United States: LNG at the heart of trade negotiations?

On the first day of his return to the White House, on January 20, 2025, Donald Trump signed a torrent of executive orders on a wide variety of subjects but heralding the political line of his second term. Several of them focused on energy issues, and more particularly on Liquefied Natural Gas (LNG): EO 14153 "Unleashing Alaska's Extraordinary", EO 14154 "Unleashing American Energy", EO 14156 "Declaring a National Energy Emergency".

Beyond the famous campaign slogan "Drill baby drill", Trump has continued to speak out very regularly on these subjects in recent weeks. LNG also seems to be a kind of link in the trade negotiations that the American administration is starting with a large number of countries, particularly in Asia. It is therefore an opportunity to take stock of American production and export capacities in this area.

Published on 7 May 2025

U.S. natural gas: a high-speed ramp-up

After 2 decades of near-stagnation, U.S. natural gas production has increased very rapidly since the early 2000s. The volumes of gas extracted from American soil have doubled in the last 20 years, to reach nearly 4000 bcf (billion cubic feet) currently.

This increase is mainly due to the growing demand for electricity, 40% of which is produced from natural gas in the United States. The IEA expects this proportion to remain unchanged given the continued decline in the share of coal.

Another element that explains the very clear acceleration in production in recent years is the start of shale oil and gas exploitation. This has considerably strengthened natural gas production capacities, in particular through the development of infrastructure dedicated to its liquefaction and export.

The sector's growth is expected to remain very strong over the next few years. According to a memo from the US Congress1, the United States had a liquefaction capacity equivalent to 15 bcf per day at the beginning of 2025. In addition, 17 bcf/day of sites under construction must be added as well as 19 bcf/day of projects approved by the authorities but not yet initiated.

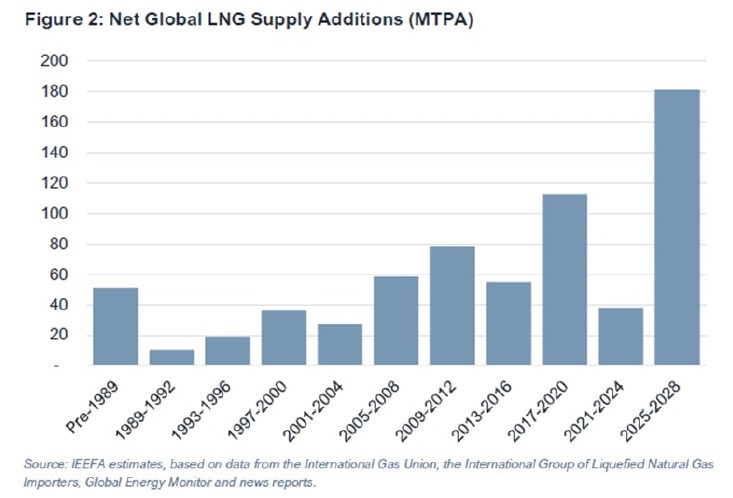

In the space of a few years, the United States has risen to 1st place among LNG producers and exporters. According to the IEEFA (Institute for Energy Economics and Financial Analysis), the increase in global LNG supply over the next 3 years (2025-28) is expected to greatly exceed (+50%) the previous record of 2017-2020. And the United States largely explains this dynamic, pushing them de facto to find outlets. This explains, beyond geostrategic issues, why LNG is at the heart of negotiations between the Trump administration and its trading partners.

A "boom" in exports, supported by the energy crisis

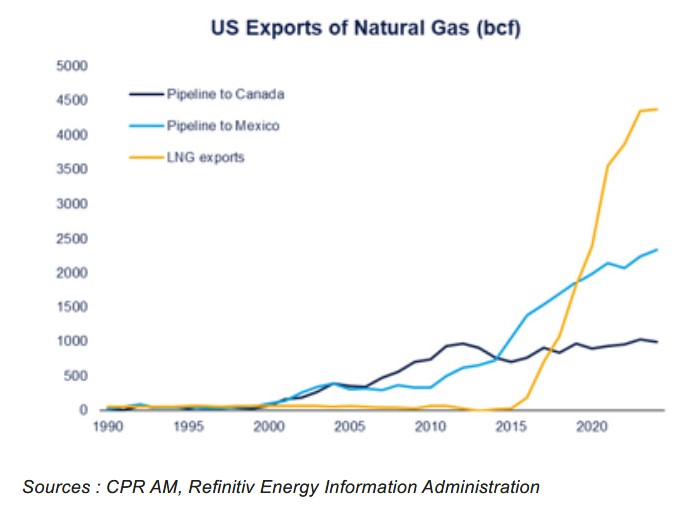

U.S. gas exports have grown exponentially over the past decade, and currently account for 15 percent of the country's total production. Less than $5 billion until the beginning of the 2010s, they totalled more than $35 billion in February 2025 over one year. Beyond the price effect, export volumes have also multiplied in recent years.

The trajectory of exports coincides with that observed on American production. While it should be noted that the United States was already exporting gas from Alaska to Japan in the early 1970s, or via pipelines to Canada and Mexico, the development of real LNG export capacity only began in February 2016 with the development of port infrastructure.

Since then, export volumes have continued to increase year after year, almost independently of gas prices. This steady growth can be explained by the significant costs associated with infrastructure development (between $10 billion and $20 billion per liquefaction terminal), which push investors to secure contracts that generally represent 80% of the site's capacity upstream. These infrastructure projects are therefore necessarily spread over several years, which makes them less sensitive to price fluctuations. And while restrictions had been implemented by the Biden administration (partly explaining the stagnation in 2024), they have since been abolished by his successor.

However, while the overall trajectory of LNG export volumes has remained relatively linear, their geographical distribution has undergone significant changes in recent years. Historically, Asia mainly and Latin America to a lesser extent have been the main markets for American LNG. In 2018, Asian countries accounted for more than half (52%) of the total volumes exported by the United States. But this share then fell considerably, due to lower demand from Asian countries (China in particular) but above all to the spectacular surge in exports to Europe following Russia's invasion of Ukraine.

Between 2021 and 2022, the volume of European imports increased almost 2.5 times and its share of US LNG exports increased from 29% to 64%. But while the energy crisis quickly propelled European countries to the top of the list of US LNG buyers, their imports decreased slightly in 2024. Demand from Europe is also expected to continue to gradually decline in line with the implementation of climate policies, and the movement could accelerate in the event of a resolution of the conflict and the easing of sanctions against Russia.

Beyond Europe, the outlook for global demand remains subdued, posing a risk of overcapacity given the sharp increase in supply (particularly from the United States) that will take place in parallel. We must therefore expect increased competition between the major producing countries.

A central place in current trade negotiations

Faced with the programmed reduction in demand, the United States must therefore find new outlets, especially as its production and export capacities continue to grow strongly. With this in mind, they are naturally turning to Asia, both a historical partner and the main driver of global gas demand in the coming years.

Beyond the trajectory of demand, the United States' stated objective is to increase its market share in many countries. And the US administration seems to have room for manoeuvre: US LNG imports represent only a relatively small share, between 10 and 20%, of imports from the main Asian countries. Respectively, this proportion exceeded 60% in 2023 for many European countries.

It is therefore not surprising to observe that LNG issues occupy a prominent place in the current trade negotiations between Asian countries and the Trump administration. Even before the announcement of the "reciprocal" tariffs by the Trump administration, many countries (Japan, South Korea, Taiwan, India, Indonesia, Philippines, etc.) had already expressed their desire to increase their imports, hoping to obtain preferential treatment.

Despite the announcement of a 90-day "pause", the continuation of negotiations is therefore an opportunity for the United States to fill its order book for the coming years and to confirm its new dominant position on the global LNG market.

As an example, Taiwanese operators recently announced a plan to significantly strengthen their US gas supplies over the next few years. The United States' share of the island's LNG imports could thus triple, from the current 10% to 30% within 10 years. But the US administration's expectations do not seem to be limited to export volumes.

Indeed, Donald Trump has clearly called on his international partners (and in particular Japan and South Korea) to invest in "Alaska LNG". Pre-approved under President Joe Biden, this megaproject, both environmentally and economically controversial, aims to exploit the resources of Alaska's far north and allow them to be exported through the construction of a nearly 1500-kilometre-long pipeline. This project is by far the largest ever envisaged: the total investment is estimated at $44 billion (between 3 and 4 times the annual budget of the State of Alaska) and it took 5 years and more than $100 million in research budget to obtain a green light from the authorities. In the long term, it could allow the operation of 3.5 bcf/day, a substantial increase compared to the current capacity, mainly intended for export to Asia.

However, the project has attracted very limited interest given the very high risks surrounding its feasibility and economic profitability, despite the calls of the American president. Moreover, as in the case of Europe, American ambitions here clash with the climate ambitions of countries such as Japan and South Korea. However, the US administration could certainly take advantage of the current negotiations to unblock the situation, as suggested by the scheduled visits to Alaska by Korean and Thai delegations, or the announcement of a summit organised on 2 June in Alaska.

In summary

In less than 20 years, the United States has significantly increased its natural gas production and developed significant export capacities. This has enabled them to rise to the world's 1st place in terms of producers and exporters, ahead of historical players such as Qatar and Australia.

The recent and planned decline in European imports is forcing the United States to find new outlets, especially as its capacities will continue to grow in the coming years. In the same way as technology or strategic resources, LNG issues should therefore necessarily occupy a central place in current trade negotiations, particularly with Asian countries.

While the US position on climate issues is hardly surprising, the Trump administration is implicitly asking its trading partners to scale back their ambitions, which is more worrying.

1. “Executive orders and US LNG Exports: Frequently Asked Questions”, 6 février 2025.