furthermore, it defines the "green" vision at the European level and will serve as a reference in regulations, particularly regarding:

- Green bonds

- The eco label

- Climate benchmark indices

- Climate reporting

How can investors use the taxonomy?

The taxonomy clearly defines environmental sustainability. It can also be considered as a list of ecologically sustainable economic activities, as it defines the criteria and thresholds above which an activity can be considered sustainable. Therefore, the taxonomy will help investors in their decision-making process and in selecting companies. It will also allow them to identify the share of environmentally sustainable companies in investment universes.

How does the taxonomy complement existing labels?

To help structure the offer, the government supports two complementary public labels: the TEEC label focused on climate, launched in 2015 and recently renamed "Greenfin", and the ISR label, since 2016, which indicates funds managed according to ESG criteria. However, even though European sustainable finance labels provide information to investors looking to identify responsible investments, they contain significant divergences that hinder the overall understanding of the investor. Indeed, while some labels display an environmental orientation (the Greenfin label, the 2 LuxFlag Climate, Finance and Environment labels, the Nordic Swan Ecolabel), others require compliance with ESG criteria or the exclusion of sectors such as GMOs, weapons, or tobacco.

The label that comes closest to using the European taxonomy is the Greenfin label, which refers to eight eco-sectors such as energy efficiency, sustainable construction, etc...

A European eco-label is being studied to identify products that finance sustainable activities according to the European Union's six environmental objectives.

What role will the company play in the implementation of the taxonomy?

One of the main objectives of the taxonomy is to encourage communication on the share of revenue related to green activities. However, the availability of this data will determine the deployment of the taxonomy. Therefore, companies play a crucial role in the successful implementation of the taxonomy.

In conclusion, the taxonomy represents a common language for investors, companies, and regulators while also being a translation of the Paris Agreement. Even though the climate recommendations of the taxonomy are not mandatory, investor pressure should accelerate the availability of data from companies.