European sovereignty

A thematic to support Europe in strengthening its strategic autonomy, on top of the numerous stimulus plans on a European level.

Why invest in European sovereignty?

Recent events, such as the Covid and energy crises, due in part to geopolitical and other tensions, have brought to light Europe’s strategic weaknesses and its severe lack of autonomy in many critical areas.

For example, during the global pandemic, Europe experienced severe disruptions in key supply chains due to restrictions on imports of intermediate products. Such restrictions covered a broad spectrum, from active principals for making medicines to electronic chips.

Because of its severe dependence on external energy sources, Europe was also the hardest hit by the recent energy crisis, with record high gas and electricity prices.

Europe has moved strengthening its strategic autonomy to the top of its political agenda, with a large number of financial stimulus plans that are only just getting started.

ReArm Europe / Readiness 2030, EU Green Deal, Repower EU Plan, Cyber Resilience Act, EU Chips Act, and so on – these are just some of the spending plans set up on a European scale to fund the construction of a more autonomous Europe, while opening up new parallel market opportunities. To achieve this ambitious goal, private capital must also be raised and directed towards Europe’s strategic sectors.

Investing in Europe's future

Supporting companies in key fields

Our approach

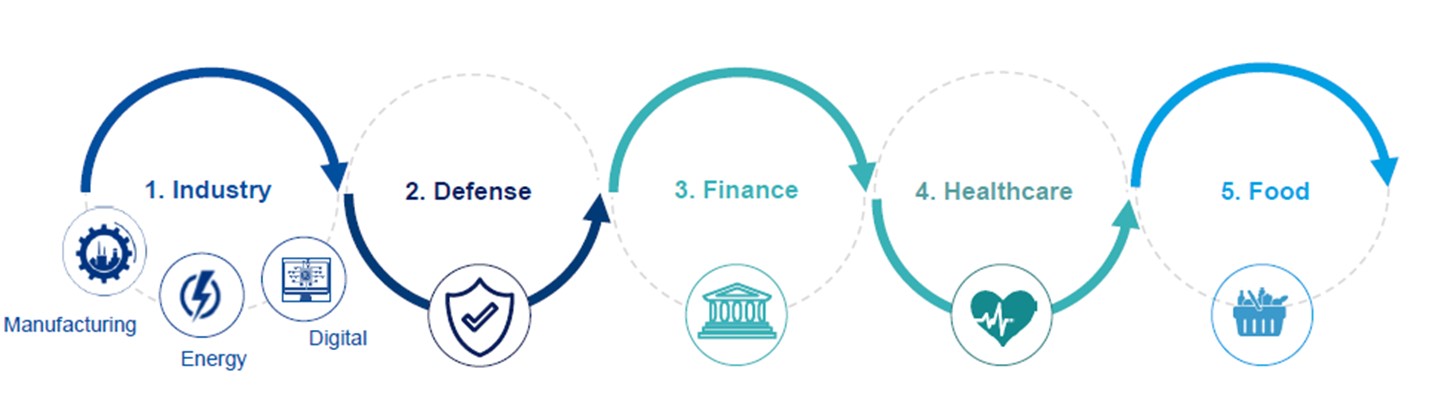

The strategy aims to help build a more resilient Europe while seeking out market opportunities arising from this thematic.

In so doing, its investment universe rests on five pillars, with each of them playing a crucial role in building a more autonomous Europe:

- Industry: manufacturing, digital technology and energy

- Food

- Finance

- Healthcare

- Defense

To join this universe, companies must be headquartered in a European Union member-state or in a signatory country to the European Economic Area (EEA) agreement.

Moreover, the strategy includes a sustainable approach through environmental, social and governance (ESG) criteria.

The main risks associated with this strategy are capital loss, counterparty risk, market and equity risk (including risk associated with small caps and emerging markets), liquidity risk, risk of performance relative to an equity market indicator, and risk associated with responsible investing. To find out more about the fund’s risk profile, please refer to its legal documentation.