DeepSeek: Are US tech giants in danger?

For the past two years, Artificial Intelligence (AI) has been asserting itself as the main driver of financial markets, propelling Nvidia and other industry giants to new heights in the stock market. But even the most powerful trends go through turbulent phases.

Published on 20 February 2025

Last summer, a report from Sequoia Capital1 raised doubts about the viability of massive investments made in AI infrastructure and their profitability, leading to an initial correction. Just three months ago, skeptics were pointing to the end of the era of exponential returns linked to the increase in the size of AI models.

The promise of a systematic improvement in performance through ever larger models was called into question, along with investments in GPUs2. Since then, researchers have discovered new scaling laws, including endowing models with reasoning capacity, thus opening up new prospects for innovation.

Repeated again, on January 27, 2025

Nvidia, once again the world's most valuable company, experienced a historic collapse, losing $593 billion in market capitalization in a single session, a plunge larger than the total value of Mastercard and equivalent to the erasure of Coca-Cola, Disney, and Nike combined. This was the worst day in history for a listed stock.

Once again, this earthquake did not result from a fundamental questioning of Nvidia's economic model, but from a sudden change in narrative fueled by the discovery of DeepSeek, a Chinese AI startup whose advancements caused a shockwave on social media and in the financial press.

Its new models, DeepSeek-V3 and R1, seemed to be able to compete with the most sophisticated systems developed by American giants, but at a significantly lower cost. Headlines quickly prophesied the end of the AI golden age, once again questioning the relevance of massive investments in the sector.

A central question arises

Will the decrease in inference costs slow down the investment appetite of the sector?

Economic history suggests the opposite through Jevons' paradox. This theory, highlighted in the 19th century, is counterintuitive: optimizing a resource - and thus reducing its cost - stimulates its consumption rather than reducing it. Transistors, for example, have become infinitely cheaper over the past fifty years, but global demand for computing power has exploded. The same goes for AI: the decrease in inference costs opens the door to new applications, which should accelerate its adoption instead of slowing it down.

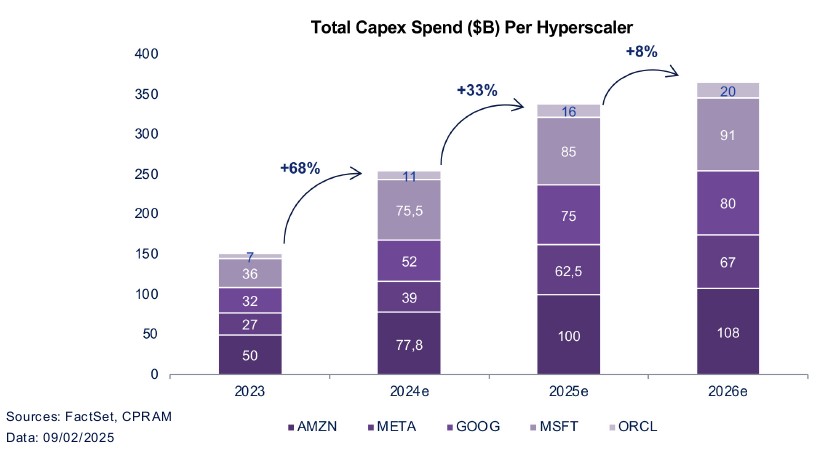

This is precisely the bet that digital giants are making. Far from succumbing to temporary market doubts, AI leaders are doubling down on their investments. Meta is increasing its spending projections from 52 to 62 billion dollars, Google is surpassing the 75 billion mark, while Amazon is preparing to inject over 100 billion dollars in 2025 to expand the capabilities of AWS.

To succeed in this transformation, the EU will have to maintain its focus on strategic investments while preserving the unity of its member states - a delicate but necessary balance to secure its place in the concert of nations.

Meanwhile, the technological rivalry between the United States and China is reaching a new level.

Donald Trump unveiled the Stargate project, a colossal initiative orchestrated by Oracle, OpenAI, and SoftBank, aiming to build next-generation data centers to power future AI models. With a budget estimated between 100 and 500 billion dollars, it is one of the most ambitious tech infrastructure projects in history.

Beijing wasted no time in responding: the Bank of China announced an investment plan of 140 billion dollars, confirming that the battle for AI supremacy is only intensifying.

These massive commitments demonstrate a deep conviction about the future evolution of AI

Three major waves have already succeeded:

- Predictive AI, which has fueled recommendation systems and financial forecasting;

- Generative AI, which has revolutionized text, image, and code creation.

- We are now entering the era of Agentive AI: systems capable of reasoning, planning, and executing tasks autonomously.

But the horizon of AI extends far beyond the virtual world. Ultimately, it will expand into the physical world. Autonomous vehicles, industrial robotics, and AI-optimized logistics are in sight, each requiring immense computing power to process real-time information.

The energy demand of future AI models is staggering: an advanced reasoning model could consume up to 600,000 times more energy than current simple tasks.

The volatility of the markets in recent weeks reflects the natural instability of a sector undergoing significant transformation. But if history teaches us anything, it is that these concerns, although legitimate in the short term, do not undermine the long-term trajectory.

We believe that, just like electricity and the internet before it, AI is going through a phase of maturation, weathering the criticism of skeptics while inexorably continuing its progress.

1. https://www.sequoiacap.com/article/ais-600b-question/

2. GPU (Graphics Processing Unit) Unité de traitement graphique