Fed: Quantitative Tightening set to end

Published on 15 October 2025

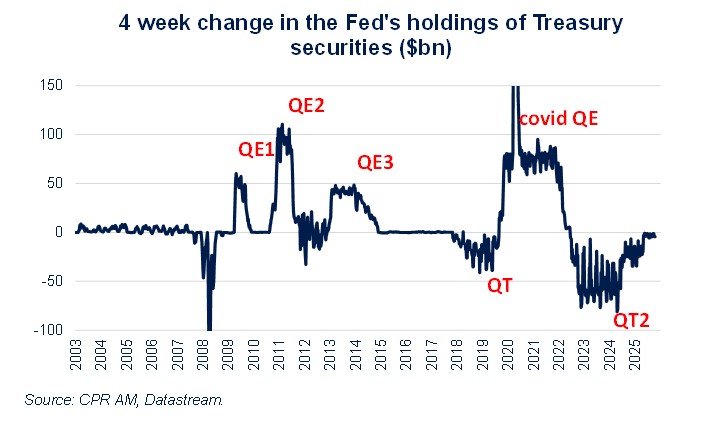

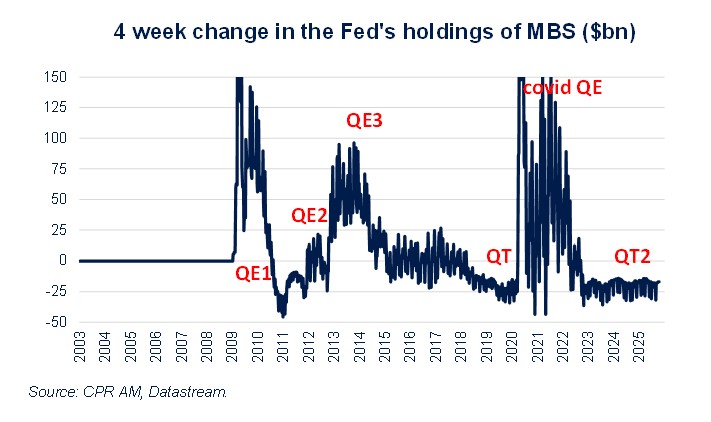

Following the inflation surge of 2021–2022, the Fed initiated a cycle of policy rate hikes and launched a Quantitative Tightening (QT) program. In that context, the Fed began shrinking its balance sheet in 2022 by not reinvesting Treasury securities and mortgage‑backed securities (MBS) that it held as they matured. In a speech delivered on October the 14th to the National Association for Business Economics, Jerome Powell suggested that the Fed could soon end its QT program.

What adjustments were made to the Fed’s Quantitative Tightening?

The maximum non reinvestment amounts were adjusted several times during the Fed’s QT: they moved from $60bn per month for Treasury securities and $35bn per month for MBS at the end of 2022, to $25bn per month and $35bn per month respectively from June 2024, and then to $5bn per month and $35bn per month respectively from April 2025. The fact that the QT slowdown has, so far, been concentrated on Treasury securities reveals a consistently stated preference to eventually reduce MBS holdings more than Treasury holdings.

Why end the Quantitative Tightening program?

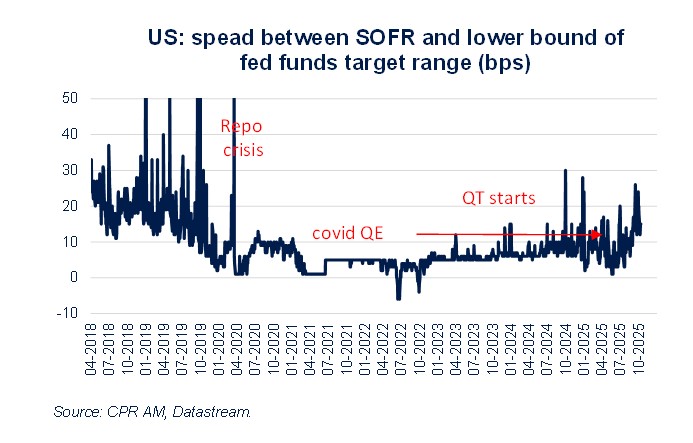

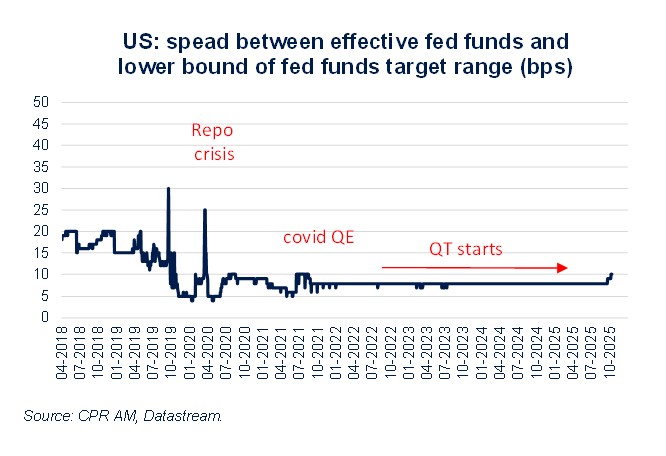

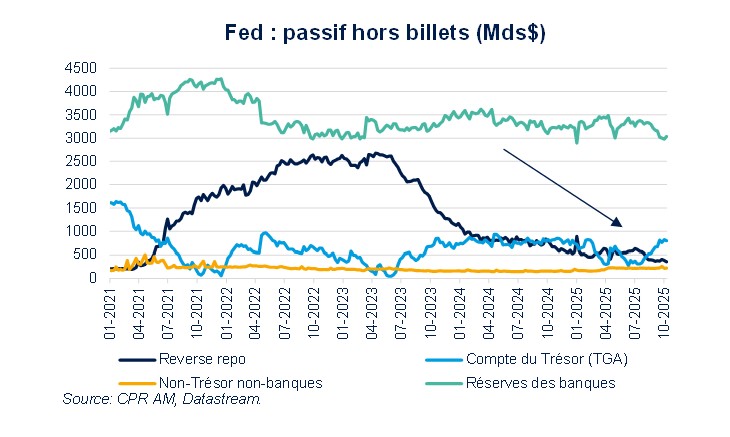

One reason QT is likely to end is the emergence in recent weeks of modest upward pressures on short term U.S. interest rates, caused by the decline in the amount of reserves held by commercial banks at the Fed — a mechanical consequence of QT.

Over the past few weeks, the SOFR1 has shifted upward within the fed funds target range and there have even been slight upward pressures on effective fed funds (which reflect small transaction volumes) in the last few days. The Fed’s aim is to stop QT well before tensions similar to those observed at the end of 2019 (see the well known “repo crisis”) recur.

What are the implications?

If the Fed stabilizes the size of its balance sheet soon, one can infer from Jerome Powell’s remarks and recent comments by his possible successor Christopher Waller that the institution will continue to reduce its MBS holdings. In order to do so, the Fed may decide to reinvest the MBS it holds as they mature into Treasury securities. This would not strictly be Quantitative Easing (QE), since it would not affect the level of reserves held by commercial banks at the Fed. Yet it would result in net purchases of Treasury securities of roughly $220bn per year. That could exert a modest downward influence on interest rates.

1 - Secured Overnight Financing Rate: overnight rate for secured lending transactions, typically repurchase agreement (“repo”) operations where U.S. Treasury securities serve as collateral