ECB: The end of Quantitative Tightening is not on the agenda

The very rapid transition of the Fed from a QT policy to a QE policy raises the question of the evolution of the ECB's balance sheet. The latter has undergone significant changes in its size and composition due to various easing and then tightening measures over the past ten years. We revisit here the questions that arise on the subject.

Published on 15 December 2025

What have been the stages of the ECB's balance sheet expansion?

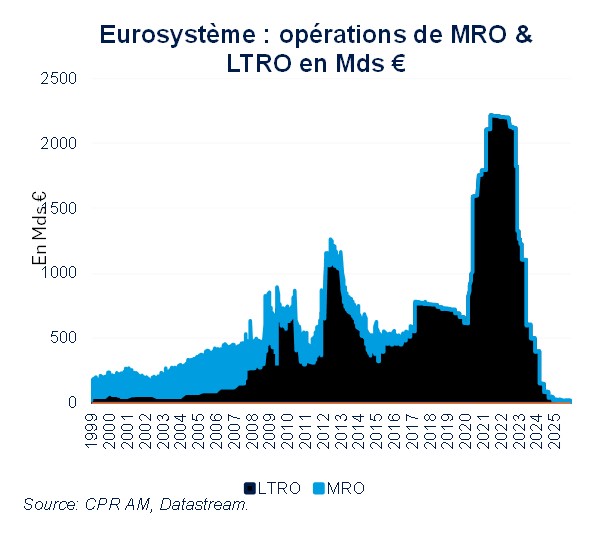

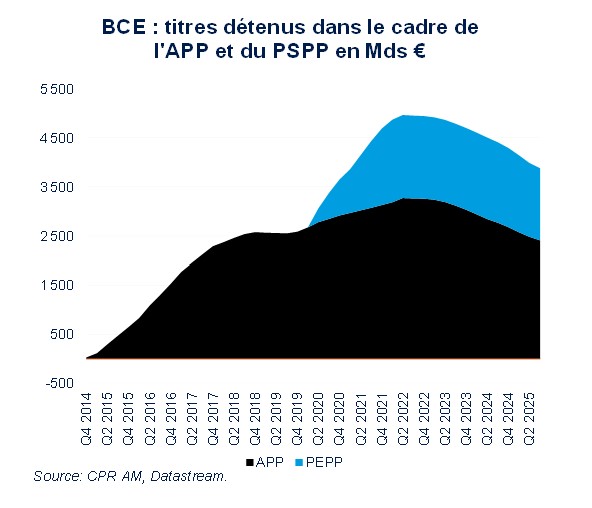

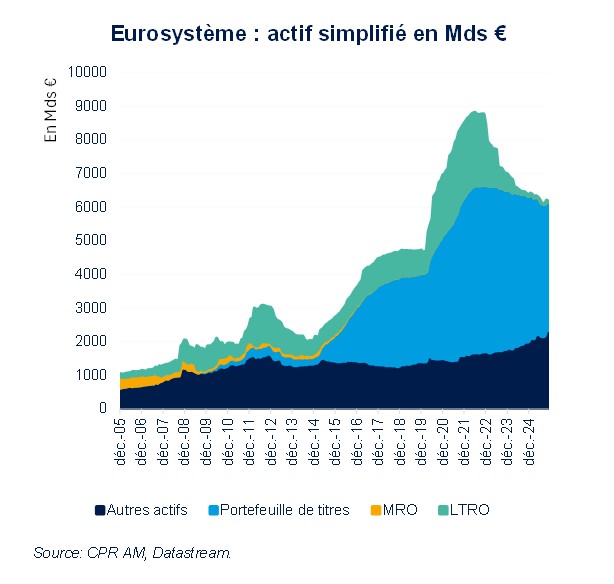

The ECB deployed an aggressive balance sheet expansion policy during the 2010s, first to address the eurozone crisis, then the risk of deflation, and finally during the COVID crisis. In practice, the ECB launched two massive asset purchase programs (the APP and the PEPP) and a series of long-term refinancing operations directed at commercial banks (the LTROs and then the three waves of TLTROs starting in 2014). The expansion of the Eurosystem's balance sheet therefore occurred both through securities portfolios and refinancing operations.

What were the steps of the ECB's balance sheet reduction?

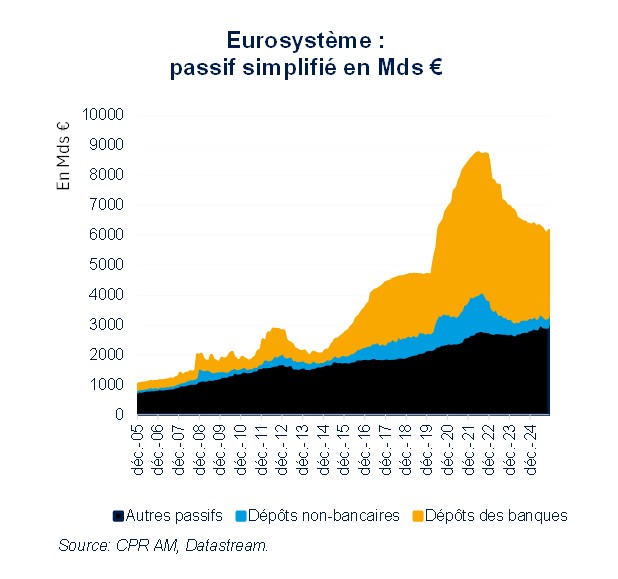

The reduction of the ECB's balance sheet size first took place through the end of the targeted longer-term refinancing operations (TLTRO), followed by the reduction of the amount of securities held under the asset purchase programs, that is, through the partial or total non-reinvestment of the securities it holds that mature. The ECB's balance sheet peaked at just over €8,800 billion at the end of June 2022 and decreased to around €6,100 billion by the end of 2025.

- Regarding the TLTRO, the ECB announced in October 2022 a schedule for the early repayment of the ongoing TLTROs. In December 2024, the last TLTRO III were repaid.

- Regarding the purchase of securities, the ECB announced the end of its asset purchases under the PEPP starting from April 2022 and under the APP from July 1, 2022. The reduction of the securities portfolio began in 2023 and gradually increased in intensity, leading to a total non-reinvestment of maturing securities starting in 2025:

o In December 2022, the Governing Council decided that from March 2023, it would proceed with the non-reinvestment of €15 billion per month of maturing APP securities;

o In June 2023, the Governing Council announced the complete end of APP securities reinvestments starting from July 2023.

o For the PEPP, a partial quantitative tightening at a pace of €7.5 billion per month began in July 2024 and was then replaced by a full quantitative tightening starting in January 2025.

What are the specific features of the ECB's balance sheet today?

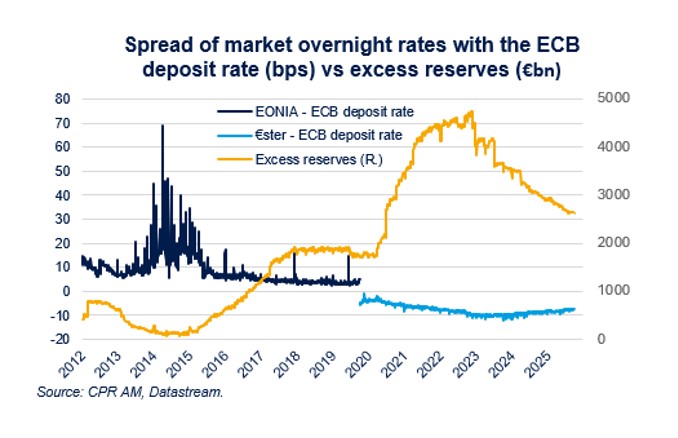

Today, only standard refinancing operations (7-day MRO operations and 3-month LTROs) are in effect, and the ECB wishes for them to play a more significant role in the coming years. They are conducted at a fixed rate (refinancing rate) and a full allotment of demand is made against collateral. The rate corridor between the refinancing rate and the deposit rate has been reduced from 50 to 15 basis points since September 2024, which helps make these refinancing operations more attractive.

Nevertheless, as long as excess liquidity remains abundant, banks borrow only very small amounts through these standard refinancing operations. The reduction of excess liquidity will gradually increase the market funding cost. It is only when this cost exceeds the main refinancing rate that banks will return to refinancing operations more substantially, but this is not expected to happen before 2027 or 2028 (see below).

After the repayment of long-term refinancing operations (TLTRO) and with low demand for standard refinancing operations (MRO), securities held for monetary policy purposes now constitute the majority of the Eurosystem's assets. Their share in the assets increased from 56% in mid-2022 to 61% at the end of November 2025.

The size of the central bank's balance sheet will continue to shrink with the ongoing QT, which will lead to the non-reinvestment of €330 billion in securities for the APP and €173 billion for the PEPP in 2026. Thus, the Eurosystem will put a little over €500 billion worth of securities back on the market in 2026.

Is a transition from QT to QE also relevant for the ECB?

The answer is clearly no. If the Fed ended its QT policy on December 1st and restarted QE on December 11th due to tensions in money market rates, it should be noted that the ECB began its own much later than the Fed. Indeed, the ECB's QT only reached its maximum pace at the beginning of 2025 (with the start of non-reinvestment of PEPP securities), whereas this occurred in September 2022 for the Fed.

The amount of excess reserves held by European commercial banks at the ECB still amounts to €2,500 billion, which is still much higher than their pre-COVID crisis level. No tension is currently observed in money market rates, and it is very likely that QT will need to continue at its current pace until at least 2027 before such tensions arise. In a recent interview, Executive Board member Isabel Schnabel estimated that liquidity scarcity should not manifest before the end of 2026 and that this would be an extreme scenario.

Who buys the securities issued on the market by the ECB?

The data provided by the ECB allows us to get an idea of the reshaping of eurozone government bond holdings over recent years. The key points are as follows:

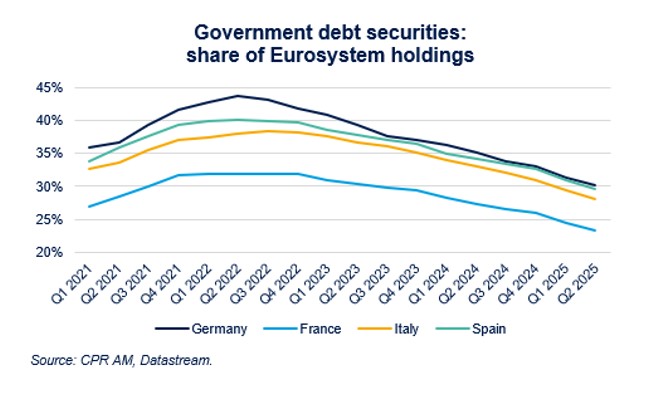

- The share of government debt held by the Eurosystem logically decreased starting from the ECB's Quantitative Tightening initiated in March 2023. In Q3 2025, this share was between 27% and 29% for Germany, Italy, and Spain, and 23% for France.

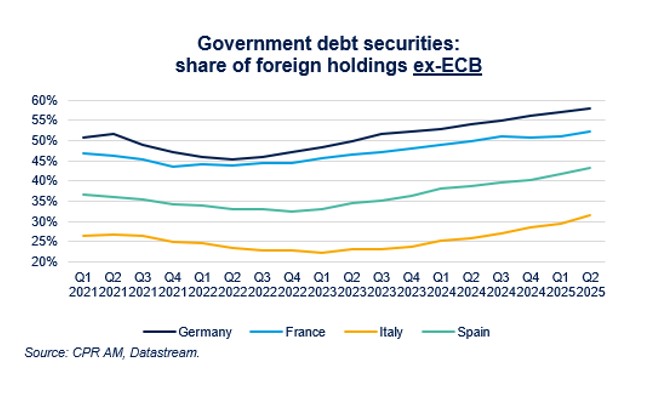

- There are similarities among the four major eurozone countries, with a clear increase in the share of government bonds held by non-residents starting from early 2023. This share is currently about 65% in Germany, 57% in France, 50% in Spain, and 37% in Italy. However, it is important to recall that part of the ECB's QE is included here since, within these QEs, 80% of purchases were made by national central banks and 20% by the ECB itself: 20% of the ECB's QE appears as holdings by non-residents. Finally, the holdings of non-residents aggregate holdings by actors within the eurozone and actors outside the eurozone.

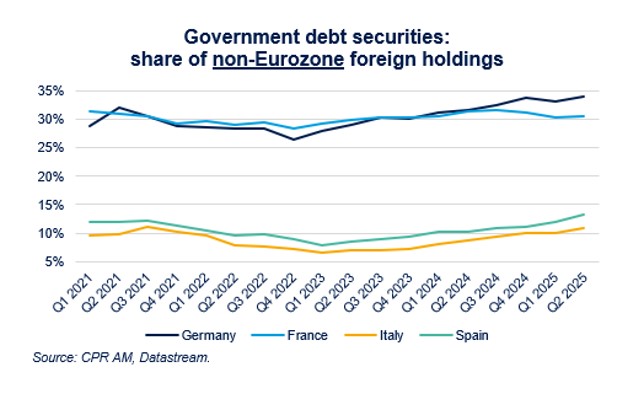

- The share of holdings by non-residents outside the eurozone has remained relatively stable in recent years for France and Italy and has slightly increased for Germany and Spain. It is currently between 30% and 35% for France and Germany and between 10% and 15% for Spain and Italy.

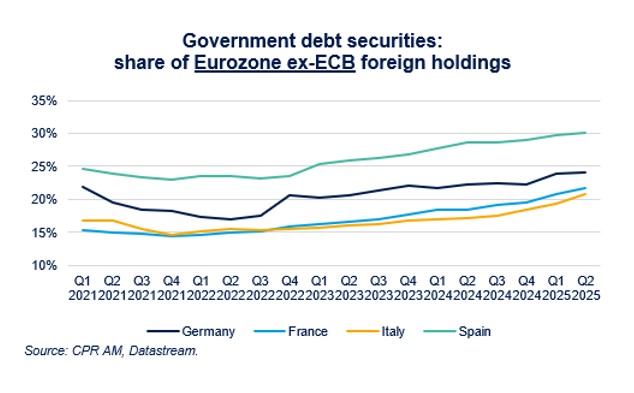

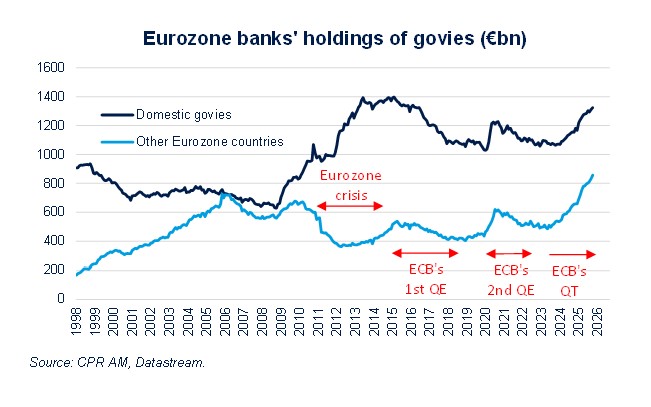

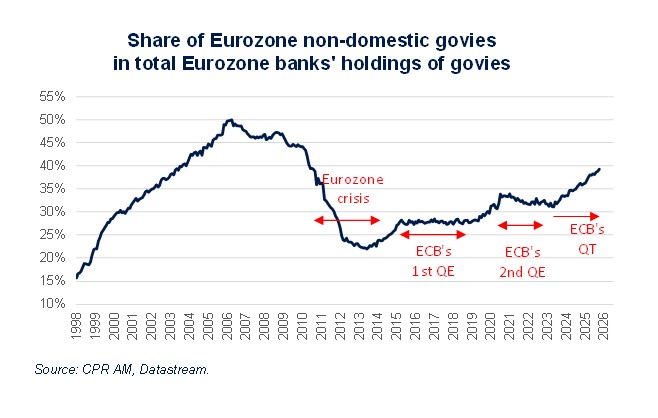

- It is especially the share of holdings by non-residents located within the eurozone that has significantly increased in recent years in the four major eurozone countries. In reality, this movement is intrinsically linked to the ECB's QT: commercial banks "lose" a risk-free asset remunerated at the deposit rate (i.e., reserves held at the central bank) and naturally shift towards the most natural risk-free asset, namely eurozone government bonds. Eurozone banks have therefore resumed massive purchases of government bonds since early 2023, and it is interesting to see that they have bought more government bonds from other countries than from their own. This is notably the case for German and Spanish banks. We are witnessing a re-internationalization of government bond holdings by eurozone banks, probably for several reasons: domestic securities shortages (in the case of Germany), risk diversification, search for slightly higher yields, etc.

The fact that the ECB's QT was running at full speed in 2025 at the very time when the Fed's QT was already reduced explains a good part of the underperformance of European government bonds compared to US Treasury securities. Nevertheless, the fact that European commercial banks are rebuilding their stocks of government bonds and re-internationalizing them again helps to cushion this trend and constitutes a stabilizing factor for sovereign spreads.