Responsible Investing

We very early chose to be an actor of change by making Responsible Investing a hallmark of our strategies. This is part of our company's accountability to society and our fiduciary obligation to our clients.

Addressing our century's major challenges

CPRAM integrates Responsible Investment into all its asset classes. ESG Integration, Climate Solutions, and Impact Investment are all part of our sustainable philosophy.

We are constantly structuring ourselves around Responsible Investment and innovating to develop our strategies and methodologies as the quality of data improves, investor awareness increases, and the market on the whole matures.

Companies, investors and asset managers: all united around responsible investing

Companies, investors and asset managers are now taking on the same responsibility – to rethink our practices and shift them towards more models that are more virtuous for both the planet and society as a whole.

Responsible Investment is an approach that supplements traditional financial research with extra-financial research. Extra-financial research aims to manage all risks that companies are exposed to and, in so doing, to generate more sustainable returns.

Extra-financial research covers all Environmental, Social and Governance issues (ESG criteria), such as board independence, gender diversity, water management, the reduction of carbon emissions, respect for human rights, and others.

A committed asset manager

Attentive to support the management proposed by an active reflection around responsible investment, CPRAM sits at the Commission in charge of SRI (Socially Responsible Investment) within the Association Française de Gestion Financière (AFG).

Alongside its shareholder Amundi, CPR Asset Management has been committed since 2006 to the Principles for Responsible Investment ( PRI ), promoted by the United Nations Global Pact.

Since then, CPRAM has continued to strengthen its ambition to integrate Environmental, Social and Governance (“ESG”) criteria into its investment strategies as well as through engagement processes with issuers in order to to support them in their progress.

To implement its Responsible Investment Policy, CPRAM can rely on the Amundi group's considerable wherewithal to supplement its own resources. CPRAM fully adheres to the Amundi group's responsible investment, while laying out its own strategic orientations and developing management methodologies based on its investment philosophies and client profiles.

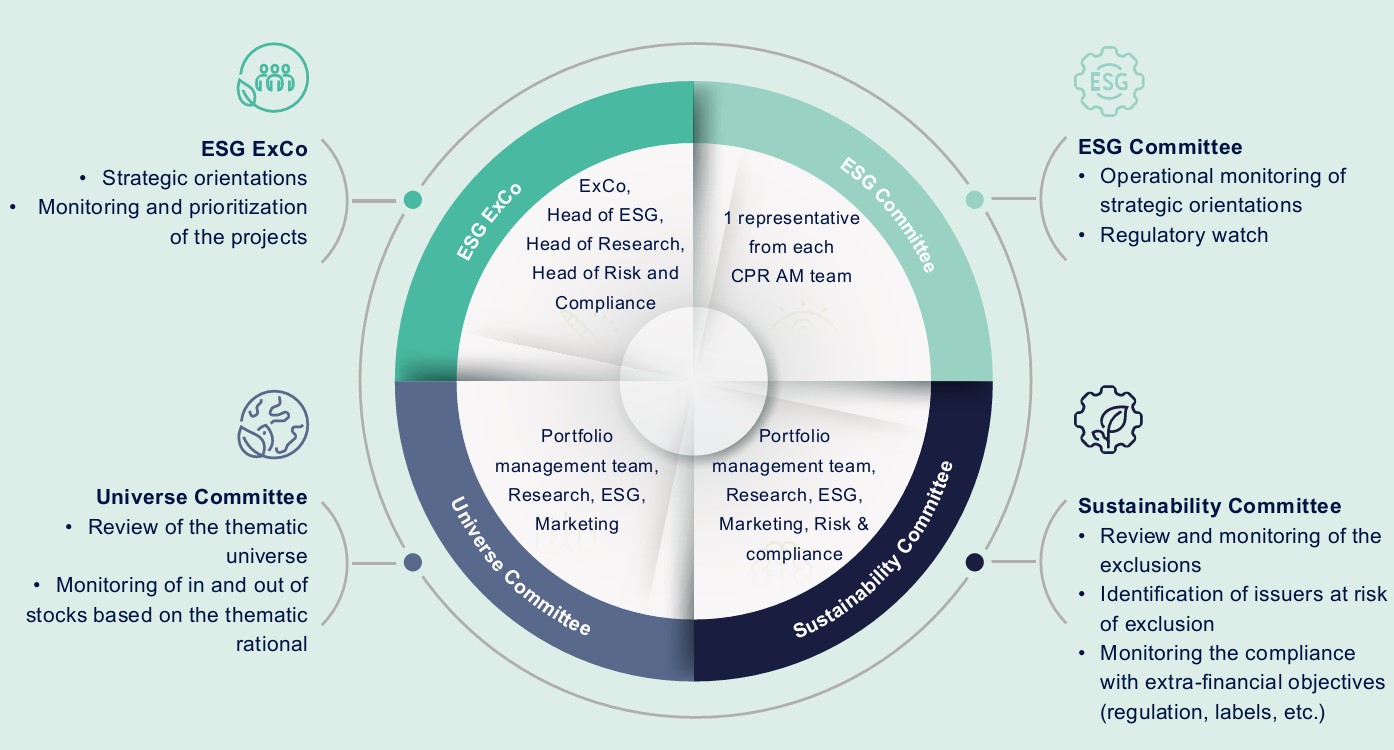

All CPRAM departments are involved in Responsible Investment. The dedicated ESG team and financial engineers of the Research team take part, among other things, in developing our ESG, impact investment and climate strategies in all asset classes.