Market Decoding: How can the Fed's QT go?

Published on 27 November 2023

What is the Fed’s current balance sheet policy?

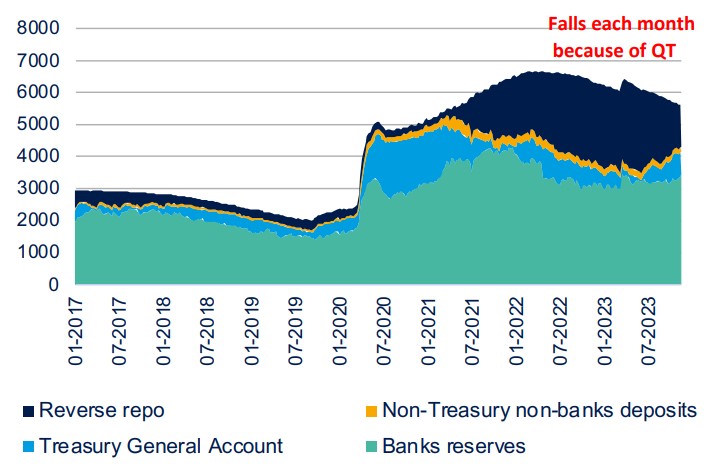

Under the Fed’s current quantitative tightening (QT) policy, up to $60bn each month in proceeds from sales of Treasuries sales is not being reinvested and up to $35bn each month in MBS. In theory, the Fed’s balance sheet can therefore be shrunk by $95bn each month. In reality, however, its balance sheet has been shrinking more slowly in 2023 for two reasons:

- the SVB episode required an expanded balances sheet, due to the various liquidity measures that were put through;

- MBS holdings have recently shrunk by just $16bn to $17bn each month, as high interest rates have slowed refinancing of mortgages and thus reduced expected MBS redemptions.

Recently, FOMC members have expressed no desire to halt the Fed’s QT policy.

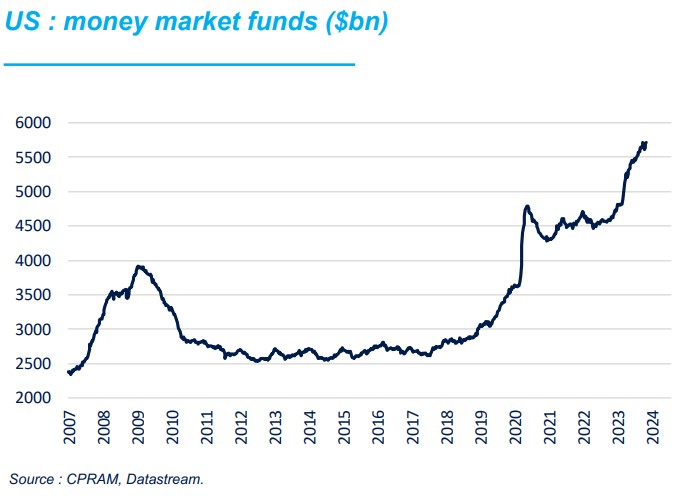

How have US money-market funds trended in recent years?

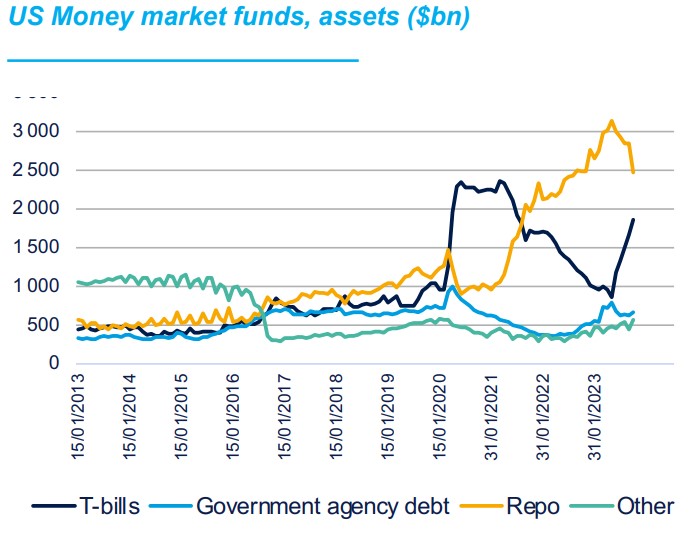

As during the 2008 financial crisis, AuM in money-market funds rose sharply during the 2020 Covid crisis, as investors sought to protect their assets. AuM such funds then stagnated at around $4500bn in 2021 and until early 2022. Thereafter, Fed key rate hikes made money-market funds very attractive, sending AuM skyrocketing, while regularly setting new records in 2023.

What is the connection between the Fed’s balance sheet and money-market funds?

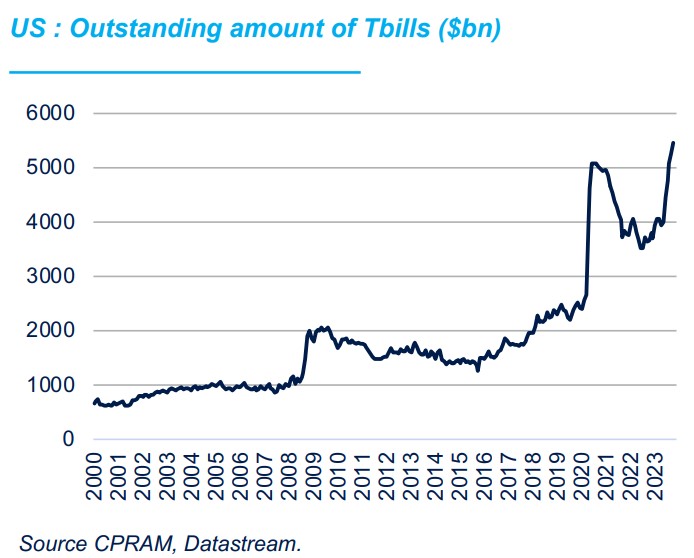

Historically, T-bills are one of the favourite assets of US money-market funds, but the fact that outstandings T-bills decreased sharply from 2021 until mid-2023 led the Fed to act as a major counterparty for money-market funds.

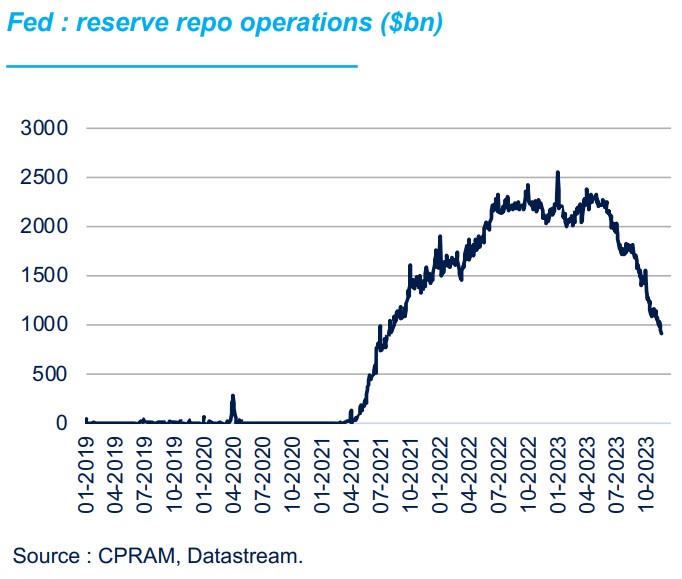

Indeed, after issuing T-bills massively at the worst of the 2020 Covid crisis, the US Treasury switched to a strategy of issuing long-dated paper (to return to T-bills’ share of US debt that prevailed before the Covid crisis) and T-bill outstandings fell steadily until mid-2023. This made a big dent in investment opportunities for US money-market funds at a time when those funds were receiving hug inflows. Money-market funds then began to make heavy use of the Fed’s reverse-repo mechanism, in which they lend to the Fed. Without the Fed, money-market funds would have been hard to manage.

What did the new suspension of the debt ceiling change?

Everything! On 3 June 2023, after the Democrats and Republicans at last managed to hammer out an agreement, the debt ceiling was suspended until 1 January 2025, i.e., after the presidential election. Since then, the Treasury has issued a huge amount of T-bills and announced that it planned to raise its stock of T-bills by $150bn per month on average until at least Q1 2024 inclusive.

This flood of newly issued T-bills gave US money-market funds new opportunities for investment, and they raised their T-bill holdings by $1000bn between May 2023 and October 2023. Meanwhile, use of the Fed’s reverse repo mechanism fell almost commensurately during the same period.

What now?

- The fact that the Treasury continues to massively issue T-bills will continue to lower the use of the reverse repo mechanism. Assuming net T-bill issuance of $150bn per month and a 1-to-1 decrease in the reverse repo mechanism, that mechanism will be exhausted within six months.

- The Treasury is targeting $750bn for its Fed account, i.e., more or less where it is today.

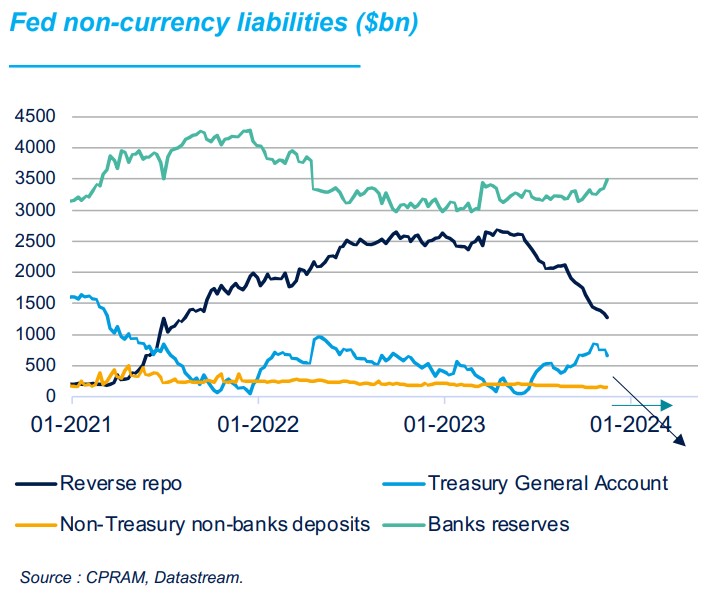

- Because of QT, the non-currency part of the Fed balance sheet (more or less, the Treasury account + the reverse repo mechanism + reserves held by commercial banks) will continue to decrease by about $80bn per month.

Based on all these assumptions, the reverse repo mechanism will no longer be used in six months’ time, and the main Fed liability item that will be reduced by QT will be the reserves held by commercial banks.

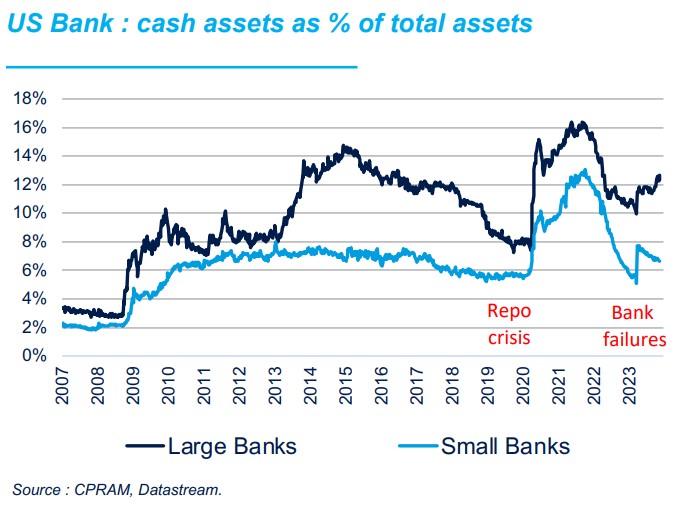

If that happens, a shortage of cash reserves could arise within a few months at small banks, and the Fed is unlikely to continue its QT policy at that time.

Meanwhile, when FOMC members were asked a few quarters ago to quantify excess reserves, their answers were always vague, but the idea was often expressed that it was equivalent to the $2000bn to $2500bn of the reverse repo mechanism. In other words, an end to QT is likely to begin to be voiced within a few months.