The 7th planetary boundary crossed: biodiversity, economy, and finance facing the emergency

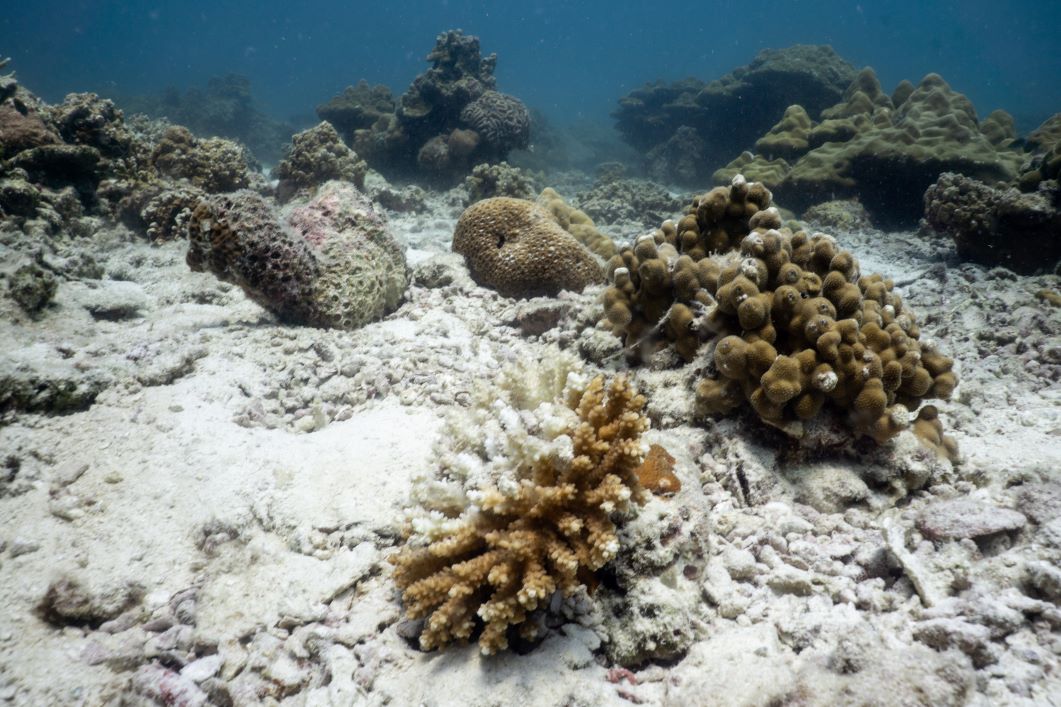

Developed by a team of international researchers specializing in climate, the planetary boundaries have once again made headlines with the crossing of a new one: ocean acidification.

Published on 22 November 2025

The concept of planetary boundaries has established itself since 2009 as a framework for understanding the critical thresholds that our planet must not exceed in order to preserve a stable environment conducive to human life. These boundaries, numbering nine, cover various areas such as climate change, ocean acidification, air quality, and of course, biodiversity. Today, this new warning marks a major turning point, revealing a profound ecological crisis that threatens not only nature but also the global economy and financial stability.

Biodiversity: a vital pillar in crisis

Definition and fundamental role

Biodiversity, often defined as the diversity of life, encompasses all forms of life on Earth — animals, plants, fungi, bacteria — as well as the ecosystems in which they live and the complex interactions that connect them. This diversity manifests at several levels: genetic diversity within species, species diversity between species, and ecosystem diversity, which corresponds to the variety of habitats and ecological interactions.

This natural wealth is much more than a simple catalog of species. It forms the foundation of ecosystem services essential to human life and the economy. These services include oxygen production, water purification, soil fertility, crop pollination, climate regulation, erosion prevention, and many other vital functions. Without biodiversity, natural systems collapse, endangering food security, public health, and economic stability.

An unprecedented collapse

Unfortunately, biodiversity is currently in crisis. Scientific data is alarming: in fifty years, the global population of wild animals has decreased by 73%1. More than 75%2 of terrestrial environments have been significantly altered, and more than 85%3 of wetlands have disappeared. One million species4 are threatened with extinction, approximately one in eight, at an unprecedented rate in Earth's history.

This crisis is referred to as the sixth mass extinction, but it differs from previous ones in two major ways. On the one hand, its speed is exceptional: while the extinction of the dinosaurs took place over hundreds of thousands of years, the current loss of species is occurring within a few decades.

On the other hand, this extinction is almost exclusively due to human activities, notably the destruction and artificialization of habitats, overexploitation of natural resources, climate change, pollution, and the introduction of invasive exotic species.

These five major pressures are interconnected and mutually reinforce each other, creating a vicious circle that accelerates ecosystem degradation. For example, deforestation contributes to climate change, which in turn affects the health of forests and oceans, further reducing biodiversity.

Biodiversity, the foundation of the global economy

Biodiversity is a topic that concerns us all because it is at the heart of the global economy. Every economic sector depends, directly or indirectly, on the services provided by ecosystems. Agriculture, for example, relies on pollination, soil fertility, and water regulation. The medical sector uses natural resources for drug discovery. The real estate sector is affected by soil quality and natural risk management. Even the digital sector depends on mineral resources extracted from natural environments.

The loss of biodiversity weakens these essential services, resulting in tangible economic risks: decreased productivity, increased costs, supply chain disruptions, and market instability. For example, the disappearance of pollinators threatens the production of many food crops, which can lead to price increases and food insecurity.

An international framework under construction: from Rio to Montreal

Biodiversity has gradually become a part of the global agenda through several foundational texts. The Convention on Biological Diversity, adopted at the Earth Summit in Rio (1992) and signed by 196 states, laid the first legal foundations. But the real turning point came with the Kunming-Montreal Agreement (COP15) in 2022. For the first time, a framework sets binding targets: to conserve 30% of land and seas and restore 30% of degraded areas — compared to 17.5% of land and 8.5% of marine protected areas in 2024. The COP also committed to targets aiming to mobilize at least 200 billion dollars per year by 2030 for nature protection. Among these 23 targets, 8 directly target the financial sector.

Also worth mentioning is the IPBES platform, often referred to as the IPCC of biodiversity. Its mission is to assess the state of ecosystems and bridge the gap between science and public policy, thus providing decision-makers and economic actors with rigorous and operational knowledge. In December 2024, IPBES published the "Nexus" report, which jointly addresses the interconnected crises of biodiversity, water, food, health, and climate. This action-oriented document offers an operational toolbox for investors: it synthesizes systemic interconnections and lists 70 organizational, political, and economic levers to address these crises in an integrated manner.

What role for finance?

Finance plays a central role in the ecological transition. Investors and asset managers are increasingly aware that biodiversity loss represents a systemic risk, likely to affect the financial performance of companies and the stability of markets. Moreover, the expectations of clients, regulators, and civil society push financial actors to integrate biodiversity issues into their decisions.

Reporting obligations are multiplying, requiring companies and investors to account for their impacts and dependencies on biodiversity. This transparency is essential to direct capital flows towards sustainable activities and reduce risks related to ecological degradation.

Regulatory and normative frameworks

To support this transformation, several regulatory frameworks and standard-setting initiatives have emerged. The European taxonomy, for example, now includes criteria related to biodiversity to define what can be considered a sustainable economic activity. The Taskforce on Nature-related Financial Disclosures (TNFD) is working to develop a global framework for reporting nature-related risks, similar to what has been done for climate with the Taskforce on Climate-related Financial Disclosures (TCFD).

These initiatives aim to harmonize practices, improve data quality, and create a common language among companies, investors, and regulators. They also encourage the integration of biodiversity pressures and dependencies into risk analyses and investment strategies.

Complexity and methodological challenges

Integrating biodiversity into economic and financial analyses is a major challenge. The interactions between species, habitats, and ecosystem services form a complex, non-linear network that is difficult to address with traditional financial evaluation approaches.

For investors, this means developing methodologies capable of translating heterogeneous scientific data into operational investment criteria. This requires multidisciplinary collaboration between ecologists, economists, financiers, and sector experts. It also requires accepting that these methods must be adaptable, as scientific knowledge about biodiversity is rapidly advancing.

In response to these challenges, some asset management companies are developing innovative approaches. CPRAM, for example, has developed a methodology aimed at building portfolios that reconcile financial performance with extra-financial performance. This strategy is based on a detailed assessment of biodiversity pressures and dependencies, both sectoral and contextual, and on mobilizing capital flows towards companies that are most exposed but also most committed to biodiversity. Rather than systematically excluding at-risk companies, this approach favors dialogue and engagement, encouraging companies to transform their practices.

Perspectives and opportunities: towards responsible and resilient finance

Exceeding the 7th planetary boundary is a warning signal that calls for rethinking finance. Integrating biodiversity as a systemic issue in investment strategies is now a necessity. This involves developing robust assessment tools capable of capturing the complexity of ecological interactions, and an appropriate governance that incorporates these issues at all decision-making levels.

In the face of this crisis, finance has a crucial role to play. By integrating biodiversity into its analyses, adopting innovative methodologies, and relying on strengthened regulatory frameworks, it can become a powerful lever for the preservation of life and the construction of a sustainable future.

1- WWF, Living Planet Report 2022 — This global report documents an average decline of 73% in wild vertebrate populations between 1970 and 2018. Source: https://livingplanet.panda.org/en-us/

2- IPBES (Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services), Global Assessment Report 2019 — This report states that 75% of the Earth's land surface has been significantly altered by human activity. Source: https://ipbes.net/global-assessment

3- Ramsar Convention on Wetlands, Global Wetland Outlook 2018 — This report highlights that more than 85% of the world's wetlands have disappeared since 1700, with a recent acceleration. Source: https://www.ramsar.org/document/global-wetland-outlook-2018

4- IPBES, Global Assessment Report 2019 — The report estimates that around one million animal and plant species are threatened with extinction in the short to medium term. Source: https://ipbes.net/global-assessment