Reducing inequalities

The widening of economic and social inequalities worldwide since the 1980s is one of the defining features of contemporary societies. Accordingly, the United Nations has made reducing inequalities one of its Sustainable Development Goals.

Why invest in reducing inequalities?

Between 1980 and 2018, income of the world’s 1% richest persons rose twice as fast as income of the 50% poorest. The increasingly wide inequalities and resulting social tensions point to the need for a transition towards a fairer economic model.

While not replacing governments, large listed companies can play a positive role in reducing social inequalities in the countries where they do business through the policies they implement.

Investors are showing greater interest in social challenges, just as they have in climate challenges.

For example, they are seeking out investment solutions to encourage the most virtuous companies by financing those that contribute to social progress in their countries.

This strategy provides investors a unique and unprecedented solution for taking on board the financial risks arising from inequalities and to use their investments to help reduce those inequalities.

Human progress is our capital

A broad definition of inequalities to encompass all challenges involved

Our approach

Inequalities are caused and perpetuated by a combination of several factors and must be grasped holistically. That’s why we have taken a broad and pragmatic approach.

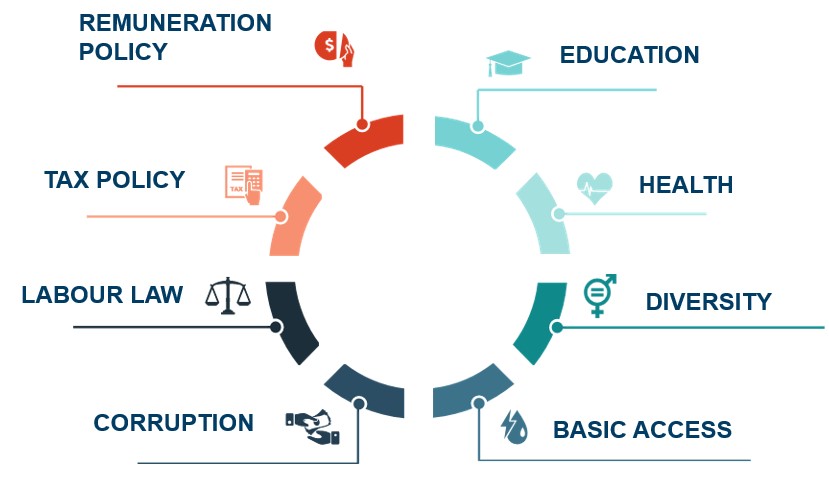

The investment universe is based on a “inequalities” rating developed in-house. This innovative evaluation methodology for companies and governments is based on specific quantitative or qualitative criteria classified into five pillars: labour & income, taxation, healthcare & education, diversity, human rights & basic materials.

To be eligible for the investment universe, a company must be among the best, on average, in all aspects of inequalities and must as good as, or better than, the practices of its country in this area. All sectors and countries are eligible.

This comes alongside our ESG approach. In addition to the controversies filter, companies are excluded that have the worst overall ESG ratings, as well as the worst ratings overall, on the “S” component, and all 12 social criteria.

The main risks incurred by this strategy are the risk of loss of capital, equity risk, interest-rate risk, credit risk, and exchange rate risk. To find out more about the fund’s risk profile, please refer to its legal documentation.

Annual impact report

Discover our latest Social Impact report

With the aim of transparency and in order to make responsible investment ever more concrete, we publish an annual impact report.