A historic year of dollar depreciation

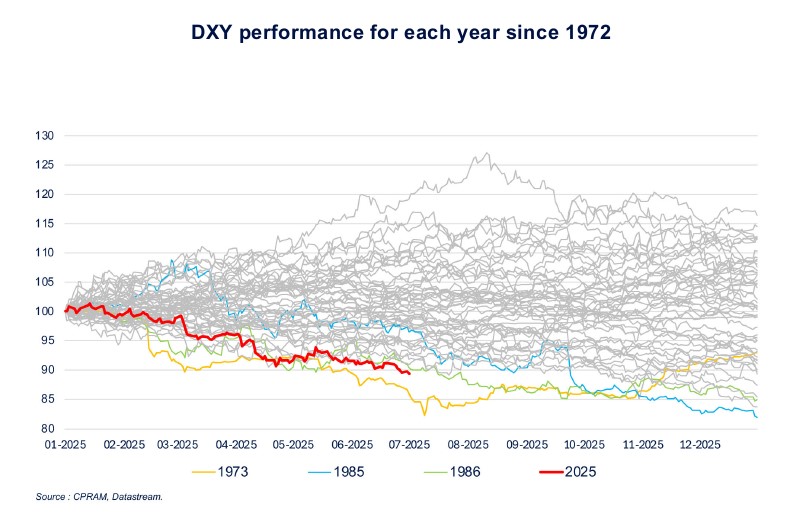

As we recently wrote, the project unveiled on April 2 by the American president to reduce the U.S. trade deficit at all costs is likely to undermine at least somewhat the dollar's status as the dominant currency. It turns out that 2025 is indeed one of the worst years for the dollar since the end of the Bretton Woods agreements.

Published on 3 July 2025

In the first half of 2025, the dollar lost just over 10% against the major currencies of developed countries. For the moment, this is the second worst year for the dollar since the end of the fixed exchange rate system established by the Bretton Woods agreements in 1973. Thus, for now, 2025 is a year comparable for the dollar to:

— 1973, that is to say a year when the U.S. administration decided on a 10% devaluation following the end of the Bretton Woods agreements,

— 1985 & 1986, that is to say two years of significant decline for the dollar following the Plaza agreements.

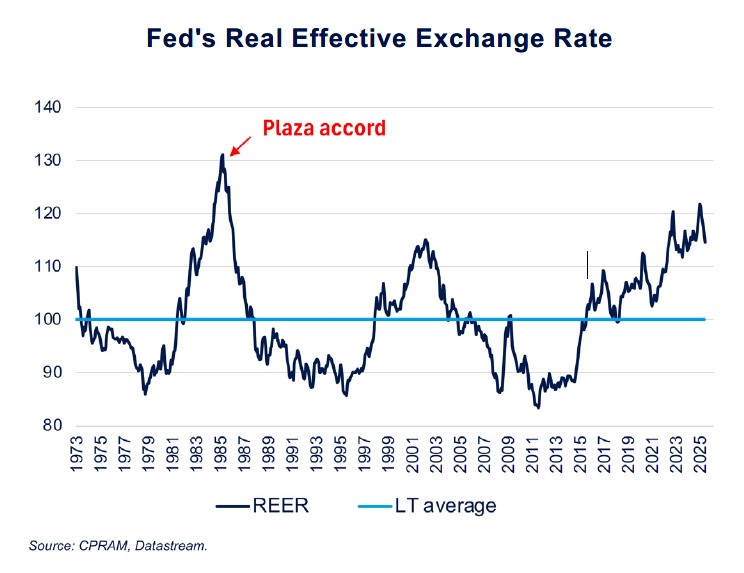

The depreciation of the dollar in 2025 thus evokes the major phases of dollar depreciation over the past 50 years. It is interesting to recall the major phases of appreciation and depreciation of the dollar since the end of the Bretton Woods agreements:

— Depreciation phase from 1973 to 1979. The end of the dollar's convertibility into gold was precipitated/decided by the too low valuation of various currencies against the dollar. A 10% devaluation of the dollar was decided in February 1973.

— Appreciation phase in the first half of the 1980s following the Volcker shock during which the Fed raised its key rates significantly more than other major central banks,

— Depreciation phase from 1985 to 1995 in the wake of the Plaza agreements, under which the major world economies agreed with the United States to lower the value of the dollar,

— Appreciation phase from 1995 to 2001 caused by the devaluation of the renminbi (to enable its development model through exports), by the Asian crisis (which caused a sharp drop in Asian currencies against the dollar) and the lack of appetite and interest from international investors for the euro at its launch,

— Depreciation phase from 2001 to 2015 caused by the very strong increase in the value of net energy imports, which itself was caused by the sharp rise in oil prices,

— Appreciation phase from 2015 to 2025 caused by the collapse of oil prices at the end of 2014, which marked the beginning of a long period of lower prices, but also by the Fed's more restrictive monetary policy compared to the central banks of other developed countries (the Fed ended its QE in 2014 just before the ECB started its own).

It can thus be observed that the major phases of appreciation and depreciation of the dollar since 1973 are caused by factors of several kinds: the major monetary cycles, of course, but also the valuation imbalances of other major currencies and the major energy cycles. The new dollar cycles have all been triggered by a significant macro-financial event that caused a strong acceleration or a strong slowdown in the demand for dollars: the abandonment of the Bretton Woods system, the Volcker shock, the Plaza agreements, the Asian crisis, the collapse of oil prices, or the beginning of a price increase cycle. Thus, it is likely that 2025 will mark the transition from one cycle to another.

The announcement of the project to reduce the U.S. trade deficit at all costs, through the largest tariff increases in nearly a century, constitutes a major shock as it will significantly reduce the demand for dollars from the rest of the world.

Moreover, beyond the commercial aspect, the unpredictability of the new American administration and the recurring threats also weaken the dollar's status as the dominant currency and may, in itself, cause a decline in its international use.

Finally, the Fed is now the central bank of developed countries with the highest interest rates, and Donald Trump does not hide his desire to see the Fed drastically lower its rates: the end of Jerome Powell's term in May 2026 will be an opportunity for him to try to influence monetary policy further, which should also weigh on the dollar.

The dollar is experiencing its worst year since 1973 and the establishment of a floating exchange rate system. It is likely that 2025 will mark the transition from a major appreciation cycle to a major depreciation cycle. Indeed, the announcement of the project to reduce the U.S. trade deficit at all costs, through the largest tariff increases in nearly a century, represents a significant shock that will greatly reduce the demand for dollars from the rest of the world.