Fed: From Quantitative Tightening to Quantitative Easing

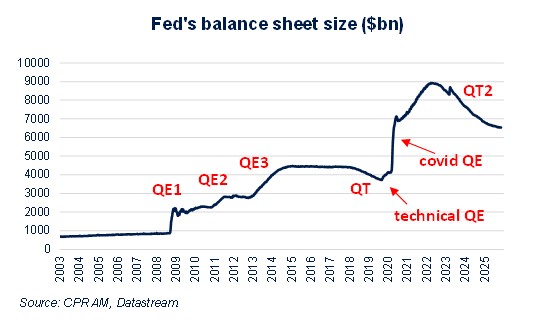

On October 29, the Fed announced the end of its QT (Quantitative Tightening) policy. The Fed's history over the past few years and recent statements by FOMC members suggest that a return to a "technical" QE (Quantitative Easing) policy should not be long in coming. We detail these elements in this text by examining the consequences for the US Treasury and US money market funds.

Published on 18 November 2025

Will the Fed move from a QT policy to a QE policy?

At the end of October, the Fed announced that it would stop its Quantitative Tightening (QT) policy from December. The end of QT should theoretically stabilize the size of the Fed's balance sheet at around $6.5 trillion. The Fed has specified that the MBS it holds and which are maturing (about $16 billion per month) will be reinvested in Tbills.

However, it is very likely that the Fed will quickly announce a return to a balance sheet expansion phase, simply because stopping QT alone will not end existing monetary pressures. In reality, fine-tuning the amount of liquidity to the lowest level to avoid currency stress is extremely difficult. Moreover, the Fed has not experienced a phase of stability of its balance sheet size since 2017. NY Fed President John Williams recently explained that this adjustment was "not an exact science" and that the Fed would "soon" return to a balance sheet expansion phase.

What would a "technical" QE look like?

Several FOMC members have spoken of a rapid return to a balance sheet expansion policy, the objective of which would be to increase the level of reserves held by commercial banks at the Fed again and thus ease monetary tensions. They insist on the fact that this is not a reversal in terms of monetary policy, in the sense that it would not constitute an indication of the future evolution of short-term rates (no signaling effect, therefore), and that the securities purchased would therefore have a short maturity.

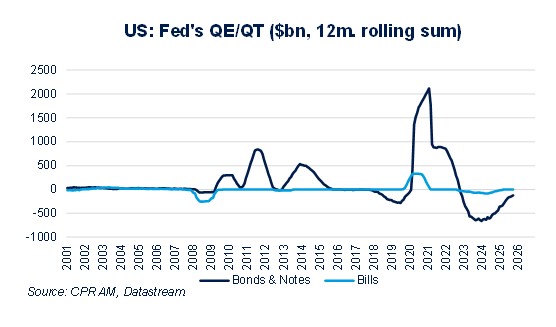

The best analogy with the current situation is that of the "repo crisis" of 2019. On October 4, 2019, the Fed announced the return to an expansionary policy at an unscheduled committee, shortly after the fed funds moved out of the Fed's fed funds target range. To some extent, the current situation on US money market rates is approaching this configuration, with the SOFR rate regularly settling above the Fed's fed funds target range. At the time, the Fed announced purchases of Tbills for an amount of $60 billion per month. Given that the U.S. economy has grown by about 40% in nominal terms since that time, one could imagine net purchases of Tbills in the region of $80 billion, for example.

What does this mean for the US Treasury?

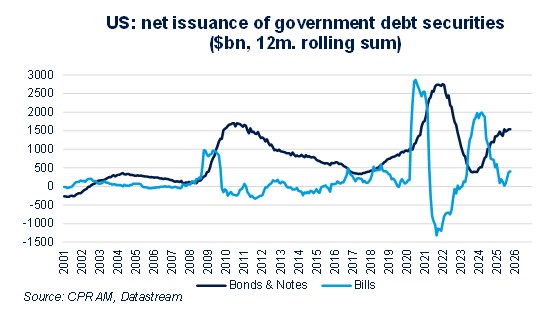

The return to a policy of balance sheet expansion is obviously good news for the Treasury since net purchases of Tbills of $80 to $100 billion per month would represent about half of the financing of the US deficit (currently around $1800 billion per year). This would be all the more good news as it could coincide with the possible decision of the Supreme Court to refund all or part of the reciprocal customs duties collected since the beginning of the year. This could therefore be perceived positively by the White House...

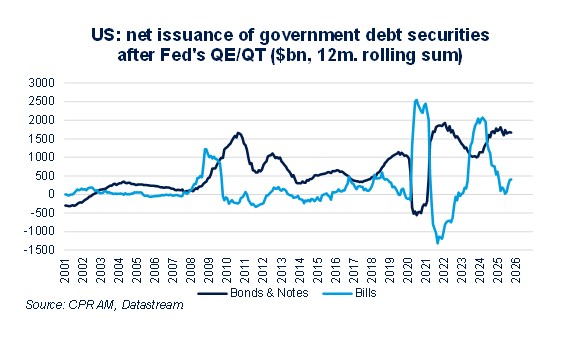

Moreover, if the "technical" purchases were to last, it would be the largest involvement in the Tbills in decades. This could eventually decide the Treasury to issue more Tbills and fewer long-maturity securities. For Q1 2026, it has already announced that 47% of net issuance of securities will be Tbills, while the latter represent only 24% of the stock of Treasury securities.

What does this mean for US money markets?

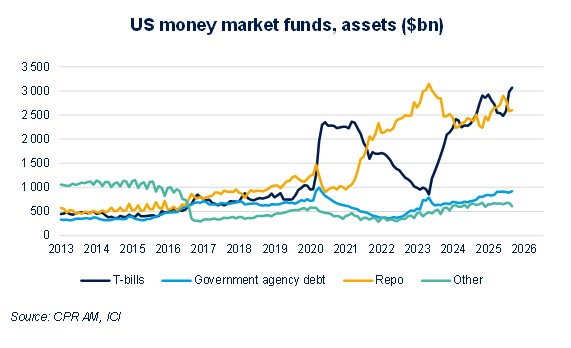

Massive purchases of Tbills by the Fed would automatically deprive money market funds of a natural investment opportunity. Over the past few years, US money market funds have swung back and forth betweenTbills and loans on the repo market, depending on the Treasury's issuance strategy. It is therefore conceivable that money market funds will turn more to the repo markets, which are a preferred source of funding for US hedge funds on a par with prime brokerage. For example, this is how the impact of global markets could be positive.