What is the current state of US public finances?

Following Moody's downgrade of the US credit rating and the prospect of a widening fiscal deficit linked to the tax cut bill, investors are once again concerned about the trajectory of US debt.

In this article, we answer 10 questions to shed light on the state of US public finances.

Published on 23 May 2025

What is the level of US public debt?

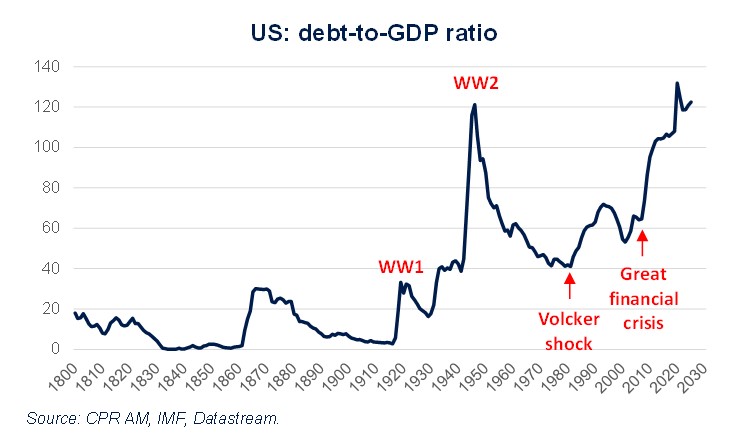

According to the IMF, the debt-to-GDP ratio is expected to exceed 122% in 2025 and if we exclude the very particular year 2020, which was marked by the covid crisis, this is the highest level since the country's independence.

The debt-to-GDP ratio had reached roughly equivalent levels by the end of the Second World War. But economic growth was particularly strong in the decades that followed, which may have led to a sharp drop in this ratio.

What is the level of the US fiscal deficit?

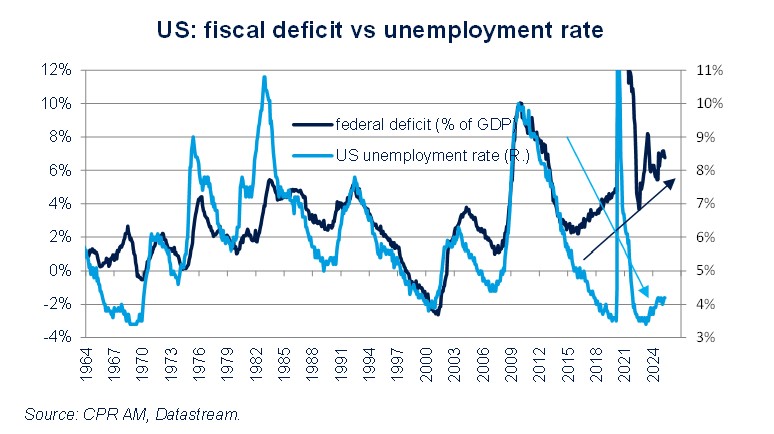

The US fiscal deficit was 7% of GDP in 2024, even before the possible adoption of the "Big, beautiful bill". Since the beginning of the twentieth century, the fiscal deficit has been higher than that:

- during the two world wars,

- during the great financial crisis of 2008/2009, during which the unemployment rate rose to 10%,

- during the Covid crisis, in 2020 and 2021, during which the unemployment rate rose to nearly 15%.

The fact that the fiscal deficit is so high outside of periods of crisis or recession is completely unprecedented historically. Another very important point is that the deficit has never been so large while monetary policy has been restrictive. Yield curve control was in place during the Second World War and the Fed had lowered its rates and carried out Quantitative Easing operations during the Great Financial Crisis and during the Covid crisis.

Is the evolution of the fiscal deficit always linked to the economic cycle?

Historically, the fiscal deficit and the economic cycle are closely linked. During an expansion phase, unemployment falls and tax revenues increase, which reduces the fiscal deficit. During a recession, unemployment rises and tax revenues fall, which increases the fiscal deficit.

Things have been completely different since the mid-2010s, as the fiscal deficit began to grow on a trend while the unemployment rate fell and even reached a more than 50-year low in 2023.

What are the causes of the widening deficit in recent years?

There are several reasons for the widening of the fiscal deficit:

- The aging of the population means that spending on the "Social Security" and "Medicare" programs increases over time. Spending on the Medicaid program has been increasing slowly but steadily since it was expanded by the Obama administration in 2010.

- The tax cut decided by the first Trump administration in 2017 has eroded tax revenues.

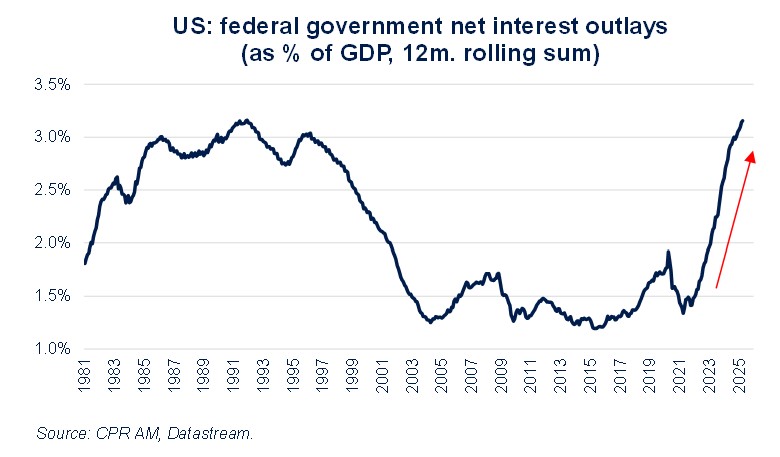

- More recently, the Fed's monetary tightening has led to a sharp increase in interest spending. In the 12 months to April 2025, they represented 3.2% of GDP, more than in the decade following the Volcker shock (key rates close to 20% in the early 1980s).

The fact that the Fed keeps rates at current levels (4.25/4.50%) leads to a renewal of the stock of debt at higher rates and interest spending will continue to grow.

What are the possible budgetary consequences of the 'Big, beautiful bill’?

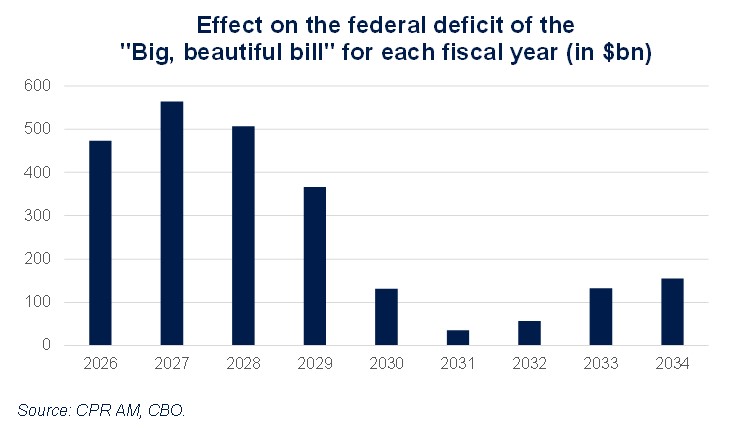

The leading lights of the Republican Party want to pass several elements in the same budget reconciliation bill, dubbed by Donald Trump "Big, beautiful bill":

- the extension of the temporary tax cuts adopted in 2017,

- until the end of 2028, an income tax cut of up to $4000 for Social Security beneficiaries over 65 years of age, the non-taxation of tips and overtime, the deduction of interest on car loans from income tax and the deduction of research expenses for companies,

- from 2029, cuts to Medicaid and the reduction or dismantling of certain provisions of the Inflation Reduction Act,

- raising the debt ceiling by $5000 billion.

Dissension between Republican deputies and senators means that the adoption of the "Big, beautiful bill" is not certain as it stands and that it could be less ambitious in the end. Nevertheless, the CBO indicated that it would increase the deficit by $2.3 trillion over 10 years with a strong focus on 2026, 2027 and 2028. Ultimately, the fiscal deficit could reach 8 to 9% of GDP if the "Big, beautiful bill" is adopted, which would be completely unprecedented outside of a recession.

In other words, an unforeseen external shock would bring the deficit well above 10% of GDP.

Is public debt having a snowball effect?

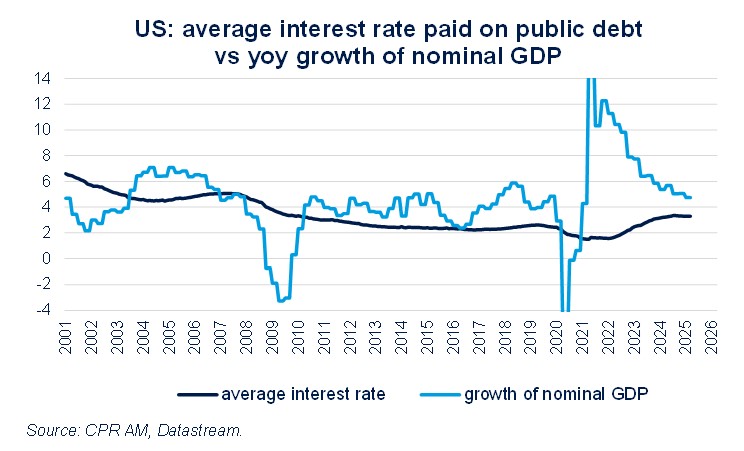

In the dynamic equation of the debt-to-GDP ratio, the quantity "r - g", which represents the difference between the rate of increase of the numerator (debt) and that of the denominator (GDP), is mechanically very important. Over the last few years, nominal GDP growth has been higher than the interest rate, which makes it possible to have a primary deficit without an increase in the debt-to-GDP ratio.

With nominal GDP growth at 5%, an average interest rate of 3.3% and a debt-to-GDP ratio of 120%, the primary deficit threshold above which the debt-to-GDP ratio rises is 2% of GDP, but it has been around 4% of GDP recently. As a result, the primary deficit is already too high at present to avoid an increase in the debt-to-GDP ratio in the United States.

What are the next deadlines for debt?

There is no deadline for the passage of the "Big, Beautiful Bill". However, in the event that this falls through, the income tax rates will be mechanically modified (essentially upwards) at the end of 2025.

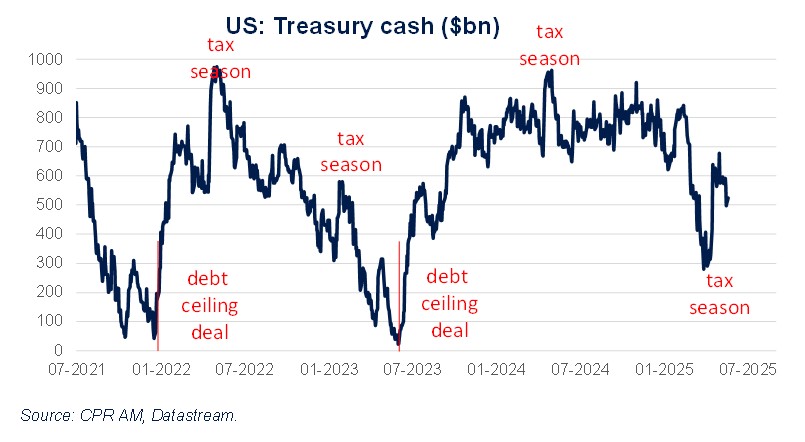

On the other hand, there is a deadline around August for raising the debt ceiling. Indeed, the debt ceiling came into force again at the beginning of 2025 and the Treasury is currently using exceptional measures for the moment in the face of the impossibility of issuing new debt. The Treasury is gradually emptying its account at the Fed. If the latter approaches zero, the market concern would be a possible default.

How does the trade war interact with the dynamics of public debt?

There are two main consequences of the trade war for public debt dynamics:

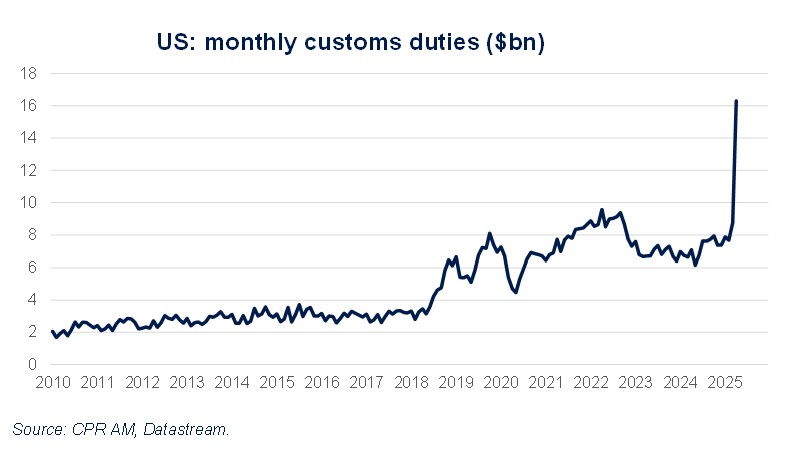

- The increase in customs duties brings additional budgetary revenues to the Treasury. Tariff revenues increased by only about $8 billion in April, which would result in a revenue surplus of $100 billion per year. This would not be negligible, but it is very far from being enough to finance the "Big, beautiful bill".

- The desire to reduce the trade deficit at all costs reduces the appetite of non-residents for Treasury securities (and thus raises interest rates and debt) because trading partners have less incentive to hold dollar reserves (see our recent article on the dollar).

What is the credit rating of the United States?

- Since August 2011, the United States rating at S&P has been AA+. The country had been downgraded after a crisis phase over raising the debt ceiling.

- As of August 2023, the U.S. rating at Fitch is AA+. The country had been downgraded due to the accumulation of deficits and the increase in debt.

- In May 2025, the United States' rating at Moody's is Aa1. The country has been downgraded due to the accumulation of deficits and the increase in debt.

The three main agencies therefore rate the United States in the same way with a stable outlook. A deterioration in the public debt trajectory and a possible crisis on the debt ceiling would be likely to lead to further downgrades in the future.

How would the Fed react in the event of a dysfunction in the Treasury securities market?

As a reminder, the main trends prevailing in the Treasury securities market are as follows: the Fed's disengagement over the last three years with Quantitative Tightening (now very slow), a generally weaker appetite of non-residents with a very slow disengagement from China, sluggish demand from US banks since the Fed's monetary tightening and increasing dependence on other domestic players such as households.

If dysfunctions in the Treasury securities market were observed (e.g. too little liquidity), a Fed action could be considered, for example by buying securities, as it did in March 2020. If long-term rates were to rise too much, it would constitute a tightening of financial conditions and would eventually decide the FOMC to lower its key rates.