United States: Replacing income tax with tariffs, is it really possible?

In recent months, Donald Trump has repeatedly stated that he wants to replace income tax with tariffs. But is that really possible?

Published on 31 March 2025

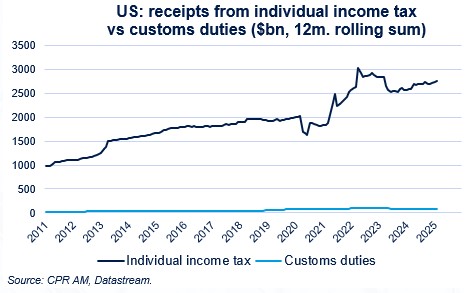

In fact, this proposal from Donald Trump is extremely ambitious because income tax accounted for 52% of federal budget revenues in 2024 ($2,716 billion). In contrast, customs duties only represented 1.6% of tax revenues in 2024 ($86 billion).

Completely eliminating the income tax and replacing it with tariffs without increasing the federal deficit would require raising an additional $2.63 trillion per year through tariffs. Considering that U.S. imports of goods amount to about $3.3 trillion, this would mean increasing tariffs by 80 pts on all imports: this is significantly more than what Donald Trump has proposed so far.

A rough calculation (that is, for example, not taking into account at all the decrease in volumes resulting from the price increase) indicates that an 80 pts increase in tariffs on all imports would raise the general price level by 10 to 15% (whereas the maximum inflation rate over the last 40 years was 9%, in 2022). The effect on household consumption would be very negative.

Furthermore, one can also imagine that such a significant increase in tariffs would provoke retaliatory measures such as increases in tariffs or non-tariff measures (export and/or import quotas), which would themselves lead to a sharp decline in the productivity of the U.S. economy.

While it is true that eliminating the income tax would significantly increase aggregate disposable income, not all Americans would benefit from it since the bottom half of earners account for only 3% of federal income tax collected. A large portion of the least affluent households would therefore face a price increase without benefiting from the elimination of the income tax.

Finally, by reversing the reasoning, the new budgetary revenues associated with a 25 pts increase in tariffs on all imports would allow for a 30% reduction in the amounts collected through federal income tax. Again, this is a very rough calculation in the first approximation, neglecting many parameters.

Ultimately, Donald Trump's desire to replace the income tax with tariffs appears more as a theoretical goal than as something achievable in the short or medium term.