Markets and strategies

Trump Victory: What are the economic consequences?

After a campaign marked by several extraordinary events, Donald Trump wins the elections: the 45th president of the United States will therefore also be the 47th. It is only the 2nd time (after Grover Cleveland at the end of the 19th century) that a defeated president manages to return to the White House.

The Senate becomes Republican again, while the fate of the House of Representatives, where the Republicans had a slim majority, is still very uncertain. Without control of both chambers, Donald Trump will therefore de facto be in a situation of cohabitation that would prevent him from implementing a good part of his economic program.

Published on 7 November 2024

One of Donald Trump's flagship measures is an increase in tariffs, which he will be able to implement without Congress.

An initial version proposed a 60-point increase in tariffs on imports from China and a 10-point increase on other imports. During the campaign, Trump sometimes mentioned even more significant increases. The Peterson Institute estimated that the initial version would cost an average household in the middle class $1,700 per year.

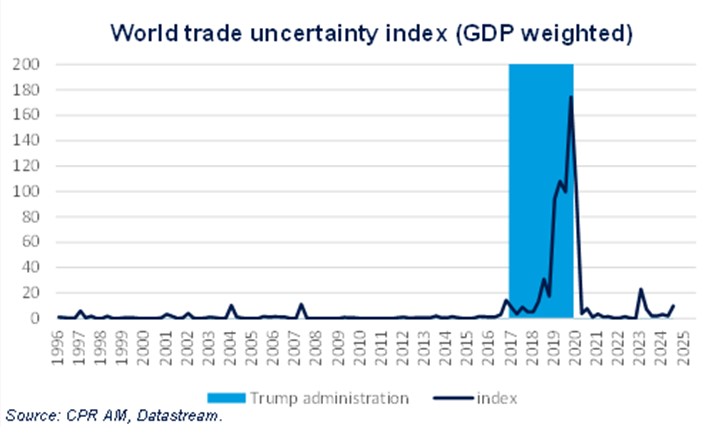

Indeed, this decision would represent a direct cost of 1.8% of GDP (simply multiplying import quantities by tariff increases), compared to 0.4% of GDP during the first Trump administration's trade war (2018-2019): the impact would be much stronger than in the first trade war.

In addition, we must obviously consider the impact of retaliatory measures that targeted countries will not fail to take. This would be inflationary and negative for activity in the United States, as well as for its trading partners, especially China, Canada, and Mexico.

The big question on this topic will be Trump's unpredictability: in 2018/2019, his communication on the subject was often erratic.

Donald Trump has proposed a reduction in the corporate tax rate from 21% to 15% ("for companies that produce in the United States"), but this measure can only be implemented with a majority in the House of Representatives. Even with a very narrow majority of Republicans, this measure could pass as it is a fairly consensual topic within this party.

Similarly, Trump has proposed an extension of the temporary income tax cuts adopted in 2017, which are set to expire at the end of 2025.

If they were to expire, the tax rate would increase slightly for a significant proportion of the population, but more so for households with higher incomes. Again, a majority in both chambers is required to extend these tax cuts. However, a compromise could be reached (not without difficulty) with the Democrats to make the tax cuts for the less affluent permanent.

Another proposal is to send back to their countries those who are in an irregular situation (which concerns approximately 11 million people).

Trump has regularly mentioned that he would invoke the Alien Enemies Act of 1798 for this. The feasibility of this project is questionable because such a project would be very costly (and would therefore require a strong majority in Congress) and many legal challenges could be considered.

Such a measure would be highly inflationary (reviving labor market shortages) and recessionary.

Trump should heavily use executive orders to remove regulations, especially in environmental matters.

During his first term, Donald Trump used executive orders to cancel or loosen over a hundred environmental regulations (for example, cancelling the requirement for oil and gas companies to report their methane emissions and allowing drilling in previously protected areas).

Trump should grant authorizations for numerous new oil and gas projects (one of his campaign slogans was "Drill, baby, drill").

Trump wants to have a say in the decisions of the Fed.

His plans are not very detailed. But a first step could be to replace Jerome Powell at the end of his term as chairman in 2026. The term of Adriana Kugler, another member of the Board, ends on January 31, 2026. That being said, Trump has often made it known that he appreciates low interest rates ... and an intervention, if it were to occur, would therefore be rather inflationary.

In conclusion, Donald Trump's room for maneuver in his second term depends on the final results of the elections in the House of Representatives: without a majority in Congress, he will not be able to lower corporate taxes or make temporary income tax cuts permanent. A majority in the House would have positive repercussions on the US stock markets, which would outperform the markets in the rest of the world.

On the other hand, a majority in Congress is not necessary for him to implement his plan for massive increases in tariffs and environmental deregulation. Trump's second term is expected to be associated with strong trade tensions and inflationary pressures. These factors are very positive for the dollar and will lead to an upward revision of the Fed's interest rate path.

On the contrary, Christine Lagarde indicated during the October meeting of the Governing Council that new trade tensions would weaken the economic prospects of the eurozone and likely lead to further monetary easing by the ECB. European bond markets are expected to outperform their American counterparts.