China: What is the state of the Chinese economy?

The Chinese economic situation came to a clear halt this summer, despite the resilience of foreign trade and the support measures for the economy announced and implemented by Beijing.

While the "small steps" policy of the Chinese authorities still seems insufficient to restore household confidence, it appears to support the domestic stock market – which shows a notable outperformance compared to developed markets.

Published on 9 October 2025

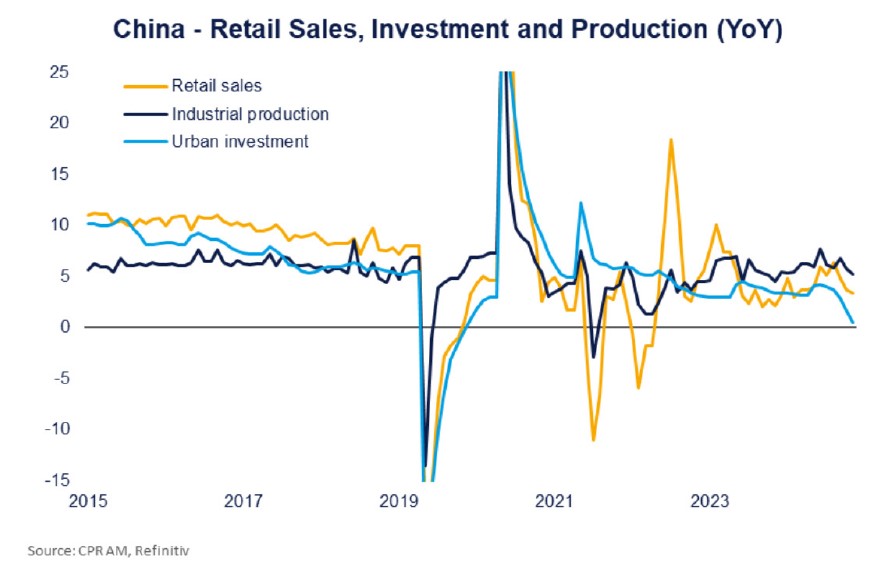

The Chinese economic situation took a clear downturn this summer despite the resilience of foreign trade. According to the NBS1, the weakness of the July figures was a minor phenomenon mainly linked to seasonal effects, compounded by extreme weather events (floods, temperature spikes). But the trend continued into August, raising fears of a sharper slowdown in the Chinese economy than anticipated. Over the month, almost all figures came in well below expectations: bank credit at 590 billion renminbi (rmb) (vs. 800 expected), industrial production up 5.2% year-on-year (vs. 5.7%), investment at 0.5% (vs. 1.4%), retail sales at 3.4% (vs. 3.9%), etc.

For some, the recent slowdown could be only temporary as it is linked to recent government measures. The "anti-involution" campaign against increased competition (overcapacity and price wars) has become an important theme over the past few weeks. It could explain a "preventive" and therefore temporary halt of many investment programs, pending a reallocation. The impacts on profits and employment remain difficult to assess. Regarding consumption, the effects of public subsidies ("trade-in programs") are gradually diminishing, but the effective implementation in September of measures aimed at easing household burdens and boosting leisure spending could offset this trend.

However, the gloom seems more deeply rooted, and the weakness of Chinese demand is mainly explained by the continuous deterioration of household morale. The propensity to save keeps increasing, and according to the PBoC2, 2 out of 3 households plan to save rather than consume or invest. One explanation for this is the relapse in real estate prices after six months of relative stabilization. Since the 2021 peak, prices in the secondary market have fallen by about 18% on average. Moreover, with a significant intensification of destocking plans, the real estate crisis is expected to continue. The sharp deterioration of the labor market is another explanatory factor (and certainly the most important) for the prevailing gloom. More than half of households describe the employment situation as "bad." Youth unemployment remains at very high levels. The "grey area" of social contributions (notably pensions) could weigh on disposable income.

What about the Chinese stock market?

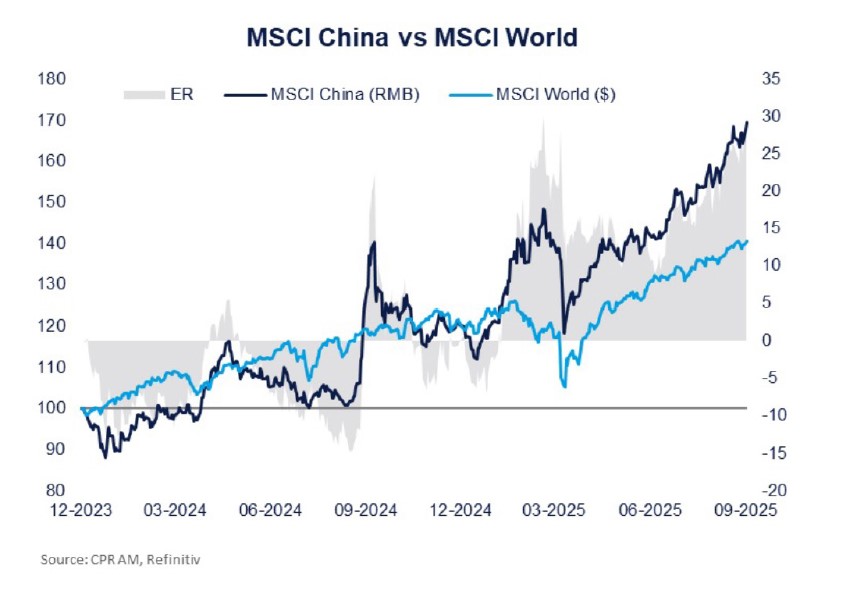

In this context, the very strong performance of the Chinese stock market may seem surprising. At the end of September, the CSI 300 index (in RMB) had recorded an increase of +20.7% since the beginning of the year, while the MSCI China showed +41.4%. In comparison, the MSCI World (in USD) only rose by +17.8%.

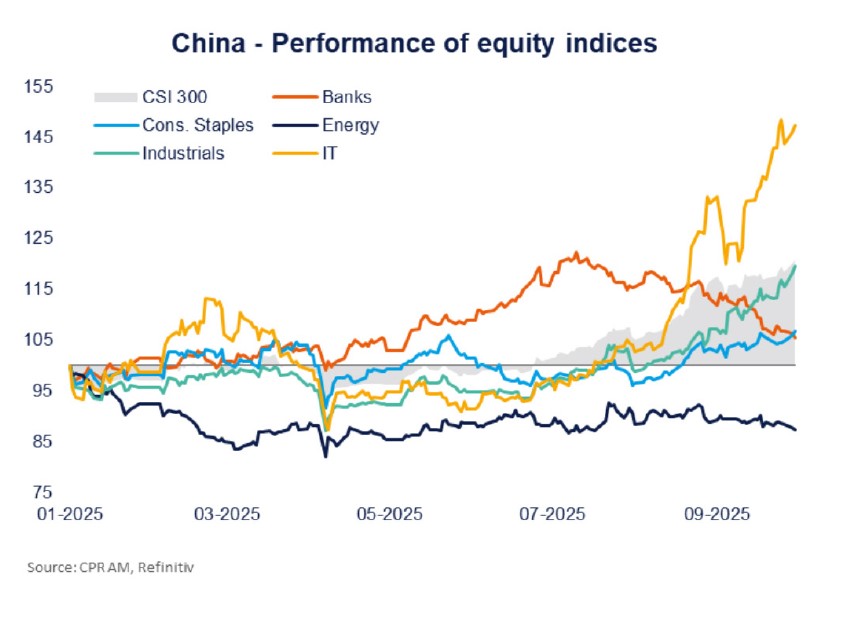

It should be noted that the rise in Chinese stocks has clearly accelerated since the summer. The CSI 300 only increased by +1.4% during the first half of the year, then jumped by +19.1% in the third quarter.

Apart from a real shift in Chinese policy during the period, this momentum suggests strong expectations from investors regarding a strengthening of measures by the government. The very disparate trajectories of the different sectors also point in this direction. The summer rally was obviously driven by Chinese technology stocks, but also benefited industrials, while the banking sector declined. In this respect, the recent movement is very different from the "boom" observed last year after the late September announcements – a sharper and more homogeneous rise – and likely more sustainable.

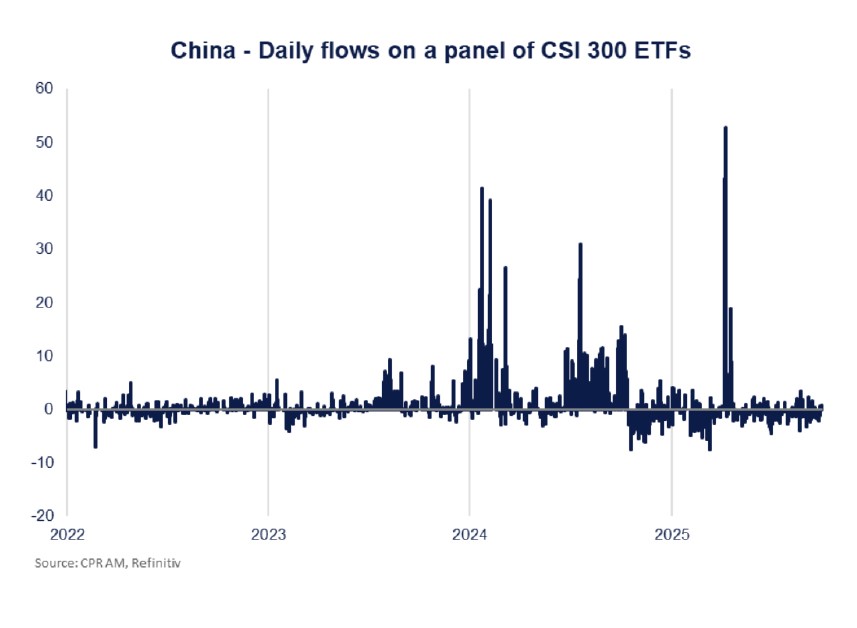

Another encouraging element comes from the fact that the Chinese market no longer seems to be supported solely by stock purchases from the authorities. The "national team" certainly intervened quickly and massively to contain the impact of the tariff announcements on April 2, but direct support operations appear more limited than last year. On the contrary, Beijing has rather sought in recent weeks to slow the movement through preventive actions to avoid a repeat of the 2014-15 bubble. Given the savings accumulated by Chinese households and the significant increase in leverage, this awareness is all the more reassuring.

After several years of crisis and in a context of renewed tension both commercially and geopolitically, restoring confidence is more necessary than ever for Beijing. The authorities are aware of this and have made a turn in this direction, but more efforts will be needed to sustainably revive the economy. And meanwhile, the Chinese market is outperforming...

1. National Bureau of Statistics - Chinese National Bureau of Statistics

2. People's Bank of China - Chinese central bank