Markets and strategies

Macro - The elements that marked 2025 and those that should matter in 2026

Like last year, we have carried out a review of 2025 and an outlook for 2026, by taking into account the most important past and future macro-financial elements.

Published on 5 January 2026

The macro-financial elements that marked 2025

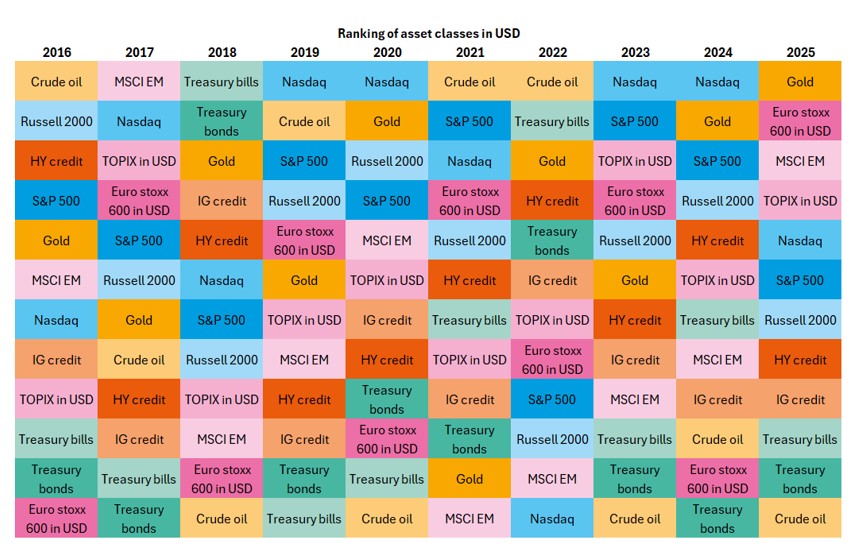

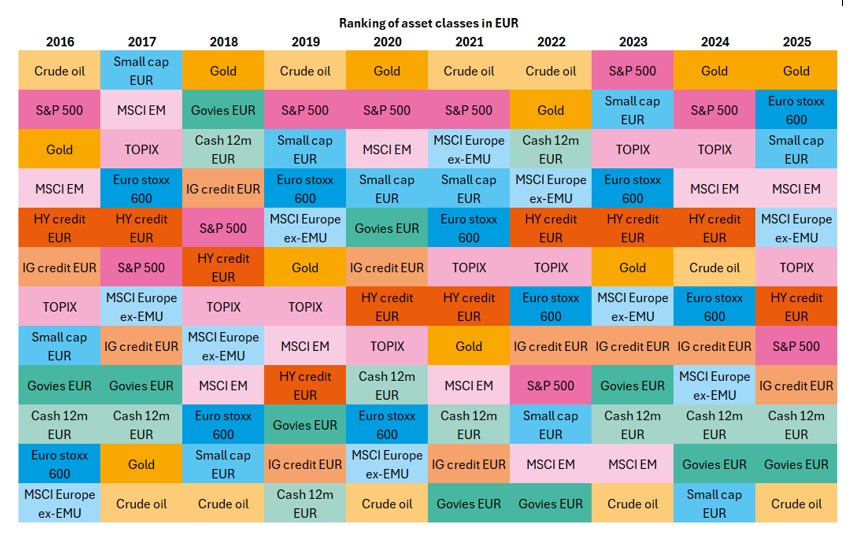

- On many levels, the year 2025 was marked by the comeback of Donald Trump to the White House. In particular, the trade war initiated on multiple fronts (country-specific and sector-specific tariff hikes) followed by the announcement of exemptions and the conclusion of trade deals produced a V-shaped year for growth prospects and for equity markets. At the worst of 2025 (April 8th), the S&P 500 was down 12.2% but ended the year at +16.4% (9th best year of the 21st century). The rebound in AI-related stocks has a lot to do with this, which illustrates the fact that "micro" developments now have "macro" impacts.

- World trade has been resilient to the trade war, with two remarkable facts: 1) China has exported much less to the United States but has exported much more to the rest of the world, its trade surplus reaching 1% of world GDP (which is considerable) and 2) trade flows linked to the "Artificial Intelligence" cycle have contributed significantly more to the growth of world trade than in previous years. Nevertheless, the understanding of the growth figures has been very disrupted everywhere by the jolts in foreign trade.

- The global economy has performed better than expected. In the United States, significant investments in hardware and software (as part of the deployment of Artificial Intelligence) have enabled growth to withstand the shock of the trade war. In the euro zone, growth also defied the most pessimistic forecasts, with scattered performances (weakness in Germany but strength in Spain). On the other hand, the real estate crisis continued to weigh on Chinese growth: domestic demand – excluding the Covid period – experienced its slowest growth since the late 1980s.

- The tariff hikes have led the Fed to pause its rate cut cycle for 9 months, due to its possible upward impact on US inflation. This greatly displeased Donald Trump, who sharply criticized the Fed and undertook various maneuvers to put pressure on it, such as the inspection of the institution's refurbishment works or the attempt to fire board member Lisa Cook. The lack of a real acceleration in inflation and the continued deterioration of the labor market led the Fed to cut key rates by 25 bps by 3 times at the end of 2025. For its part, the ECB lowered its deposit rate by one percentage point in H1 and left it at 2% in H2.

- Unusually, European long-term rates rose over the year while US long-term rates fell. This had only happened twice in the 20 previous years. In particular, we can see the impact of the ECB's full-throttle QT while that of the Fed has been gradually slowed down and then stopped. The rise in German rates allowed Italian and Spanish sovereign spreads to return to their lowest levels in 15 years.

- Gold had its best year since 1979 with a 64.7% increase. Silver, platinum and palladium also performed spectacularly over the year. Several structural supports are behind this increase: fears about public debt trajectories and central bank independence, persistent geopolitical uncertainties, and a trend towards de-dollarization due to the trade war. The overall cycle of key rate cuts has been a strong cyclical support. It should be noted that gold has been among the best-performing assets over the past 10 years. For its part, the US dollar lost about 10% in effective terms in 2025 and the EUR/USD parity fell from 1.04 to 1.17. Bitcoin has lost value in 2025.

- The European and US credit indices had a good year, both in investment grade and high yield. Initially, the trade war caused spreads to widen, but the easing phase initiated from mid-April and the resilience of the economy allowed spreads to tighten throughout the rest of the year.

The macro-financial elements that should mark 2026 and the possible consequences

- In the United States, the prospect of the midterms on November 4 will punctuate the political news in 2026. The fact that Donald Trump is struggling in the polls, that the Republicans currently have only a very slim advantage in the House of Representatives and that 18 of the last 20 midterm elections have led to the loss of seats in this chamber for the president should encourage the latter to try to appeal his electorate again. The only other major economy that will hold general elections in 2026 is Brazil (October).

- The reshuffle of the FOMC composition will be decisive for the interest rate environment in 2026. Donald Trump is expected to announce his choice for the Fed chair fairly soon in 2026. Two other important dates for the composition of the FOMC are: January 21st when the Supreme Court will hold a hearing on the possible dismissal of Lisa Cook and May 15th when Jerome Powell will hand over to the new Fed chairman, with the question: will Powell remain on the Board as a simple governor or will he decide to resign? which would allow Donald Trump to appoint someone else? A possible confirmation of Lisa Cook's dismissal would be a game-changer for the Fed.

- Global growth is expected to remain weak in 2026, due to population ageing in developed countries and China, high public debt, the real estate crisis in China, and high global uncertainty.

- A possible ceasefire between Ukraine and Russia in 2026 could bring more optimism to the European economy, especially due to a possible drop in energy prices. On the other hand, this would not call into question the increase in investment in defense by European governments. In addition, infrastructure spending in Germany is expected to have a positive impact in 2026.

- The yield curve is expected to continue to steepen, due to the continuation (at different paces) of the rate cut cycle, the size of government debt and the large amounts of securities put back on the market by some central banks such as the ECB or the BoE.

- The impact of AI on the labour market is expected to become even more central for central banks. As 2025 progressed, many companies announced that they were cutting jobs or freezing hires due to productivity gains through AI. This has gradually become a matter of concern for central banks and could lead them to ease their monetary policy in the end.

- Questions about the AI-related investment cycle will continue. Of the three risks identified today, namely financing, monetization and physical limits, the order of concern is in our view as follows: physical limits followed by monetization and then financing. The issue of electricity supply is expected to be even more about attention, especially in the United States. We remain confident in the development of the AI-related technology cycle, but stock market progress is not likely to be linear. By the way, this investment cycle has become very important for the US economy in general and for the stock market in particular, given the preponderant weight of tech in the major US indices.