Artificial Intelligence

A strategy built around real players in the Artificial Intelligence market worldwide. A global AI approach with a high exposure to the technology sectors.

Why invest in AI?

Artificial Intelligence (AI) refers to the simulation of human intelligence by machines, particularly by computer systems. It encompasses a set of techniques, including machine learning, natural language processing, and computer vision, that enable a machine to learn, reason, and solve problems.

AI has already existed for several years. Its concept is starting to become more widespread with "Deep Blue," the computer that beat the world's best chess player in 1997. More recently, AI has appeared in our daily lives thanks to virtual assistants. In recent years, its development has been widely supported by investors, to the point that its market is estimated to reach 327 billion in 2023 according to a Statista study.

AI is used in various fields, such as voice recognition, virtual assistants, autonomous driving, and web marketing. But that's just the visible part of the iceberg. Artificial Intelligence is also used in industry, medical research, cybersecurity, or even logistics.

If Artificial Intelligence has experienced real growth in recent years, it is also partly due to the infrastructure that fuels these technologies. New types of smaller and faster chips have emerged, and the creation of massive data centers has allowed for the hosting of all the necessary data for the development of these technologies. At CPRAM, we believe that the development of these infrastructures will play a key role in the development of AI.

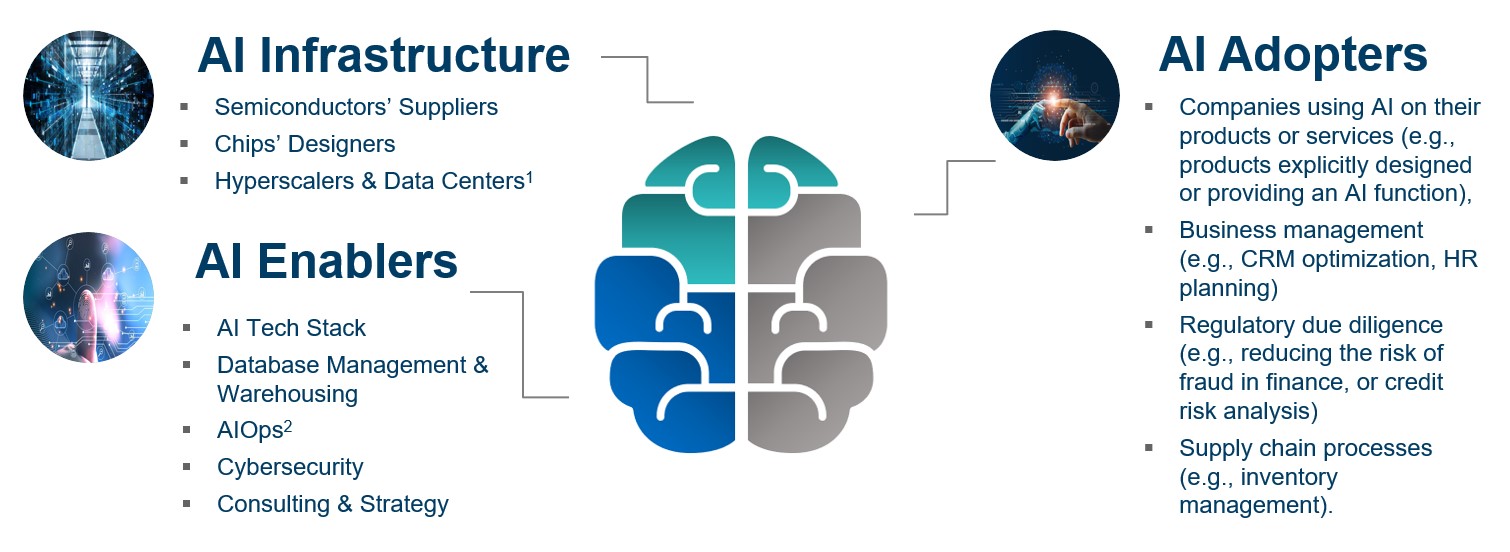

Artificial Intelligence in 3 dimensions

1 Hyperscaler : Large cloud service providers, which can provide services such as computing and storage at enterprise scale

2. AIOps : Artificial Intelligence for IT Operations

Embrace the acceleration of the generative AI adoption

Our approach

Artificial Intelligence primarily operates in the technology sector. Therefore, in order to capture the growth potential of this theme, the fund's investment universe has been divided into three dimensions:

AI infrastructures, which are essential to the development of Artificial Intelligence, covering chip manufacturers, Cloud service providers (computing and data storage) and data centers.

Generative Artificial Intelligence (GenAI) is driving a profound transformation in the digital infrastructure landscape, with hyperscale and LLM inference data centers emerging as the epicenters of this revolution. These new accelerated data centers are dramatically larger than historical norms, with capacities reaching up to 1GW compared to the previous standard of 50MW.

As AI's impact grows across various sectors, the supporting infrastructure must quickly adapt to meet the extraordinary demands for computational power, energy efficiency, and scalability. This evolution includes the integration of specialized hardware, such as GPUs, which are essential for the parallel processing capabilities needed for training and inference of LLMs.

AI enablers are companies that support the deployment of Artificial Intelligence by providing the tools, technologies and expertise needed to integrate it: data management and extraction, observability and security solutions, consulting firms.

As artificial intelligence (AI) continues to revolutionize industries, the need for a robust tech stack to support its deployment has never been more critical. A well-structured tech stack not only facilitates the development and implementation of AI applications but also ensures scalability, security, and efficiency. These layers serve as foundational pillars, supporting the intricate web of algorithms, data pipelines, and application interfaces that power AI systems.

These enablers encompass a diverse range of solutions, including advanced DevOps tools that streamline development processes, robust database management systems that ensure efficient data handling, and comprehensive security tools that protect against emerging threats.- AI users include companies that are adopting Artificial Intelligence to drive innovation, create new opportunities and optimise their operations.

At any age, in all companies, the adoption of artificial intelligence is accelerating and becoming part of everyday use. Companies use it to gain sustainable competitiveness by accelerating innovation and improving operational efficiency. For individuals, it promises an improvement in quality of life, through the use of new virtual assistant services or better medical treatments, for example. Here, we select companies (B2B and B2C) with a strong culture of innovation, for whom AI will be a true growth accelerator.

To be comprehensive and diversify the profile of the companies in the portfolio, the investment universe composed of 200 stocks includes both international companies that contribute to the development of artificial intelligence and those that benefit from it.

The main risks associated with this strategy are capital loss, equity, interest rate, credit, and currency risks. It is advisable to refer to the legal documentation of the investment fund to obtain detailed information on its risk profile.