Markets and strategies

The acceleration of inflation is a global phenomenon

In many countries, inflation has accelerated strongly and is at its highest level for several decades. The causes of the acceleration of inflation are multiple: rising energy and food prices, tensions in the real estate market in some countries, tensions in supply chains, etc. We analyze in this paper the common factors behind this acceleration and the singularities of each zone.

Published on 27 February 2022

Energy and food are pushing up inflation everywhere

Everywhere, inflation is pushed up by the price of raw materials, and in particular that of oil. At the end of January, the barrel of Brent had come back to $90, versus $50 at the beginning of 2021. This is the result of a marked increase in consumption and of a strict control of the production by OPEC+ countries. Commercial inventories of crude oil in OECD countries have thus fallen to the lowest level since the end of 2014.

As far as natural gas is concerned, prices in Europe and Asia, two areas that are major importers of natural gas, have risen sharply. There are several reasons for this, but the two main ones are the very sharp drop in Russian gas deliveries to Europe and the temporary reduction in electricity production from coal-fired power plants (closures), wind sources (less wind) and nuclear (reactors temporarily shut down), which led to a switch to natural gas. This also contributed to the sharp rise in electricity prices in these areas, a rise that was partially or fully passed on in the selling prices by companies. This has also contributed to a sharp rise in the price of metals, whose production plants are very energy-intensive.

Food inflation also accelerated sharply in 2021. If we take the FAO index of global food prices, it rose by an average of 28.1% in 2021 compared to 2020 with an increase in the index in all sub-sectors (cereals, oils, meat, dairy products, sugar, etc.). This sharp increase is the result of both an increase in demand, a more limited supply for certain foods due to disappointing harvests and high freight costs over the period.

In the united states, a surge in inflation caused by a combination of factors

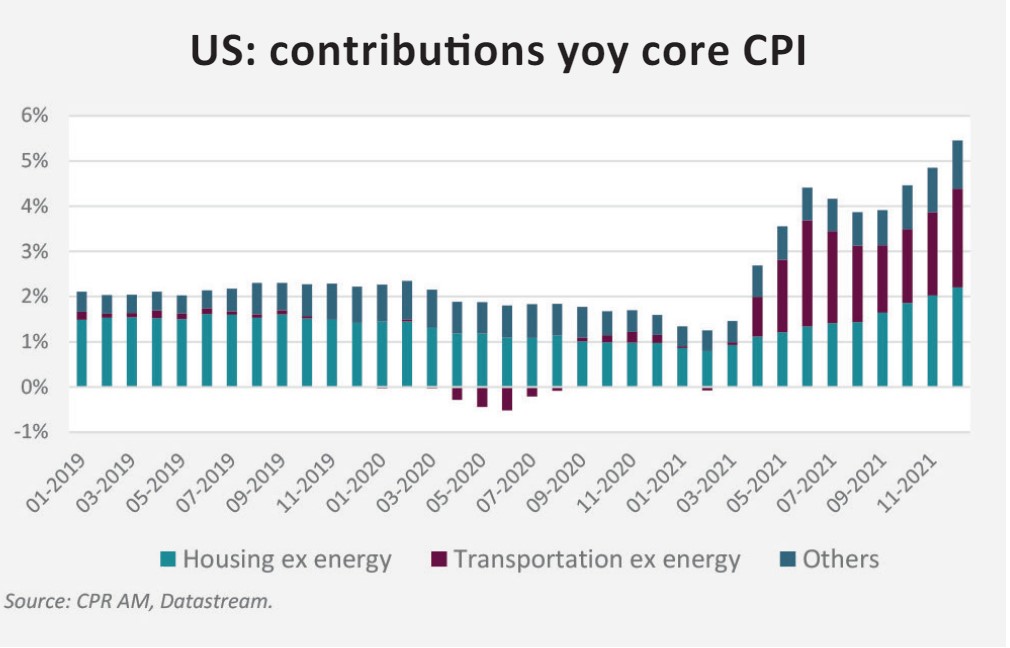

In December, inflation reached 7% year-on-year, the highest figure since 1982 and well above the Fed's 2% target. The rise in energy prices explains a large part of the rise in inflation in 2021, but it should be noted that their contribution will be much weaker in 2022, due to much more unfavorable base effects. Core inflation (i.e. inflation excluding energy and food) was up 5.4% in December.

Even though the price of multiple goods and services increased during the covid crisis, due to supply problems or increased labor costs, two factors explain most of the rise in core inflation:

- The very sharp rise in the price of new and used cars, due to the sharp drop in car production, itself caused by a shortage of semiconductors. Between the end of 2019 and the end of 2021, the Manheim used vehicle price index increased by 67%!

- The very strong increase in rents observed by private institutions (double-digit increases yearon-year) is starting to be taken into account by the BLS in the calculation of the CPI: a phenomenon that could last for some time.

During 2022, inflation should decelerate significantly, due to unfavorable “energy” base effects and because car prices should eventually normalize. However, the uncertainty is very high because it is very difficult to have a precise idea of the timing of the normalization of the supply chains of semiconductors and cars. Another factor of uncertainty, as in the other zones, lies in the evolution of food prices: a notable difference with the other zones on this point relates to the fact that the prices in restaurants are up sharply because of the sharp increase in wages in the sector. IN THE EURO ZONE, THE GAS CRISIS AND BASE EFFECTS ADD TO THE TRENDS AT WORK IN THE REST OF THE WORLD

In the euro zone, the gas crisis and base effects add to the trends at work in the rest of the world

In December, inflation stood at 5.0% year-on-year at its highest level since the creation of the euro zone. It is interesting to observe that this increase was general in the euro zone and that certain Eastern countries are experiencing annual inflation rates close to or above 10%. In addition, Germany (5.7%) and Spain (6.6%) stand out with higher inflation than the average for the area.

Europe facing a “gas crisis”

The acceleration in inflation is largely due to the sharp rise in energy and food prices over the course of 2021. However, the euro zone faced a jump in electricity and gas prices on the wholesale markets in the second half of 2021, which was not perceptible in the rest of the world with the same vigor. This resulted in an increase in the electricity component of the CPI by 23% over 2021 and that of gas by 28.5%.

Core inflation also accelerated sharply, reaching 2.6% in December, a level it had not reached since 1996. As in the rest of the world, the acceleration in the prices of goods and services is firstly due to imbalance between supply and demand and bottlenecks. The increase in industrial producer prices of +23.7% over one year at the end of November and of +9.8% excluding energy partly illustrates the tensions at work in supplies.

Base effects specific to the euro zone have to be mentioned. At the beginning of 2021, Eurostat strongly modified the weightings of the inflation components of the zone, thus reflecting the changes in household consumption between 2019 and 2020. This had a positive effect on inflation by increasing the weight of the food, for example, and by lowering that of certain services such as “travel packages”, the prices of which increased little in 2021 given the health measures still in force. In Germany, the government has decided to lower VAT in the second half of 2020 to boost household consumption, from 19% to 16% for the standard rate and from 7% to 5% for the reduced rate. This had a positive effect on Eurozone inflation in the 2nd half of 2021.

The ECB estimates these two cumulative effects at nearly 0.5% in the inflation data for the second half of 2021. Inflation should reach a peak at the start of 2022, and then it should decelerate from the 2nd quarter under the influence of several factors. First, the end of the base effects mentioned above, then the normalization of supply chains and finally a slowdown in energy prices. However, there is an unknown factor in the evolution of the gas-electricity components (2% and 3% of the index) which pass on price changes on the wholesale electricity and gas markets with a delay influenced also by government decisions on regulated tariffs. Indeed, several euro area countries have taken temporary fiscal measures to cushion the effects of rising energy prices for consumers.

These can have a direct impact on consumer prices when there are tax cuts or price caps, but others have no impact on inflation when it comes to energy checks for low-income households, for example. This increases uncertainty about the pace and timing of inflation deceleration.

Inflation is accelerating everywhere in the rest of the world, but the pace varies from one area to another

The trends revealed in developed countries exist in the rest of the world and are even exacerbated in some emerging zones. If we look at emerging countries as a whole, we see a clear acceleration in inflation almost everywhere since the second half of 2020. The acceleration is particularly pronounced in Latin America and Eastern Europe, with in most countries an inflation rate far exceeding the central banks’ target, requiring a sometimes very violent reaction from the latter. The importance of the weight of food in the price indices of emerging countries explains a significant part of the acceleration in inflation rates.

But we can also note, particularly in Latin America, that the scale of income support measures caused a sharp acceleration in demand even though supply was still constrained. The example of Chile is particularly a good example. In Brazil too, it is interesting to note that inflation is now not only very high but also very scattered with an overall index that should remain above 9% throughout the first half of 2022. The existence of automatic mechanisms for the retrospective adjustment of wages and other benefits to the cost of living represents a threat to price stability. The sharp depreciation of Latin American currencies during 2021 has exacerbated price pressures with the sharp rise in import prices in these countries.

In Eastern Europe, a little less sensitive to the exchange rate factor apart from Russia, inflation was initially driven by food and energy prices during 2021, but core inflation has been accelerating very markedly over the past few months.The strongest rise was in durable goods, whose prices are largely driven by global factors, and which are proving persistent. The rise in the prices of services was later and more gradual, but it should last throughout 2022. The peak of inflation is probably close but overall inflation should remain above the banks' objectives power stations throughout 2022. Turkey is a special case. Inflation there doubled to 36% year-on-year in December. This has its roots in a combination of unorthodox monetary and more generally macroeconomic policies, the currency crash and the consequent spike in import prices against a backdrop of sharply rising domestic inflation expectations.

On the other hand, in Asia, inflation is certainly accelerating overall, but the movement has so far remained much more modest, for several reasons. First of all, domestic demand was less buoyant, budgetary support having been less significant at the height of the crisis on the one hand, but also due to stronger activity restriction measures (with the implementation of the so-called “zero-Covid” policy). Then, we can see that contrary to what we observe almost everywhere in the world, food prices have remained lower. In this zone, movements in exchange rates remained generally more limited.

Finally, in a number of countries, energy prices remain partly administered, which for the time being transfers the cost of the increase in energy to the State.

The case of China calls out. Indeed, Chinese inflation remains very low, at +1.5% in December over one year. If specific factors explain a large part of the weakness of Chinese inflation, in particular on energy or food prices (with the consequences of the pig crisis), it is remarkable to see the core inflation capped at 1.2% in December. This undoubtedly reflects weak demand limiting the pricing power of companies.

Japan also remains in a particular configuration. Inflation is still well below the central bank's target of 0.8% year-on-year in December. While energy and food prices are pushing inflation up, specific factors (mobile plans, hotels, insurance premiums) have so far offset this development. Domestic demand should continue to accelerate in the coming months, which will continue to drive up the prices of industrial goods and those of services with the end of the restrictions. However, inflation will remain below 2% in 2022.

Inflation will remain a central subject in 2022 because its evolution will determine the pace of normalization of monetary policies. Although a deceleration is expected in the coming months almost everywhere in the world, uncertainties remain high with regard to the timetable for improving supply chains and the dynamics of food prices, not to mention the risk of second round coming from an acceleration of wages…