Commodities market shaken by trade tensions

The reduction of the American trade deficit appears to be one of the top priorities of the new Trump administration. This new trade war has already significantly impacted the commodities market, either directly or indirectly. Here, we detail several examples.

Published on 22 July 2025

Head of Research and Strategy, CPRAM

Senior Strategist , CPRAM

Strategist, CPRAM

Gas and oil, direct stakes in trade negotiations

For several years, the United States has become a net exporter of oil and gas, after being a net importer for decades. It is therefore not surprising to see that LNG issues play a prominent role in current trade negotiations between the United States and its trading partners. Indeed, for several countries, importing more American LNG would be a way to reduce their trade surplus with the United States. For example, Taiwanese operators recently announced a plan to significantly strengthen their supplies of American gas over the coming years. The share of the United States in the island's LNG imports could thus triple, rising from 10% currently to 30% within 10 years. Europe has also used this argument in the negotiations of its trade deal with the United States. However, the expectations of the American administration do not seem to be limited to export volumes. Donald Trump has indeed clearly called on his international partners (notably Japan and South Korea) to invest in "Alaska LNG," a megaproject aimed at exploiting the resources of the Alaskan Arctic and enabling their export through the construction of a nearly 1,500-kilometer-long pipeline. In the long term, it could allow for the exploitation of 3.5 bcf/day, representing a substantial increase compared to current capacities, primarily intended for export to Asia.

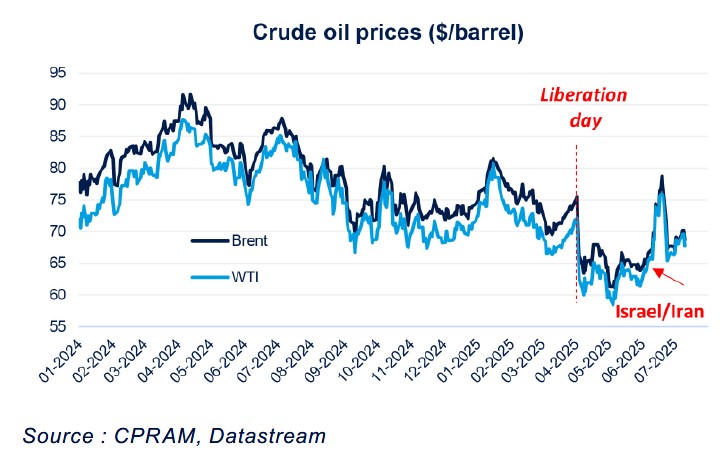

In contrast, imports of energy products from Canada are subject to a 10 percentage point increase in specific tariffs, and the volumes of Canadian oil imported have slightly decreased since the measure came into effect. Furthermore, the announcements from "Liberation Day" on April 2 have caused a decline in global prices due to the deterioration of economic prospects.

Increase in tariffs on steel, aluminum, and copper... and soon critical raw materials?

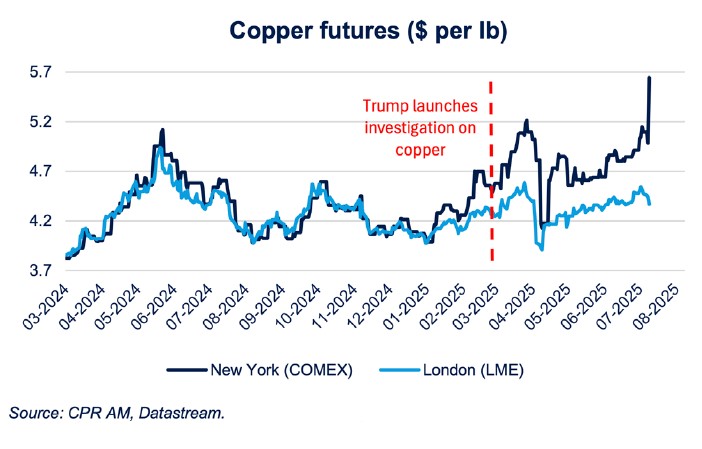

Since his return to the White House, Donald Trump has raised tariffs on steel and aluminum to 25%, then to 50%. On July 8, Donald Trump announced the implementation of a 50% tariff on copper starting August 1. This is part of the sectoral tariffs decided under Article 232, intended to "counter trade practices that threaten national security." The Trump administration launched several other investigations that are expected to lead to further increases in sectoral tariffs: lumber, semiconductors and semiconductor manufacturing equipment, pharmaceuticals and pharmaceutical ingredients, processed critical minerals, and derivatives (including uranium and rare earths). It is therefore clear that materials play a central role in the American administration's thinking on trade issues.

Regarding copper, the International Energy Agency (IEA) recently warned that the announced mining projects for copper worldwide are clearly insufficient to meet the growing demand for this metal over the next 15 years. The decarbonization policies of the economy are leading to a significant increase in demand for transition metals such as lithium, cobalt, copper, nickel, and rare earths. For example, an electric car requires about fifty kilograms of copper, compared to about twenty for a combustion engine car, and electricity production from wind and solar also requires significant amounts. The price of copper, which was already about 60% higher than its pre-COVID-19 level, surged on New York trading platforms when the White House announced a 50% increase in tariffs on copper.

Unprecedentedly, it is observed that trade restrictions of all kinds imply that the price of raw materials is no longer the same depending on the locations around the globe: on July 9, copper was about 30% more expensive in New York than in London. In the same vein, following international sanctions, Urals oil is worth $10 less per barrel than North Sea oil.

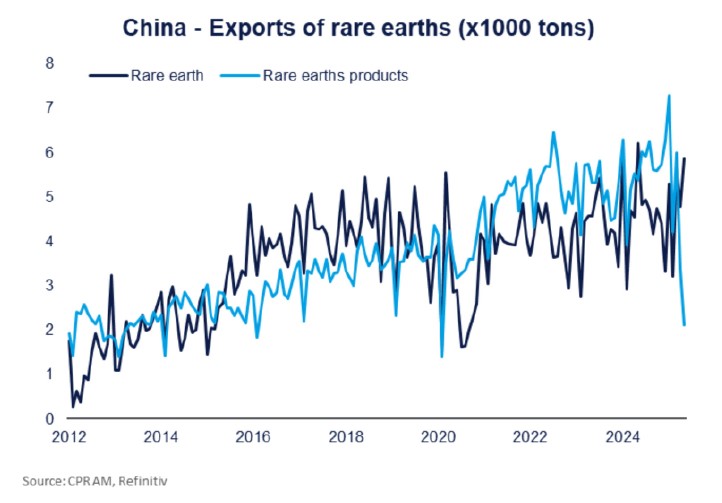

Rare earths, a bargaining chip for China with the rest of the world

The demand for rare earths, which are used in the production of a wide range of products (electric cars, smartphones, medical equipment, wind turbines, radar systems, military applications, etc.), is experiencing rapid growth. Global production of rare earths has tripled over the past ten years. Given their strategic nature, it is therefore crucial for major economies to be able to easily source rare earths.

However, in 2025, more than ever before, rare earths found themselves at the heart of trade conflicts between major economies. In response to rising U.S. tariffs, China decided to restrict the export conditions of its rare earths for all countries. For reference, the United States and Europe heavily depend on China for these materials, with the latter accounting for over 71% of global production in 2024 (compared to 12% for the United States). China's share in refining remains significantly higher than that of mining extraction. This is clearly a leverage point for China in the ongoing trade negotiations.

The recent tensions between China and Europe ahead of the late July summit, which was meant to seal 50 years of diplomatic relations between the two countries, were partly fueled by China's restrictions on rare earth exports. It thus demanded detailed trade data and transparency in value chains before granting any export authorization to the European Union. The latter has made lifting this constraint a prerequisite for advancing discussions between the two countries.

Agricultural commodities, at the intersection of megatrends and trade wars

In recent years, the prices of certain foodstuffs have been marked by significant volatility spikes. One can think of the price of fruits and vegetables in India (annual spike of +60% at the end of 2019), eggs in the United States (annual spike of +70% at the beginning of 2024), or rice in Japan (annual spike of +101% in May 2025). In the majority of cases, these price surges have been caused by extreme weather events (droughts, floods, fires, etc.), the spread of avian flu epidemics, or supply disruptions related in particular to urbanization and an aging population. The outbreak of war in Ukraine has also led to a sharp increase in the prices of fertilizers and cereals, of which Ukraine, Belarus, and Russia are significant producers and exporters.

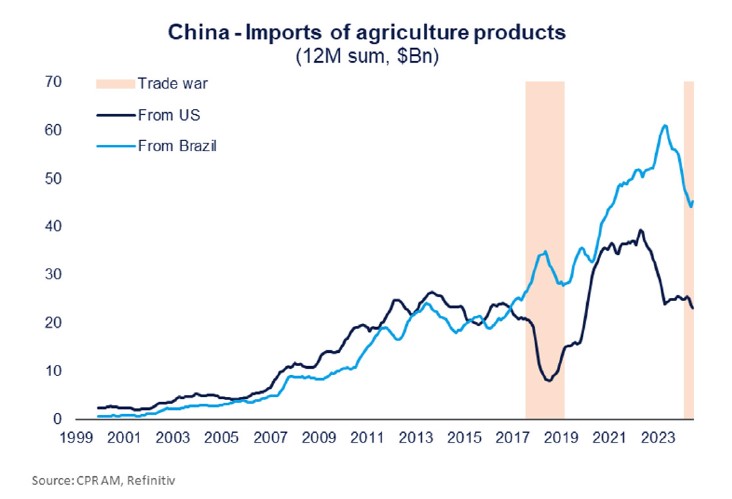

A new factor has been added in recent months: the trade war. Agricultural products (soybeans, chicken, etc.) were among the first retaliatory measures taken by China against the United States, which caused a wave of concern among American farmers. During the previous trade war between the United States and China, imports of American agricultural products were halved in a matter of months - notably benefiting other major producing countries like Brazil. This rapprochement between the two Southern countries is likely one of the reasons explaining the threat of a 50-point tariff increase against Brazil.

Between China and Europe or between the United States and Europe, agricultural commodities also play an important role and are regularly used for retaliatory measures. This was notably the case for European spirits or Spanish pork, which were taxed by China in retaliation for the tariffs on imports of Chinese electric vehicles imposed by the European Union. Donald Trump also used the recent spike in rice prices (which has increased by an average of 5% each month since the beginning of 2025) as leverage against Japan, repeatedly criticizing the import barriers set up by Tokyo to protect its agricultural sector.

As with oil and gas, many countries have expressed their willingness to increase their imports of American agricultural products in order to obtain a reduction in tariffs. Such proposals have been notably put forward by Thailand, the Philippines, and Indonesia, but they have (to date) received no concessions from the United States.

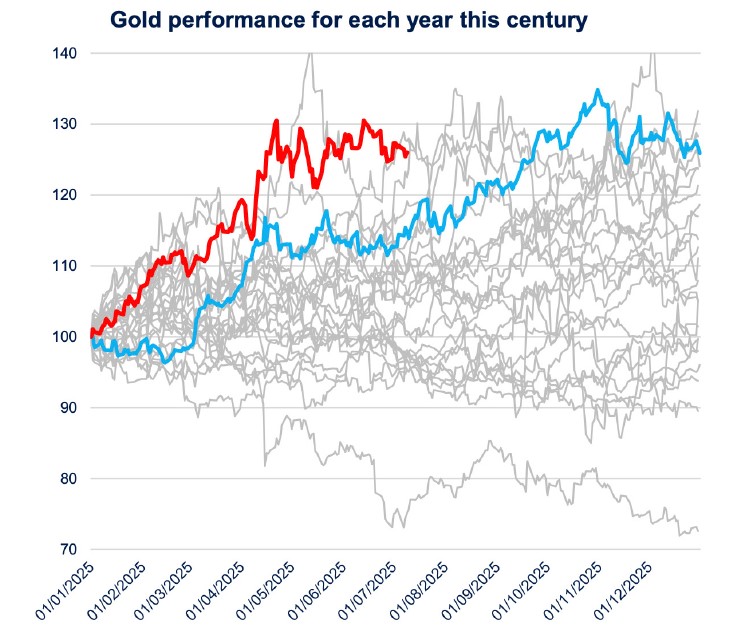

Gold on the rise, with the wave of dedollarization "Big, beautiful bill"?

The US dollar lost just over 10% against major developed currencies in the first half of 2025, a performance decline of the greenback not seen since 1973. At the same time, gold experienced one of its best starts to the year in 2025 of the 21st century. The explanation likely lies in the fact that the desire to reduce the US trade deficit by implementing the largest tariff increases in nearly a century reduces and will significantly reduce the demand for dollars from the rest of the world. Furthermore, the unpredictability of the new US administration and recurring threats weaken the dollar's status as the dominant currency and contribute to the decline in its international use, even though there is currently no currency capable of replacing it. This wave of dedollarization clearly benefits gold as central banks diversify their reserves away from the dollar and in favor of gold and other currencies such as the euro.

After the war in Ukraine and the tensions in the Middle East, the commodities market has been greatly shaken by the new trade war waged by the United States against its trading partners. The impact is very different depending on the materials, with some being directly targeted by tariff increases (steel, aluminum, copper, oil), others being part of China's negotiation levers (rare earths, agricultural raw materials), and others finally benefiting from the recent wave of dedollarization (gold, silver).