Climate, biodiversity: Solvency 2 in the face of environmental risks

CPRAM has been involved in monitoring the Solvency 2 directive since very early, and our experts have published various regulatory watch papers on the subject, as well as a white paper in 2016.

The purpose of this article is to summarize the latest information provided by EIOPA on the integration of climate and biodiversity risks into the Solvency 2 framework.

Published on 19 May 2025

Why have environmental risks become a prudential issue?

Since 2022, Solvency 2, the European regulation that governs the capital requirements and governance of insurers, has gradually begun to take environmental risks into account - initially focusing on climate-related risks, but now extending to biodiversity.

Biodiversity is essential for the provision of ecosystem services, and many industries highly depend on or have a direct impact. Consequently, the loss of biodiversity poses multidimensional risks to insurers, which may affect the value of their investments held and the intensity and frequency of insured losses, among other things:

- As investors, insurers hold portfolios that are heavily exposed to sensitive transition sectors (e.g. fossil fuels, intensive agriculture, low-efficiency property, etc.) or dependent on ecosystems (e.g. agri-food, tourism, materials).

- As insurers, they cover intensifying physical risks due to climate changes and the loss of biodiversity (natural disasters, droughts, floods, pandemics, etc.).

In short, factors that weaken the climate and ecosystems also weaken balance sheets and ultimately affecting solvency.

Climate: a framework already in place and growing

The climate has paved the way. Since August 2022, European insurers have been required to integrate climate change risks into their ORSAs1. This requirement is based on EIOPA guidelines, which insist on two pillars:

- Analysis of the materiality of climate risks for each entity (transition and physical),

- The development of forward-looking scenarios consistent with transition trajectories (e.g., NGFS scenarios2).

In practice, insurers must identify the asset and liabilities segments sensitive to climate variables, and then test their resilience under ordered or disordered transition scenarios.

Since then, regulatory pressure has increased and the European Commission mandating EIOPA to propose amendments to integrate climate risks more precisely into the calculation of insurers' capital requirements. At the end of 2023, EIOPA proposed:

- The introduction of specific capital shocks for exposure to fossil fuels, to reflect their high transition risk, with the SCR3 Action rising from 39% to 56% and the SCR Spread increasing by 40% for fossil fuel issuers (identified using NACE codes for fossil fuel activities).

- The mandatory introduction of 2 climate risk scenarios in the ORSA for entities exposed to material climate risks: a scenario in which the temperature increase remains below 2°C, and a scenario in which the temperature increase significantly exceeds 2°C. In both cases, there will be an analysis of the impact in the short (1 to 5 years), medium (5 to 15 years) and long term (more than 15 years).

We are moving from a mainly declarative framework to a more prescriptive approach, which could ultimately have a direct impact on capital requirements. EIOPA's proposals have been submitted to the European Commission, which will decide whether to implement them in 2027.

Biodiversity: the new prudential frontier

While climate change has been integrated into risk management strategies, biodiversity is still in its regulatory infancy. Yet there are increasing warnings about the loss of pollinators, soil erosion, deforestation, and the decline of wetlands. These phenomena compromise the stability of value chains, the sustainability of agricultural models, and even the long-term viability of certain investment portfolios.

The NGFS acknowledges that "biodiversity loss and nature-related risks could have significant macroeconomic and financial implications, and that failing to address these risks is "a source of significant risks to financial stability. The NGFS highlights that biodiversity loss and ecosystem collapse are among the three most serious long term risks (10 years).

EIOPA has found that around 30% of insurers' corporate bond and equity investments depend heavily and directly on at least one ecosystem service (e.g. water resources). In November 2024, EIOPA published a public consultation on the integration of biodiversity risks into ORSA. No new formal requirement, but a clear message: even without a standardised framework, insurers must anticipate this new systemic risk in their governance and risk management processes.

This consultation reveals several points:

- Risks that cannot be treated as a simple extension of climate risks, even though climate and biodiversity are linked (the climate/nature nexus); because biodiversity is more local, more multi-dimensional and less modelled.

- There are no standardised scenarios as there are for climate (NGFS), which makes modelling difficult.

- More indirect and multifactorial transmission chains, making quantification uncertain.

- A lack of consistent metrics (as opposed to greenhouse gas emissions for climate), even though initiatives such as the TNFD4 and ENCORE5 are trying to address this issue.

But just as it did with climate change three years ago, EIOPA is not letting the players take a wait-and-see approach:

- Encouraging the use of exploratory (qualitative) scenarios: a starting point could be to include biodiversity as an additional risk factor in existing scenarios, particularly in areas of activity that are heavily affected by biodiversity loss, such as health or agricultural insurance, or market risk for corporate and property bonds.

- A call for a mapping of exposures: sectors, geographies, dependencies.

- We invite you to lead a dual materiality analysis, combining physical risks, transition risks and impacts, with different time horizons.

- Incentives to take action to manage material risks to biodiversity (although assessing the degree of risk mitigation remains a challenge...): exclusion of certain investments because of their negative impact on nature, investments to promote biodiversity restoration/conservation, stakeholder engagement...

In short, biodiversity follows the same logic as climate, but with a difference in maturity. Where the climate has structured its tools and standards, biodiversity still requires exploration, experimentation and feedback on practices. Practices are now being developed – albeit imperfectly - and regulators are watching... But the direction of the story is the same.

The summary of the consultation and EIOPA's final report are expected by the end of June.

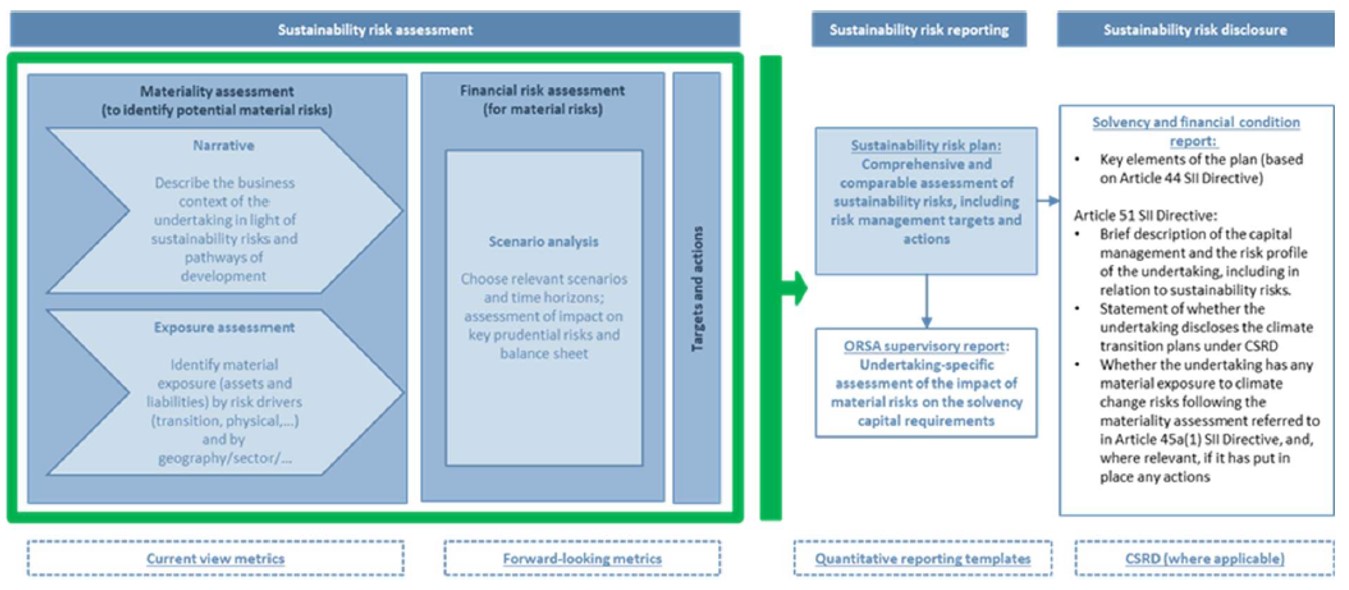

Framework integrating sustainability risks into Solvency 2

In conclusion, what was still marginal in the 2020 ORSAs is becoming central: environmental risks are becoming part of the European prudential framework, and insurers must evolve with it. It is no longer simply a question of compliance, but of building a coherent and defensible environmental resilience strategy...

CPRAM, committed to Climate and Biodiversity

CPRAM has been committed to environmental issues since 2018 through a climate range representing over €4.7 billion in assets under management (as of the end of March 2025). Today, we are leveraging this expertise to build a strategy dedicated to biodiversity. In this context, we benefit from the scientific support of the National Museum of Natural History.

Our new solution, CPR Biodiversity Global Equities, invests in international equities across all sectors, excluding fossil fuels, aiming for long-term financial performance while integrating sustainability indicators in terms of biodiversity by selecting companies that seek to improve their practices to reduce the pressures of their activities on biodiversity. During our discussions with companies, we also pay particular attention to the preservation of natural capital (plastic pollution, water usage, deforestation…).

[1] Own Risk and Solvency Assessment

[2] Network for Greening the Financial System

[3] Solvency Capital Requirement – represents the cost of capital, broken down into several sub-modules. The Equity and Spread SCRs are part of the Market Risk module.

[4] TNFD : Taskforce on Nature-related Financial Disclosures

[5] ENCORE : Exploring Natural Capital Opportunities, Risks and Exposure