Gold Rush: An unprecedented craze

In a global context marked by geopolitical tensions and growing economic uncertainty, gold is performing well, breaking records left and right and confirming its status as a safe haven.

Published on 26 May 2025

A historical performance

Gold is breaking records. In April 2025, an ounce of gold reached a new high of $3500/oz on Easter Monday, a level never seen before. The upward trend began in 2024 with an annual performance of +34%, followed by a +20% increase in the first four months of 2025!

Global demand for the precious metal has also intensified, surpassing 1200 tons during the 1st quarter, the highest level for a 1st quarter since 2016 according to the World Gold Council (WGC)! Interestingly, this increase in demand occurred despite the high prices observed during the first quarter of 2025, which highlights the central role that gold plays in the current economy.

"Gold is money, everything else is credit" Citation JM Morgan

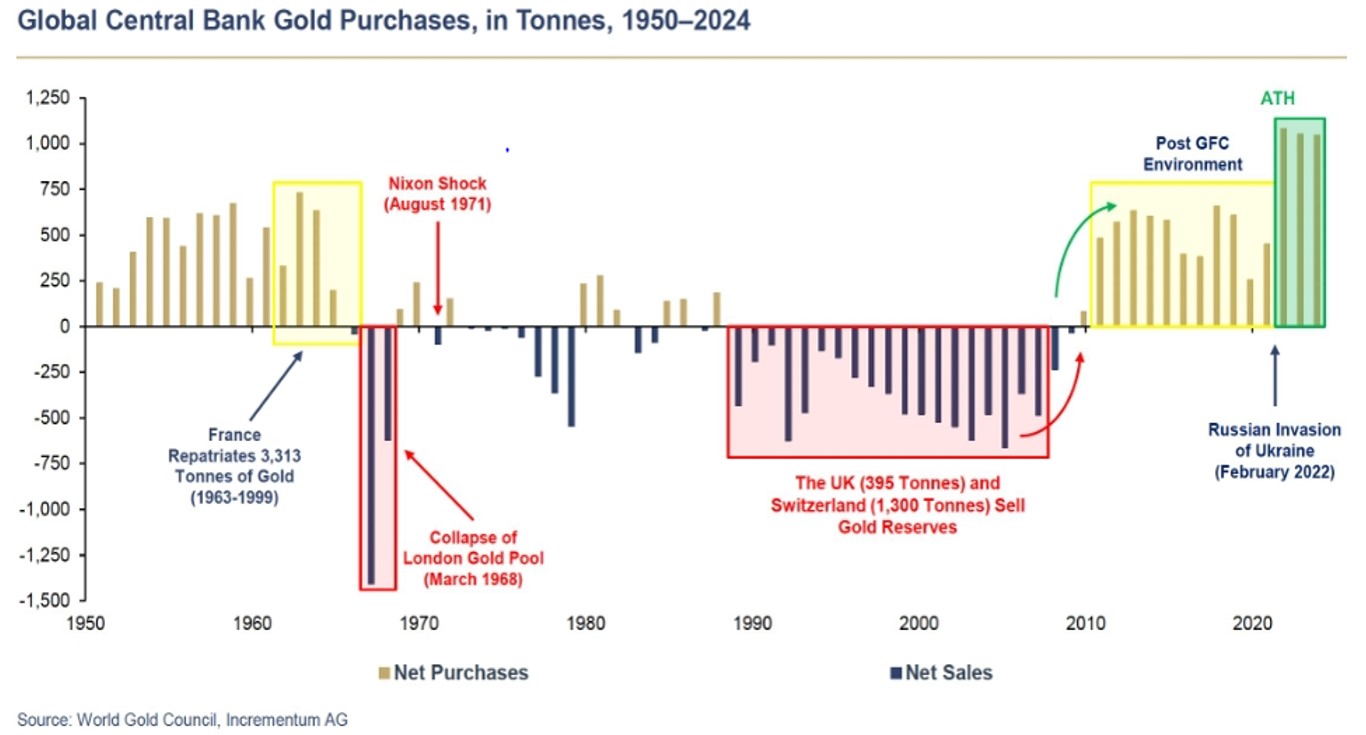

Several factors explain this trend. Geopolitical tensions, conflicts in Ukraine and the Middle East, market volatility and uncertainties related to the trade war have all caused investors to turn to this safe haven. Added to this, some central banks have initiated a massive movement to strengthen their gold reserves as a strategy.

The precious metal allows a country to strengthen its financial stability and can act as a lever to influence the financing of future challenges. Gold is an asset globally known as a universal currency in emergency situations for example. Finally, as foreign exchange reserves are mainly in dollars, rebuilding foreign exchange reserves in gold can free a country from dependence on the US dollar.

According to the World Gold Council, China stands out among the main buyers. In 2024, it was one of the largest buyers of gold. In terms of stock, however, gold represents only 7% of its reserves, ranking it in 5th position. Analysts therefore expect Beijing to continue its strategic purchases of the precious metal.

Is it still time to invest in gold?

Physical gold (bars, coins, etc.) or funds backed by the precious metal, it exists many alternatives for investors to purchase gold. Other lesser-known options exist, such as investing in mining companies that extract gold and other precious metals (such as platinum, silver, or palladium). These companies cover all stages of the gold mining industry from exploration and extraction to marketing), have not yet benefited to the same extent from the gold rush.

Between 2019 and 2025, the value of assets under management in funds dedicated to this theme increased by €10 billion to €21 billion, reflecting the growing interest of investors in this asset class (source Funds Magazine, April 2025).

Central bank policy could also play an important role in this trend, among them the Federal Reserve, whose activity is crucial for the gold market. If it were to lower its key rates, this could influence the performance of the mining company shares, the dynamics of which can be correlated with the one of gold.

Among the solutions for investors, since 2014, CPRAM has offered a "Global Gold Mines" strategy that allows investors to invest in international stocks aimed at capturing growth opportunities for mining companies involved in the extraction of gold or other precious metals. This strategy provides diversification to portfolios in mid-sized international companies while drawing on the expertise of CPRAM's teams on this theme.

Informations

Past performance is not a guarantee of future performance. Diversification is neither a guarantee of profits nor protection against losses. Investing involves risks; before making any investment, potential investors are encouraged to contact their advisor to ensure the suitability of the proposed investment for their financial situation and assets. Before making any final investment decision, investors should review the information contained in a fund's prospectus and Key Information Document.

The comments and analyses reflect CPR Asset Management's opinion on the markets and their developments, based on currently available information. The information contained in this document has no contractual value and does not engage the responsibility of CPR Asset Management. It is based on sources we consider reliable, but we do not guarantee that it is accurate, complete, valid, or timely, and it should not be relied upon as such for any purpose whatsoever. All trademarks and logos used for informational purposes are the property of their respective owners. This publication may not be reproduced, in whole or in part, or communicated to third parties without the prior authorization of CPR Asset Management. Subject to compliance with its obligations, CPR Asset Management cannot be held responsible for the financial consequences or any other nature resulting from the investment. All regulatory documentation is available in French on the website or upon request from the management company's head office.