United States: Who buys U.S. Treasury securities?

Published on 14 April 2025

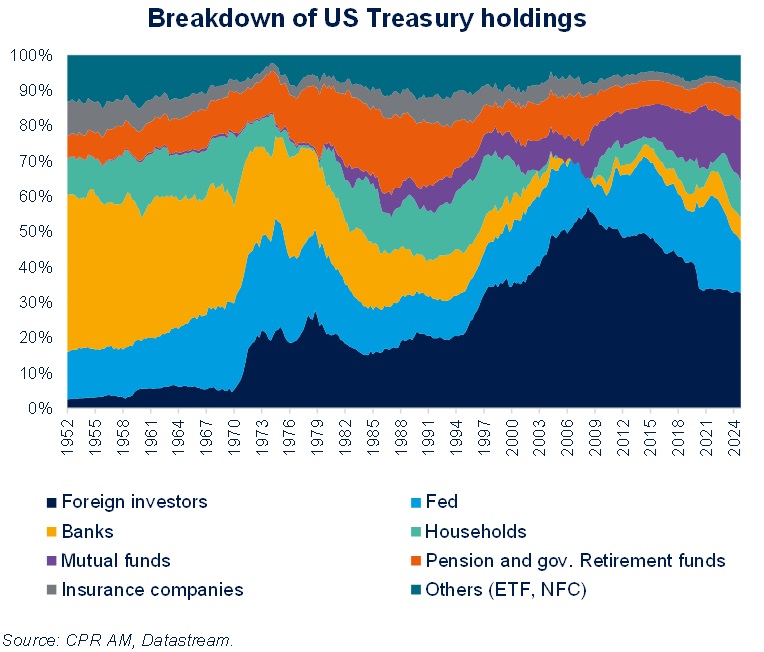

Recent tensions in the U.S. Treasury securities market have given rise to several hypotheses, including the one suggesting that official actors have offloaded significant amounts of securities. This is therefore an opportunity to take stock of these holdings. We use two sources here: the Treasury's TIC data for international holdings and the Fed's data for total holdings.

- At the end of 2024, non-residents were still the largest holders of Treasury securities with 33% of the market. This share has been in continuous decline since the Great Financial Crisis of 2008 (it was 57% in 2008). The holdings of Treasury securities by non-residents, measured in billions of dollars, continued to increase, but at a slower pace than U.S. debt.

- The Fed's share has significantly decreased since 2022 due to its Quantitative Tightening policy: it fell from 26% at the end of 2021 to 15% at the end of 2024.

- U.S. banks bought a lot of Treasury securities during the COVID crisis but very little since the Fed's monetary tightening began in early 2022. FDIC figures show that their unrealized losses on securities portfolios remain very significant.

- Money market funds, whose assets have grown significantly, have purchased large quantities of T-bills.

- The "households" category, which includes households in a broad sense (i.e., also hedge funds), has been very active in purchasing Treasury securities over the past three years.

The holdings of Treasury securities by foreign investors do not all follow the same trend.

- Statistics on China taken individually tend to show a disengagement, but specialists in the subject have become accustomed to adding the holdings of Belgium to those of China because the latter is believed to hold part of these securities on the Euroclear platform in Belgium. The sum of "China + Belgium" does show a disengagement, but it has not been spectacular in recent years.

- Holdings from Japan have been relatively stable over the last 10 years.

- In contrast, the demand for Treasury securities has been strong from Europe in a broad sense and from Asian countries excluding China and Japan (over $1,300 billion).

The latest available figure for TIC data is from January and does not allow for determining whether recent movements were caused by massive sales by non-residents.

Due to the delay in publication, the official statistics on Treasury securities holdings obviously do not explain the recent movements in the U.S. bond market.

On the other hand, they serve to remind us of the major prevailing trends: the Fed's disengagement over the past three years with Quantitative Tightening (now very slowed down), a generally weaker appetite from non-residents with a very slow disengagement from China, a lack of demand from U.S. banks since the Fed's monetary tightening, and an increasing dependence on other domestic players such as households.

If the dysfunctions in the Treasury securities market were to persist, an action by the Fed could be considered, for example by buying securities, as it did in March 2020.