Germany : 5 years of stagnation, and what's next?

After being the economic powerhouse of Europe for over a decade, the Covid crisis marked a turning point for Germany. Its economic model has been challenged on multiple fronts: trade, industry, energy, etc. It is interesting to examine the reasons for its current relative difficulties and to see the challenges that Germany will have to address in order to experience a more pronounced economic recovery. It is important to remember that Germany, which was referred to as the "sick man of Europe" in the early 2000s, was able to adapt and reform (Agenda 2010) to then experience a long period of sustained growth.

Published on 17 February 2025

Two years of recession and very modest prospects for recovery

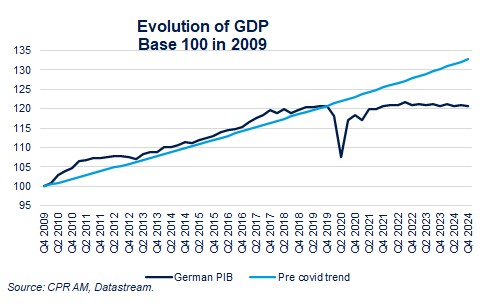

Between 2009 and 2019, the German economy experienced a long period of sustained growth, averaging 1.9% per year. However, over the past 5 years, the German GDP has simply stagnated. This is a relatively unprecedented situation in Europe, as other major economies in the region have experienced modest but slightly positive performance: an average annual growth of 0.8% in France, 1.1% in Italy, and 1.5% in Spain.

According to the expectations from the Federal Statistical Office (Destatis), the GDP is estimated to have contracted by 0.2% in 2024, following a year of contraction in 2023 (-0.1%). In 2023, domestic demand, particularly consumption and investment, beared down on growth. In 2024, it was external trade and investment that had an impact.

Business surveys remain very negative in all sectors and do not indicate a significant rebound in the short term.

Thus, the growth prospects for 2025 remain very modest: the latest IMF forecasts project a growth of 0.2% for the year, in line with those of the Bundesbank.

The central role of the industrial sector in the German economic model

Germany stands out in Europe with a very important industrial sector, and this situation has persisted despite the globalization of the past 20 years. Four sectors are key: automotive, mechanical engineering, electrical and electronic equipment, and the chemical industry.

In 2023, the manufacturing industry accounted for 20.4% of the value added generated by the German economy, compared to a European average of 16.4%. The industrial sector is also very important in terms of employment, with 8 million employees.

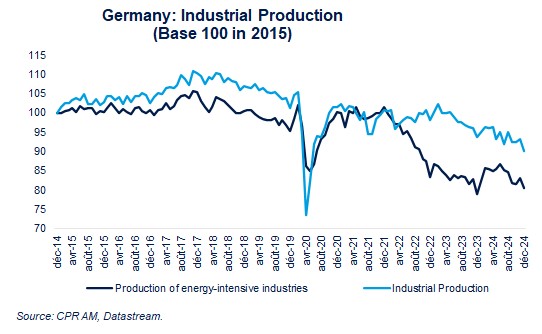

Since 2018, German industrial production has been declining, affected by successive difficulties: a decline in global trade, Brexit, a decrease in exports to China, post- Covid supply chain disruptions, labor shortages, energy prices, a decline in car sales, etc. As a result, industrial production is now nearly 10% below its pre-Covid level, and even 15% lower for energy-intensive industries. The German automotive sector is also facing difficulties, with 6% fewer cars produced in 2024 compared to 2019.

Today, the lack of both domestic and export demand appears to be the most persistent challenge. A survey conducted by the European Commission in the fourth quarter of 2024 among German industrialists showed that 43% of respondents reported limiting their production due to weak demand. This level had not been reached since the great financial crisis.

Export difficulties are partly due to Germany's loss of competitiveness (in the chemical industry) and the rise of Chinese competition. As a result, Germany finds itself in direct competition with the Chinese industry in the automotive sector, particularly in the production of electric vehicles and machine tools.

Furthermore, Germany has not yet succeeded in creating new major players in the technology sector, as it has done in other industries.

A high level of international openness

Germany is ranked as the world's third-largest exporter, behind China and the United States. German goods and services exports accounted for nearly 44% of the GDP in 2023, and the export share in the manufacturing industry reached 48.4% in 2021.

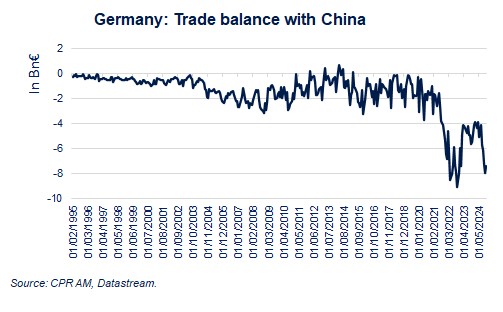

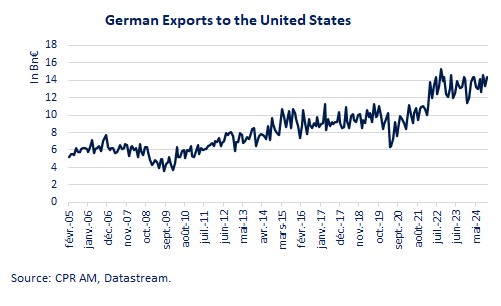

While trade with the United States has significantly increased in recent years, Germany has suffered from a decline in its exports to the United Kingdom (due to the Brexit effect) and especially to China. Until the end of 2020, Germany had a slight trade deficit with China (around 20 billion euros per year), and it was only in 2021 that Germany's trade deficit with China significantly increased to 60 billion euros in 2023 and 65 billion euros in 2024. This comes at a particularly difficult time as Germany appears to be the main target of the trade measures that President Trump would like to take against Europe. In 2024, Germany exported nearly 160 billion euros worth of goods to the United States, resulting in a trade surplus of nearly 70 billion euros with the country.

A costly energy bill since the war in Ukraine

Germany phased out nuclear power in 2011 and invested in the development of renewable energy while still maintaining a certain dependence on fossil fuels, which still accounted for nearly 75% of its energy mix in 2023 and 41% of its electricity mix. For many years, Germany benefited from very low gas prices, averaging less than 20€/MWh, thanks to its supply of Russian gas. These prices increased significantly after the outbreak of the war in Ukraine, with an average of 95€/MWh in 2023. Although there has been some price relief since 2023, gas prices remain nearly twice as high as they were before 2022.

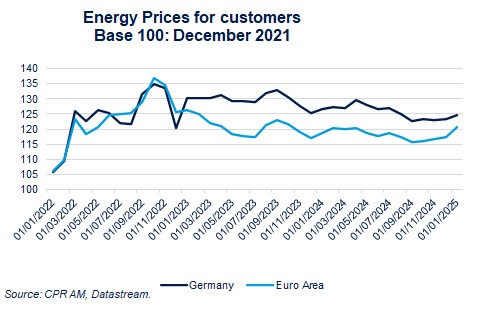

Germany experienced a peak inflation rate of 10.4% in October 2022, with an inflation profile very similar to that of the eurozone in recent years.

However, when comparing the overall level of energy prices between the end of 2021 and the end of 2024, the increase is nearly 24.6% in Germany, compared to nearly 4 percentage points less for the eurozone. The increase in energy prices has been much more pronounced in Germany than in the rest of Europe.

Electricity tariffs are also more than twice as high as those in OECD countries with the lowest tariffs.

The risk of energy imports remains high, and episodes of low temperatures and low wind, known as "Dunkelflaute," have led to significant imports of French nuclear electricity. Germany also remains highly dependent on its gas supplies, which still accounted for 24% of its energy mix and 14% of its electricity mix in 2023. The issue of energy prices, which hampers the competitiveness of businesses and weighs on household confidence, is a prominent topic in the political programs for the February 23, 2025 elections.

Fiscal policy has significantly constrained public spending and investments

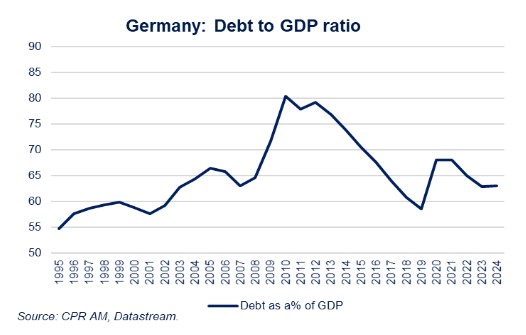

For Germany, the European budgetary framework represents a limited constraint, as with a public deficit of 2.2% of GDP in 2024 and a debt reduced to 62% of GDP after peaking at 68% in 2020, it already complies with the rules of the Stability and Growth Pact.

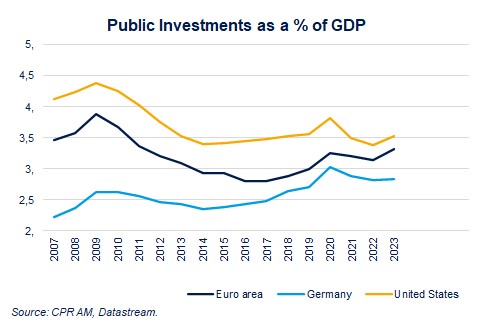

However, German rules that were introduced into the constitution following the 2008 financial crisis, particularly the "debt brake" (Schuldenbremse), significantly restrict its budgetary leeway. These rules stipulate that the government must strive for a balanced budget (Schwarze null) and that the structural deficit1 of the federal budget will be limited to 0.35% of GDP. This rule has helped stabilize public debt at a level close to 60% of GDP, but it has also significantly constrained public investments.

Recent governments have created numerous special funds for investments because they were not integrated into the federal budget and therefore not subject to German budgetary limits. In an audit in August 2023, the German Court of Auditors identified 29 special funds with a total financing volume of 869 billion euros and called for their integration into the federal budget to allow for more effective parliamentary control. In 2023, these funds financed 170.9 billion euros in public spending.

The use of special funds has been affected by the decision of the Constitutional Court in Karlsruhe in November 2023. It eliminated the use of 60 billion euros in credits initially planned for the Covid crisis and reallocated them to a fund dedicated to economic transformation and climate. While their use is now more complicated, their elimination or reduction cannot be implemented without relaxing the budgetary rules, risking a collapse in public investments.

The Council of Economic Experts, which advises the government, has proposed a reform of the "debt brake" to make it more flexible, particularly when the debt is low. This would require a modification of the German Constitution, which requires a two-thirds majority in both the upper and lower houses of Parliament (Bundesrat and Bundestag). The IMF, in its July 2024 Article IV consultation on Germany, also called for a reform of the debt brake to address the challenges posed by an aging population and to make the necessary investments for the modernization of the economy.

This debate is attracting the attention of the CDU, SPD, and the Greens, and could lead to a relaxation of the rules after the February 2025 elections. Increased flexibility, within the framework of the European budgetary rules, would provide additional billions of euros for public investments.

The necessary "modernization of the economy"

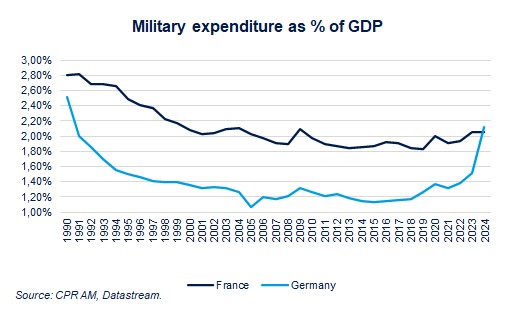

DIn a report from the end of 2024, the German Council of Economic Experts called on the government to invest public funds in the modernization of the economy. They believed that "future-oriented public spending has been low in Germany for far too many years." Such spending amounted to 7.6% of GDP in 2022, which is more than one percentage point below the European average. They identified three priority areas: transport infrastructure, defense, and education. They suggested creating an investment fund for transportation and setting minimum spending quotas for education and defense.

In February 2022, following the invasion of Ukraine, Chancellor Olaf Scholz pledged to meet NATO's target of allocating 2% of GDP to military spending, while the country was only allocating 1.38% of its GDP to this purpose. A massive investment effort was made in just a few years thanks to the creation of a dedicated defense fund with 100 billion euros. However, this fund is expected to be depleted by 2027, and additional funding will be needed to sustain these expenses.

The labor market has remained resilient, and demographic pressure is increasing

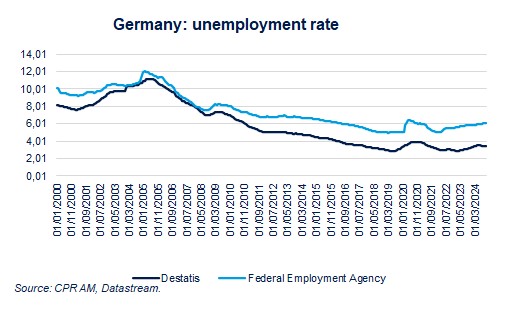

Despite the economic downturn in the past two years, the labor market has remained relatively resilient. After reaching a low point of 2.9% in May 2023, the unemployment rate (according to the ILO definition) began a slow increase and stood at 3.4% in December 2024. The unemployment rate measured based on individuals registered with the Federal Employment Agency also increased from 5% in May 2022 to 6.1% in December 2024. Several major German companies have announced workforce reductions or factory closures in the coming months.

Thus, forecasts indicate a continued gradual deterioration of the labor market in 2025, but the aging German population and the decline in the active population remain a structural factor of support. A recent study by the German Economic Institute (IW) showed that the population aged 15 to 66 is expected to decrease by 13.9% between 2023 and 2040, from 37.5 million people to 32.3 million in the absence of immigration. This decline could be limited to 6% with work-related immigration of 4.8 million people.

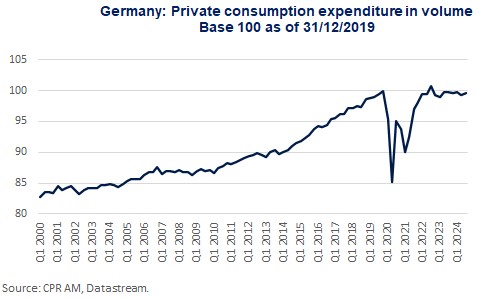

Pessimistic households and slow recovery in consumption

The level of confidence among German households remains particularly low despite the decrease in inflation. This has resulted in a significant increase in the savings rate, which reached 20.5% in the third quarter of 2024, well above its long-term average of 17.5% and that of France. The corollary is a slight decrease in consumption in 2023 and the first half of 2024.

However, in recent months, a shift is noticeable, and consumption has modestly contributed to growth at the end of 2024. The reduction in political risk and a more substantial recovery in household confidence could generate a second wind for consumption, which is expected to be one of the main contributors to growth in 2025.

Chancellor Olaf Scholz had stated that the war in Ukraine marked a new era for Germany, a change of times ("Zeitenwende"). While this event dealt another blow to the German economic model based on a strong and export-oriented industry, its difficulties had already been noticeable for several years. The war in Ukraine highlighted Germany's strong energy dependence on Russian gas, but its commercial dependence on China appears to be its most structural challenge.

As the German model must adapt to this new reality, it can rely on its strengths, including very solid public finances that offer budgetary leeway if the debt brake is relaxed. Furthermore, its well- diversified industrial fabric, as evidenced by the 7 Magnificent companies in the DAX index: software publisher SAP, insurer Allianz, reinsurer Munich Re, pharmaceutical group Merck, energy group Siemens Energy, armament industrial group Rheinmetall, and telecommunications operator Deutsche Telekom. Finally, the decline in inflation and the maintenance of a very low unemployment rate and a strong labor market should support private domestic demand after several years of contraction.

1. The structural balance represents the budget balance that would be obtained outside the effects of the economic cycle. It therefore corresponds

to the budget balance when GDP growth is at its potential. Differences in the assessment of the structural balance are related to the difficulty of

evaluating a country's potential growth.