Artificial Intelligence, "how to think about the AI impact on the economy"

Artificial Intelligence (AI) has been even more in the news in 2023 because of the spectacular breakthroughs of generative AI, which is capable of generating texts, images and many other things through generative models.

Published on 15 November 2024

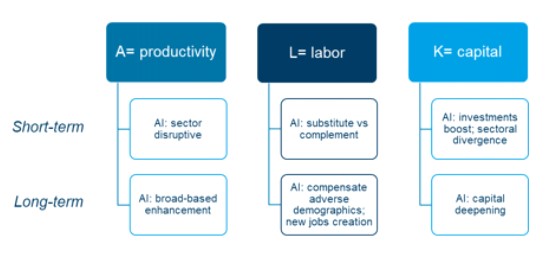

There has been a lot of speculation about how the economy could be changed or even disrupted by these developments. Indeed, AI has the potential to impact a wide range of industries and therefore to reshape the economy via multiple channels and angles, such as labor market, investments and productivity. In this piece, we present a theoretical framework of how to think about it and present some empirical findings.

The economists’ framework to think about the AI impact on the economy

To think about how AI could impact the economy, it is necessary useful to remind how economists usually model potential growth. They usually model potential GDP as a function of capital, labor and productivity. The most common model is the following equation (the so-called Cobb Douglas production function):

Y=A La K1-a

Where L stands for labor, K stands for capital and A for the productivity. GDP can grow if there is more available capital and/or if there is more available workers and/or productivity increases.

Potential growth of the economy could be significantly impacted by AI in all the drivers of growth: capital, labor and productivity, both in the short-term and in the longterm. In the following of this piece, we will elaborate on how AI can impact each of these factors.

AI and the capital factor: a round of ‘creative destruction’?

Capital investments are indeed a key dimension in the AI implementation. A McKinsey report (The State of AI) shows in 2022 AI adoption was 2.5x higher than in 2017. In 2017, 20% of respondents reported adopting AI in at least one business area, whereas in 2022 that figure moved to 50%. Consequently also the level of investment in AI has increased alongside its rising adoption. If in 2017 40 % of respondents at organizations using AI reported more than 5% of their digital budgets went to AI, now more than half of respondents report that level of investment and 63% of respondents said they expected their organizations’ investment to increase over the next three years.

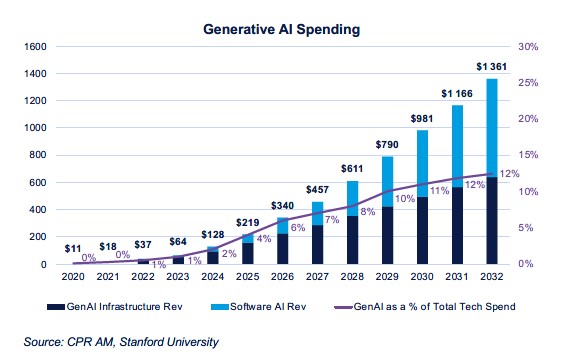

Global investments in AI is rising exponentially and also investments in generative AI are doing so. Another McKinsey report related to generative AI shows that “funding for generative AI, though still a fraction of total investments in artificial intelligence, is significant and growing rapidly, reaching a total of $12 billion in the first five months of 2023 alone. Venture capital and other private external investments in generative AI increased by an average compound growth rate of 74% annually from 2017 to 2022. During the same period, investments in artificial intelligence overall rose annually by 29 %, albeit from a higher base.”

It is particularly interesting that investment in AI is spreading across sectors as the areas in which companies see value from AI have evolved over time, moving from manufacturing to services, especially with the latest wave of AI. Back in 2018, according to the McKinsey report (the State of AI), “manufacturing and risk were the two functions in which the largest shares of respondents reported seeing value from AI use”. In 2022, “the biggest reported revenue effects are found in marketing and sales, product and service development, and strategy and corporate finance”. Indeed, this trend in investments is already supporting right now the economy and the output of the sectors most involved, while the improving capital per worker will likely increase future potential growth

However, it would be naïve to focus only on this positive aspect. Indeed, we have to underline that in a classical growth model (for instance the Solow model) the evolution of capital actually depends on two factors: the stock of capital at time t is the sum of the capital stock available at (t-1) minus the depreciation of capital due to deterioration and obsolescence and of new investments. If investments are increasing, this will lead to higher capital stock per worker and ceteris paribus higher potential growth. The usual equation representing this is:

Kt = It + (1 - δ) * Kt-1

Where Kt stands for the stock of capital at time t, Kt-1 stands for the stock of capital at time t-1, δ the depreciation rate of the stock of existing capital and It the new investments. Indeed, the fast innovation and evolution of these new AI technologies could make the depreciation rate (proxying the speed at which existing capital may become obsolete) much higher than in the past, thus requiring increasing levels of investments to keep the capital per worker unchanged, implying most likely higher cost of capital for a given level of available savings in the economy. Thus, the short-term impact could sharply diverge across sectors. There is here the idea of “creative destruction” popularized by the famous economist Joseph Schumpeter.

AI and the impact on the labor market: unclear in short-term, needed in long-term?

While many think about the most recent generative AI, there are various types of AI used across the value chain, some of them operating since long in various sectors:

- ‘Human-in-the-loop’ technologies: software, systems and machines assisting workforce (help to perform tasks better and more efficiently, with the potential of freeing up time for higher value-added activities);

- ‘No-human-in-the-loop’ technologies: automating processes (e.g. robotics) which remove/substitute the labour input.

Therefore, in the short-term, the debate about AI as “a substitute vs a complement” to human labor seems misplaced, as it can be both. One peculiar aspect of the most recent wave of AI marks a change from past technological transformations, as it expands from “physical automation”, which focused on physical jobs or routine cognitive tasks, to “cognitive automation”, which sees creative and cognitive jobs being impacted. Instead of the lowest paid workers being the most affected, now many of the highest-paying occupations are potentially affected too.

An ECB study1 shows that around 25% of all jobs in European countries were in occupations highly exposed to AI-enabled automation but “the degree of exposure is as much an opportunity as it is a risk. The outcome for jobs depends on whether the AI-enabled technologies will substitute or complement labour.”

It shows that the doom-mongering takes about the AI impact on the labour market are “greatly exaggerated”. Indeed, it demonstrates that in Europe, the subsectors most exposed to deep learning AI (language processing, image recognition, recommendations based on algorithms, fraud detection, etc.) during the 2010s saw their weight in total employment… increase. For low- or medium-skilled populations, exposure to AI had no impact on employment. For highly skilled populations, exposure to AI had a significantly positive effect on employment. On average, exposure to AI also has a positive effect on the employment of the younger population. No significant impact has been observed on wages. The conclusion of ECB economists is that it is too soon to reach a verdict.

Reskilling of workers will be even more the key word, as also the higher level and specific acquired human capital may become obsolete or may require to adapt to operate in conjunction with AI. Historical precedents tell us that technological innovation initially displacing workers drove employment growth over a long horizon (GS) and that workers who lost their jobs could transition to new jobs, with generally and on average an increase in labor income. We think that the present may rhyme with the past: on the one hand, like in every major technological revolution, there will be workers displaced, but on the other hand, the technological revolution will also require new jobs and new roles that currently do not exist. However, depending on the scale and the speed of adoption of AI and the regulatory framework, the short-term impending disruption of the labor market remains still highly uncertain.

But AI, while creating disruption in the short-term, may come to the rescue in the long-term perspective. Against a population ageing backdrop, the labor force dynamic is one of the most challenging issues for a great number of developed and emerging countries.

In the Eurozone, the working age population decreases now by more than one million each year. The same type of evolution takes place in many countries (Japan, China, South Korea). Here is where we could expect AI to come to the rescue, both as labor complement, making workers more efficient and productive, and as labor substitute, thus filling the gap of missing workers due to an ageing society

AI and the impact on productivity: significant but when?

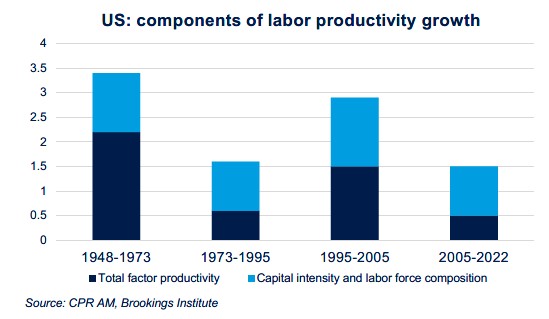

The primary determinant of long-term growth and is productivity growth. For the United States, from WWII until the early 1970s, labor productivity growth averaged over 3% per year. In the early 1970s, productivity growth slowed markedly, posting a rebound in the 1990s and then eventually slowing again dramatically since the early 2000s.

Productivity (i.e. producing more with existing resources, or the same with less resources) is generally achieved in three ways: via raising quality of labor, increasing capital per worker or by improving the way labor and capital work together (total factor productivity). Interestingly, in the 1990s the surge in productivity growth, which lasted for a decade, was driven primarily by a huge wave of investment in computers and communications, improving both total factor productivity and capital intensity. As highlighted in the box below, the diffusion of new technologies is not necessary straightforward as there could be hurdles of many types and the materialization of productivity gains at the macro level could take some time (sometimes a long time…).

Like in the 1990s, AI may play a major role in improving productivity across the economy, with applications ranging from the manufacturing to the services sector, with advances driven by progress in hardware, software, data collection and growing investments.

As a general purpose technology, we think that AI could mirror 3 typical phases of development:

- A first phase characterized by strong innovation and capital accumulation but limited visibility on the productivity impact; there is no widespread adoption yet and benefits productivity in the aggregate economy are small, although they may be significant in some sectors of the economy, but offset by losses in others.

- A second phase, when costs of using and investing in new technologies fall, the implementation becomes more widespread and increases in productivity growth are boosted across the economy. Divergences may remain, but the benefits are more visible.

- Third phase, where the law of declining marginal returns starts to apply and productivity growth boost tapers-off, most likely returning to a longer-term trend.

Quantifying the potential impact on productivity is not easy. Although there is an emerging literature that estimates the productivity effects of AI, these empirical studies remain still scattered and very sector-specific. Studies focusing on the most recent developments of generative AI, thus on the impact on cognitive workers, find improved AI could improve productivity in a range between 10-20%.

How the global context influence the diffusion of innovations

The speed at which innovations spread throughout society depends not just on their intrinsic features, but also on the broad societal and economic environment. Regardless of an innovation’s quality and value, it will not necessarily be adopted. Moreover, the insufficient uptake of technological innovations has often been cited as one of the main causes of the weak productivity gains at the beginning of the 21th century (the well-known “productivity paradox”)3.

Public policies to combat such barriers (training programmes, facilitating financing, subsidies, development of infrastructures, etc.) may contribute to a quicker diffusion, which is very often the case when there is an alignment of interests between the public and private spheres. In some areas (energy transition or strategic autonomy, for example), cooperation between various actors is necessary. Also, public policies (subsidies in particular) can help speed up the adoption of a new technology. Public policies to combat such barriers (training programmes, facilitating financing, subsidies, development of infrastructures, etc.) may contribute to a quicker diffusion, which is very often the case when there is an alignment of interests between the public and private spheres. In some areas (energy transition or strategic autonomy, for example), cooperation between various actors is necessary. Also, public policies (subsidies in particular) can help speed up the adoption of a new technology.

That training generated 502 tons of carbon emissions, according to the same paper, or about as much as 110 US cars emit in a year. That’s for just one program, or “model.” Another relative measure comes from Google, where researchers found that artificial intelligence made up 10 to 15% of the company’s total electricity consumption, which was 18.3 terawatt hours in 2021. That would mean that Google’s AI burns around 2.3 terawatt hours annually, about as much electricity each year as all the homes in a city the size of Atlanta.

Another possible hurdle is that AI is feared by many, included in the political sphere, and that some regulation could greatly reduce its diffusion.

Conclusion

Overall, we expect the impact of AI on the economy to be positive for output and economic growth in the medium and longer term, although in the early stages of the road to widespread adoption, it could be disruptive across industries and in the labor market, creating significant dislocations, with winners and losers determined by the extent and speed of adoption.

The productivity boost will be significant in the long run but can take some to materialize at the macro level like other previous technological innovations. Despite some provocative takes in the press (sometimes fear mongering), the deployment of AI should not cause a global disaster for the labor market and can even be beneficial against a backdrop of population ageing where the working-age population is shrinking and where the labour shortages are more and more generalized.

1. ECB, “Reports of AI ending human labour may be greatly exaggerated", ECB research bulletin n°113.

2. Acemoglu D. and P. Restrepo, 2022, “Demographics and automation”, Review of Economic Studies, vol. 89(1).

3. Acemoglu, Daron, David Autor, David Dorn, Gordon H. Hanson, and Brendan Price. 2014. "Return of the Solow Paradox? IT, Productivity, and Employment in US Manufacturing." American Economic Review, 104 (5): 394-99. Andrews, D. C. Criscuolo and P. Gal (2016), “The Best versus the Rest: The Global Productivity Slowdown, Divergence across Firms and the Role of Public Policy”, OECD Productivity Working Papers, No. 5.

4. OECD, 2018, “Digital technology diffusion: a matter of capabilities, incentives or both?”, Economics Department working paper n°1476. Patterson D. et al., 2021, “Carbon emissions and large neural network training”.