Markets and strategies

10 things to have in mind before the Fed's first cut

At the Jackson Hole Conference, Jerome Powell indicated that "the time has come" for the Fed to start cutting its key rates. This rate cut should therefore occur at the FOMC on September 18. This will be the Fed's first rate cut since March 2020 and this cut would occur nearly 14 months after the last rate hike (July 27, 2023). On this occasion, we recall here 10 points to have in mind about the Fed's rate cuts.

Published on 3 September 2024

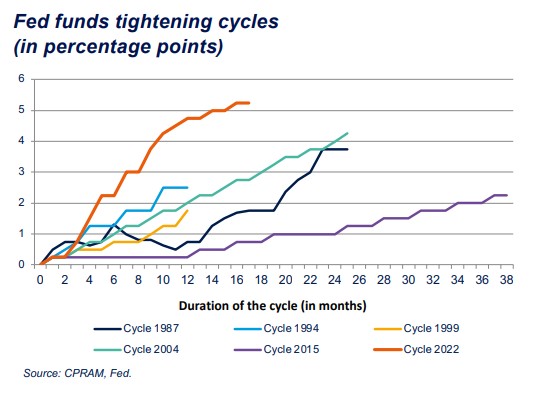

1 - This is the end of the most brutal rate tightening cycle since the early 1980s

With the most significant surge in inflation since the 1970s, the Fed has embarked from March 2022 on the most brutal cycle of rate hikes since the early 1980s: key rates have been raised by 525 bps in less than 18 months.

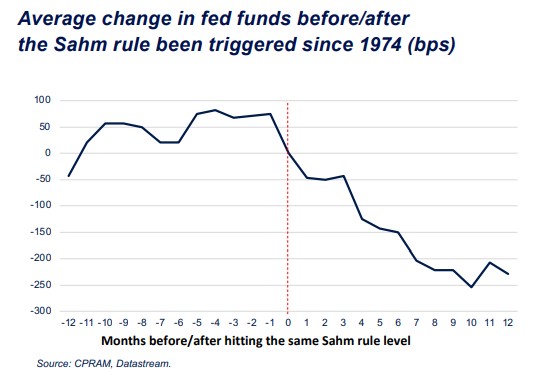

2 - The path of policy rates when the labor market deteriorates

At the July 2024 FOMC, the Fed brought the full employment objective back to the same level as the price stability objective after two and a half years of focusing on inflation. This is explained primarily by the return of inflation close to the 2% target and by the rise in the unemployment rate, which rose from a cycle low of 3.4% to 4.3% in July. On this occasion, the “Sahm rule” (a statistical rule that dates the entry into recession based on the speed of the rise in unemployment) was triggered. Since 1974, the Fed has lowered its rates by an average of just over 200 bps over 12 months once the “Sahm rule” was triggered.

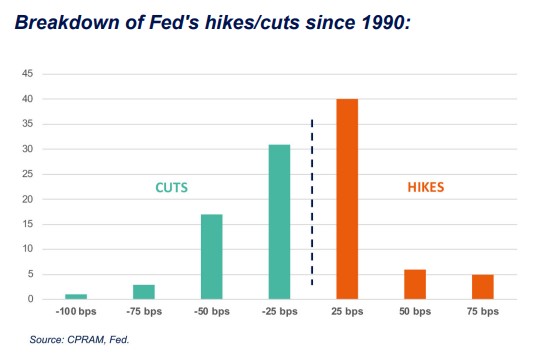

3 - The asymmetrical side of Fed funds changes

Since 1990, the Fed has made 103 key rate changes, with about as many cuts (52) as hikes (51). The distribution of key rate changes according to their amplitude is very asymmetrical. While nearly 80% of rate hikes (40 hikes) were hikes of 25 bps, less than 60% of rate cuts (31 cuts) were rate cuts of 25 bps. This is particularly because a good proportion of rate cuts occur during periods of economic or financial stress, during which the Fed seeks to reassure economic agents with spectacular actions.

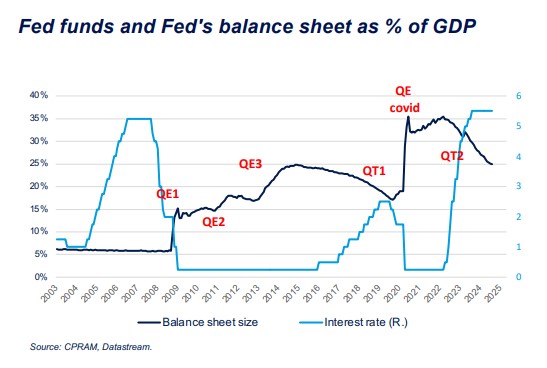

4 - The link with interest rate policy and balance sheet policy

Since the 2008 financial crisis, the Fed has begun to use its balance sheet policy much more openly, via Quantitative Easing (QE) operations. Since that time, the Fed’s interest rate and balance sheet policies have been broadly synchronized, with rate cut phases being coupled with QE operations and rate hike phases being coupled with Quantitative Tightening (QT) operations. During this cycle, the Fed began raising its key rates in March 2022 and began a QT operation on June 1, 2022. The Fed had already reduced the pace of its QT from June 1, 2024. With a first rate cut scheduled for September 18, it is likely that the Fed will end its QT operation in a few months. However, given the "losses" incurred by the Fed recently, it is unlikely that the Fed will engage in aggressive QE in the coming quarters.

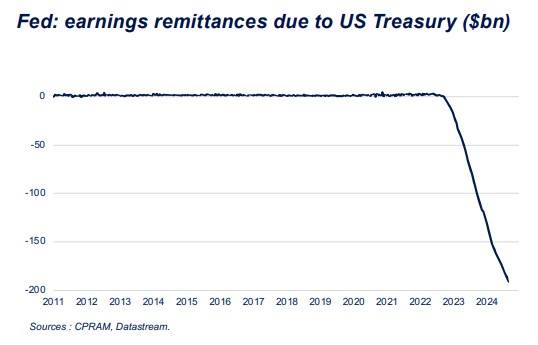

5 - The link between rate policy and Fed profits

The Fed’s rapid tightening cycle has induced a sharp rise of its interest expenses (primarily interest paid to commercial banks to pay for their excess reserves) and has accumulated $190 billion in “losses” since the beginning of the monetary tightening cycle. The Fed will need to return to profit over time (which it will if it lowers policy rates enough) before it will start paying dividends to the Treasury again.

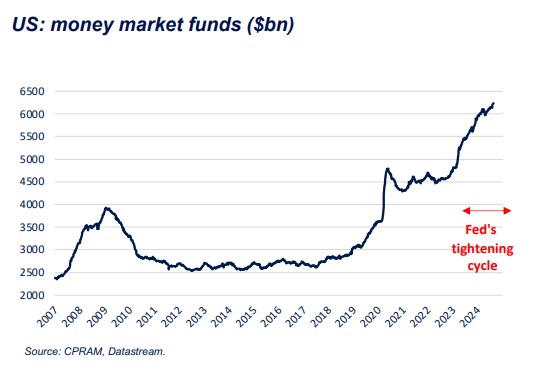

6 - The link with American money market funds

While flows to money market funds had already been significant during the Covid crisis (flight to safety), they have increased very sharply again with the Fed's monetary tightening, due to the sharp increase in their remuneration. The outstanding assets of American money market funds now exceed $6,200 billion. As the Fed cuts its key rates, the attractiveness of American money market funds will diminish and arbitrages towards other asset classes should take place.

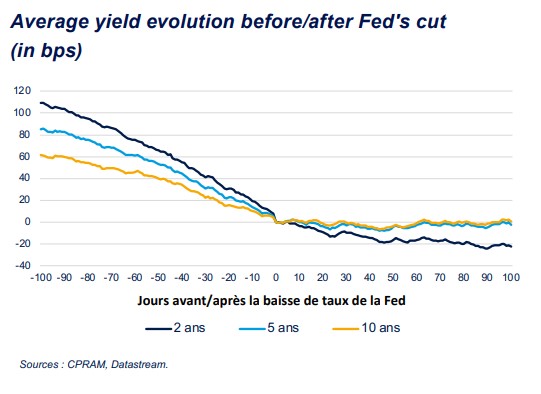

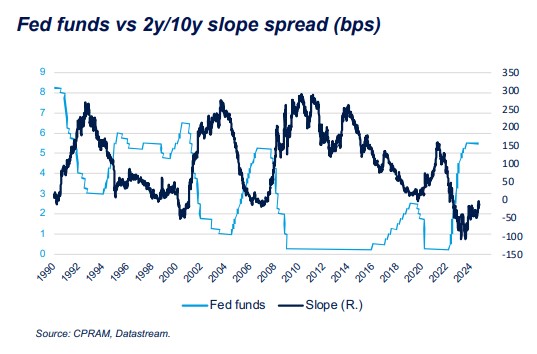

7 - The yield curve when the Fed lowers its key rates

Logically, the phases of monetary easing (respectively monetary tightening) lead to a steepening (respectively flattening) of the yield curve. On the following chart, we represent the average evolution of 2-year, 5-year and 10- year yields before and after the 52 rate cuts by the Fed since 1990. It is clear that short-end rates are falling more than long-end rates and we should therefore soon see the de-inversion of the yield curve.

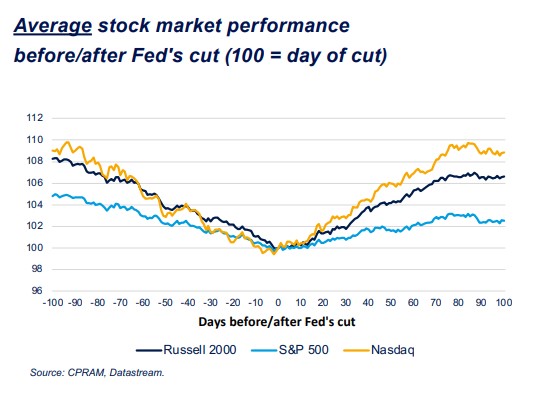

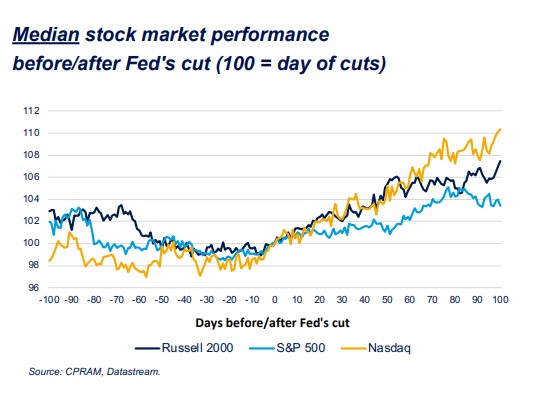

8 - The stock market when the Fed lowers its key rates

On average, over the 52 Fed rate cuts since 1990, the stock markets were down before the Fed’s rate cuts and rebounded afterwards. This is explained in particular by the fact that the Fed lowered its key rates during phases of economic and financial stress and reassured the markets by doing so (thus implying a rise in the stock markets). On average, the Nasdaq and the Russell 2000 outperformed the S&P 500 after the rate cuts: ‘growth’ stocks and small caps outperformed. This is also true when studying the median evolution of the markets during these 52 rate cuts.

9 - The dollar when the Fed lowers its key rates

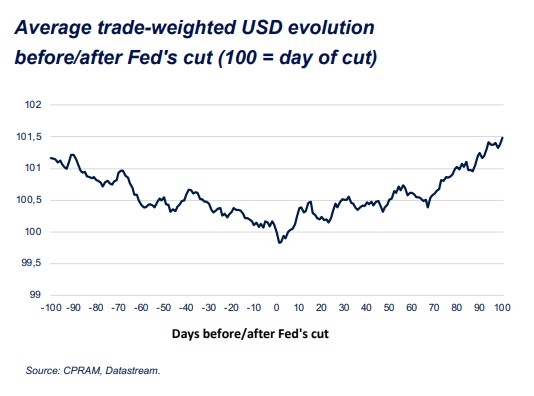

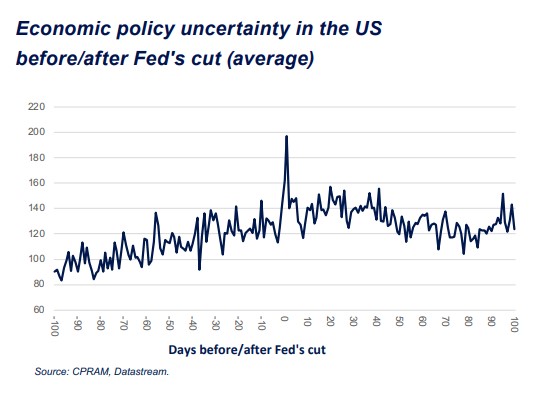

Here, the difficulty in studying the “average” behavior of the US dollar during Fed rate cuts lies in the fact that the foreign exchange market is determined by the lag in the monetary cycles of the different central banks. Nevertheless, the “trade-weighted dollar” has been on average falling before rate cuts and rising after rate hikes since 1990. The same observation can be made for the median evolution. As in the case of the stock markets, the rebound of the dollar from the Fed rate cut can also be explained by the fact that the Fed rate cuts reassured the markets during phases of economic and financial stress. This is corroborated by the fact that economic uncertainty indices stabilize on average after rate cuts.

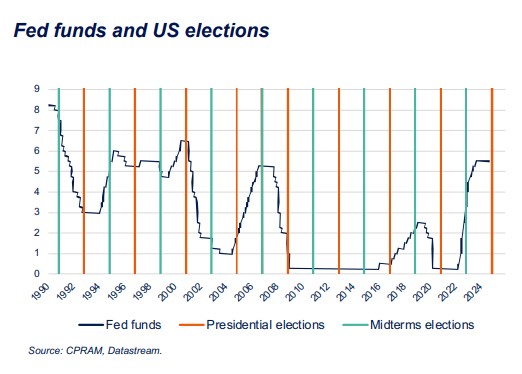

10 - The link with the elections

With each US presidential election, the same question comes up: "Will the Fed dare to raise or lower its key rates before the election?" For example, Donald Trump said in July: the Fed "knows that it must not" lower rates before the November 5 election because this would supposedly favor the Democratic candidate. Insinuations about political interference are recurrent, but for several reasons, it is unlikely that the Fed will change its policy to influence the elections:

- The Fed is generally classified by academic studies as one of the central banks most independent of political power,

- Jerome Powell, appointed to head the Fed by Donald Trump, has already shown in 2018 and 2019 that he would not hesitate to stand up to political pressure,

- Electoral cycles are very short in the United States, with presidential elections taking place every 4 years and mid-terms being interspersed between presidential elections. If the FOMC wanted to influence the outcome of elections, it would theoretically have to do so extremely often... and that would have led to very unstable inflation in recent decades, but that has not been the case.

The study of the impact of Fed rate cuts on financial markets over the last 35 years shows that the start of the Fed's monetary easing cycle will have significant repercussions. However, it should be remembered that this is not the only market determinant because other factors will play an important role in the coming months (US elections, geopolitics, etc.).