Markets and strategies

Japan: Japanese rates soar...

Japanese government bond yields have risen sharply over the recent period, particularly at the longest maturities.

Published on 30 May 2025

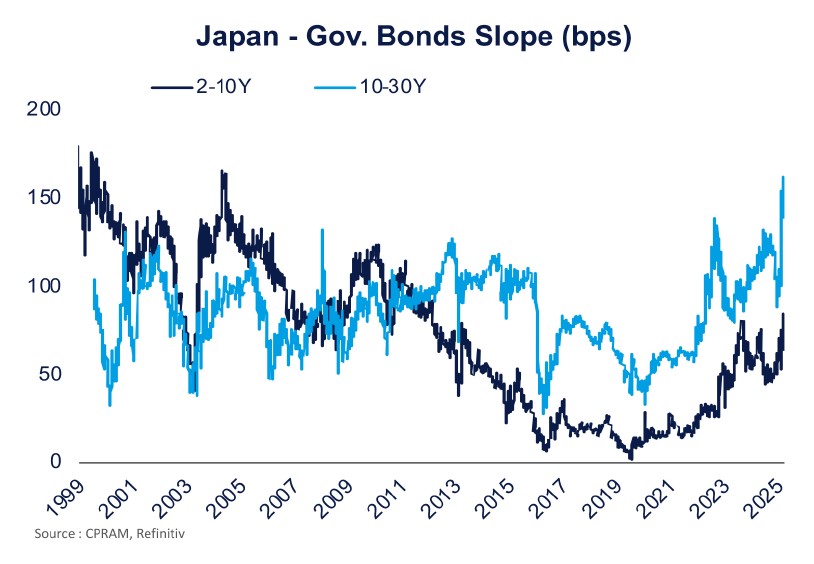

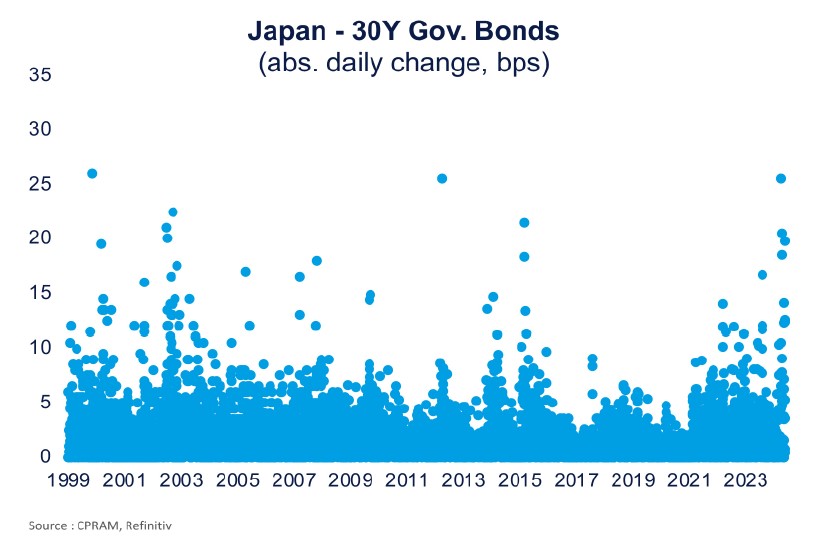

After a sharp retracement in early April following the "Liberation Day" announcements, the 10-year JGB yield has returned to levels close to the highs of 2025. The sell-off was more pronounced on 30-year bonds, whose yields have far exceeded all-time highs and were around 3.20% on May 22. De facto, the long end of the Japanese curve has steepened sharply, and the spread between 10-year and 30-year yields has reached levels never seen before.

What are the factors that explain this movement?

A colossal public debt

The problem of Japan's debt burden is far from new, as Japan is one of the most indebted countries in the world. At the end of March, the public debt was close to its all- time highs and totalled 1,324 Tr JPY (just over $9000 billion). In terms of GDP points, it has certainly tended to decline since the peak in 2020, thanks to a revival of growth and slightly higher inflation, but still stands at a level of 212%.

In terms of structure, Japan's public debt is mainly composed of long-term securities. 77% of the securities have maturities of more than 10 years. In recent years, the Ministry of Finance has certainly increased the share of short securities in the budget plans (such as the revision of the April issuance programme). But these adjustments remain anecdotal, and the average residual maturity of the debt is currently between 9 and 10 years. Additional efforts by the Department of Finance could be supportive factors in the short term, but the current fears seem to be mainly related to weak demand.

Weak demand from domestic investors

While JGB supply is expected to remain strong, it is above all the weakness of domestic demand that has revived investors' fears. The surge in yields on May 20 follows a 20-year sovereign debt issue that went very badly, a symptom of lower demand from Japanese investors.

In recent years, insurers in particular have bought long-term public debt, mainly due to an adjustment in the regulatory framework that has pushed them to reduce the duration gap between their liabilities and their investments. Passed in 2019, this law did not come into force until 2025 in order to give the entities concerned time to gradually adjust their allocations. With this reform having come into force, we automatically expect a drying up of the demand for JGBs, which has already been undermined by the BoJ's unconventional policies.

The gradual disengagement of the BoJ

Through its massive purchase programmes, the BoJ has taken a considerable place in the JGB market in just a few years, to the point of holding nearly half of the existing stock of sovereign debt. In doing so, it has squeezed out "natural" buyers of government debt, including commercial banks, and created strong distortions in the liquidity and functioning of the JGB market.

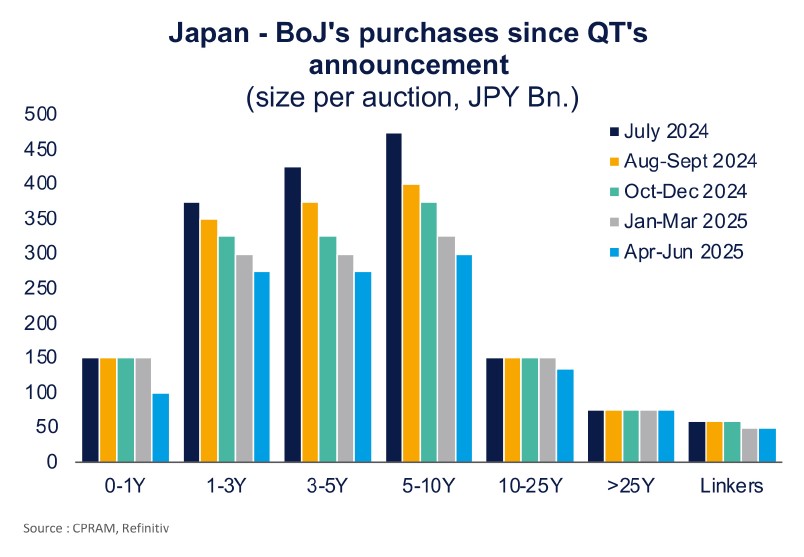

In June 2024, the central bank announced the start of a new phase of quantitative tightening and gradually reduced its purchases of sovereign debt. The share of public debt held by the BoJ has begun to decrease, and is now closer to 40%. Over the past year, purchases of short-dated securities have mainly been reduced, while the amounts of purchases of long-dated securities have been maintained so far.

At its June MPC, the BoJ is expected to take stock of this first phase of QT, and likely provide guidance on the future path of its balance sheet policy. In view of recent events, these elements will be closely scrutinized by investors. The possible announcement of so-called "twist" operations (sharper reductions in purchases of short maturities to strengthen purchases of long maturities) would be a supporting factor.

Until then, an ad hoc intervention to counter the surge in long-term rates seems rather unlikely. While this type of operation has been mentioned several times in the past, recent statements by BoJ members seem to rule it out. Noguchi described the rise in yields as "rapid but not abnormal", while Ueda, more measured, said that the central bank was closely monitoring market fluctuations.

The upcoming parliamentary elections

At the end of July, elections will be held for representatives of the upper house of parliament. With just a few weeks to go, the debate is naturally focused on supporting households undermined by a context of high inflation and monetary tightening. Such support would result in an overhaul of the current fiscal plan to the detriment of public finances, putting more pressure on sovereign debt.

The opposition parties are calling for reductions in consumption taxes, which would significantly reduce tax revenues. The current government has so far tried to preserve public finances, with Ishiba going so far as to describe Japan's situation as "worse than Greece's". But the prime minister, who was elected with difficulty at the end of last year and is losing ground in the opinion polls, could be forced to make concessions, notably in the case of the formation of a large coalition.

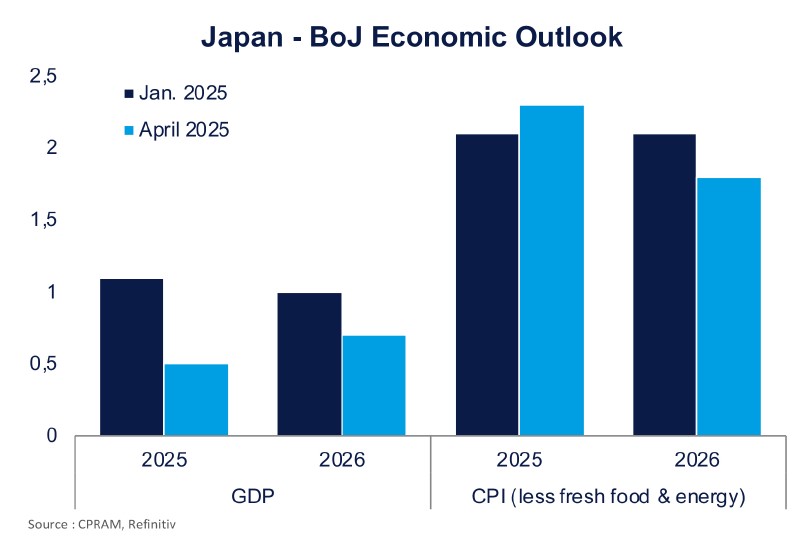

Uncertainties surrounding the trade war

Since the return of Donald Trump and the announcement on 2 April of the "reciprocal" tariffs, the financial markets have experienced a sharp increase in volatility. In this context, and in view of the risks weighing on the Japanese economy, the BoJ marked a very "dovish" turn at the last CPM at the end of April.

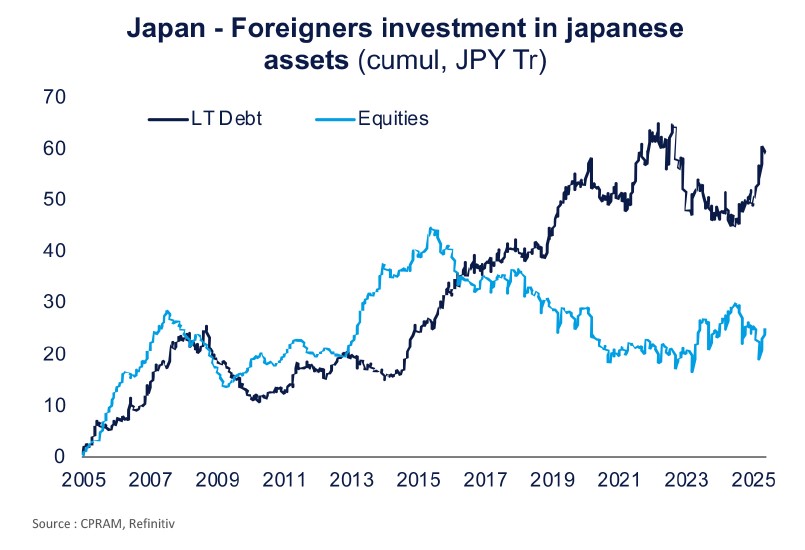

This reversal explains to some extent the acceleration of the upward movement in Japanese long-term rates, as many investors (especially foreigners) then sold off the flattening positions initiated in the wake of the normalisation of Japanese monetary policy. But while foreign investors have been the main buyers of JGBs in recent months (instead of local players), the amounts at stake remain disproportionate to the massive investments of Japanese investors in non-domestic assets.

In the event of a decline in volatility and stabilization of JGB yields at high levels, many Japanese investors could thus be encouraged to repatriate some of their assets invested abroad. Such a move is an important support factor for local debt, but it would have negative effects on many markets, first and foremost US government bonds - which could, in an extreme case, interfere with trade negotiations between Japan and the Trump administration.

Can we expect repercussions on other assets?

No "deleveraging"

At the beginning of August 2024, an unexpected change in tone from the BoJ coupled with renewed concerns about the US economy had a strong impact on the Japanese currency, leading to a massive unwinding of so-called "carry-trade" positions, the shock wave of which had repercussions on many assets. While comparisons can be made, the repetition of such a move seems very unlikely in this case, in particular because of less recourse to leverage.

On the currency

Japan is a country that accumulates current account surpluses, and therefore does not depend on financing from international investors. Foreign investors have certainly been buyers of JGBs in the recent period, but their weight remains very low (<10%) among the holders of public debt. Also, the impact of outflows linked to a movement of defiance should remain relatively measured. In the medium term, such a move would probably be more than offset by Japanese investors' reallocating to domestic assets. In the shorter term, the Japanese authorities have the capacity to act to support the yen in the event of a shock.

But such a scenario seems unlikely and investors still seem to be anticipating the appreciation of the yen against the dollar.

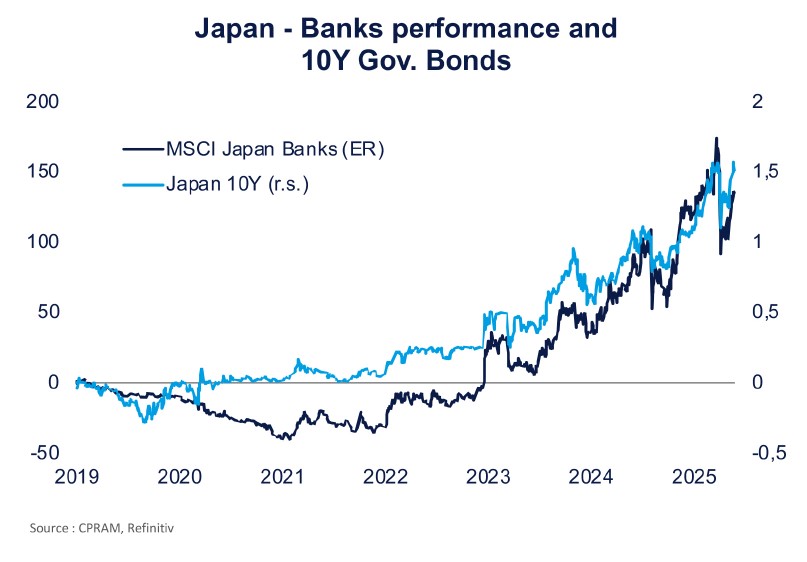

On domestic assets

Rising rates and a steeper steepening should therefore benefit some Japanese assets, and in particular banking stocks. While the Japanese 10-year yield has returned to levels equivalent to those prevailing at the end of March, the banking sector, heavily penalised by the announcement of reciprocal customs duties, remains behind in absolute and relative terms. An easing of trade tensions could thus allow banks to extend their recent recovery.

On other assets

The fact that Japan's very long rates are high now makes Japanese debt competitive with bonds in other developed countries as part of a global allocation and can therefore have an upside effect on the rates of other major international bond markets. This new environment could indeed push some Japanese investors (especially commercial banks) to reallocate their portfolios in favour of domestic assets, as the yield gap no longer necessarily justifies them bearing the currency risk. While it is difficult to accurately assess the amounts at stake, it can be assumed that the risk is more marked for US Treasuries because Japanese investors have already paid off part of the European debt (particularly French) they have held over the last 2 years.