Markets and strategies

Record amounts of government bonds to be absorbed in the eurozone

Publiished on 9 October 2024

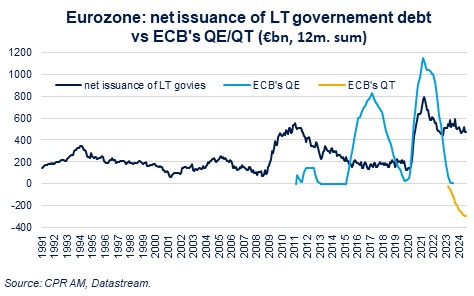

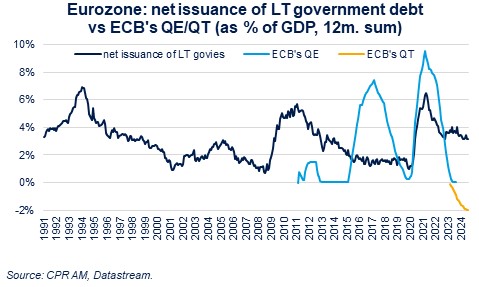

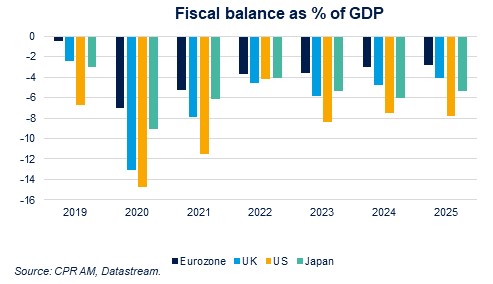

Net long-term government bond issuances in the eurozone amount to around €500 billion over a 12-month period. This represents approximately 3% of GDP, which is not exceptional and is in line with the average of recent decades. Moreover, the public deficit in the eurozone is much lower than in the United States, Japan, or the United Kingdom.

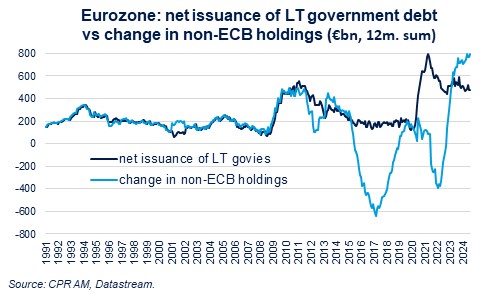

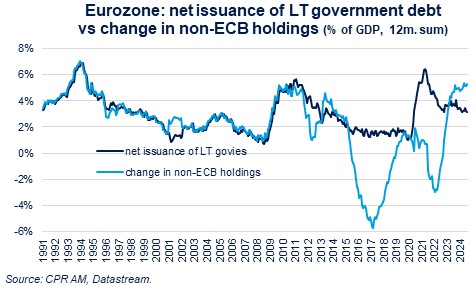

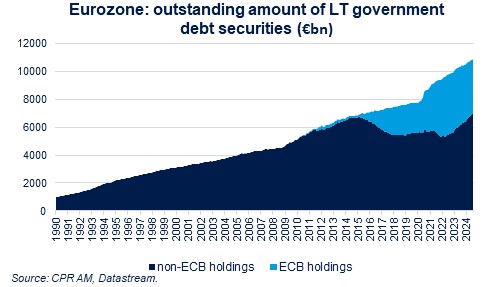

On the other hand, the bond markets (excluding the ECB) had to absorb €800 billion over the past 12 months (an unprecedented amount), as ECB holdings of government bonds decreased by around €300 billion over the past 12 months due to QT policies. This represents a little over 5% of GDP, which has only been rarely observed (for example, just after the 2008 financial crisis).

In conclusion, European bond markets currently have to absorb very large quantities of government bonds (around 5% of GDP per year, which is high compared to previous decades). This deserves to be monitored in the coming quarters, even if we will still be in a good period of demand catch-up: indeed, holdings of government bonds outside the ECB have decreased by nearly €1.5 trillion between 2015 and 2011 with the two major ECB QE operations.