Spain, a growth rate significantly higher than the European average

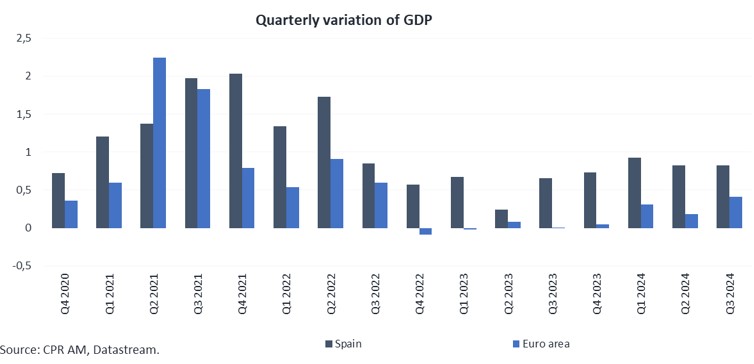

While the Spanish economy had suffered greatly from the Covid crisis, its post-2020 rebound is particularly impressive. Indeed, it has significantly outperformed the rest of the eurozone for the past 3 years, thanks to the strong momentum of the service sectors and the growth of its industrial activity. It is interesting to examine the reasons behind this good economic performance, to see the challenges faced by the Spanish economy, and to consider whether this outperformance will be sustainable.

Published on 10 December 2024

Spain has experienced three years of sustained growth

After being particularly affected by the Covid crisis (GDP contraction of 11.3% in 2020), due to the significant weight of the tourism sector in the economy, Spain experienced a slow start to its recovery. Household consumption and residential investment took time to recover, and GDP did not return to its late 2019 level until the second quarter of 2022, slightly after the eurozone. Since late 2021, Spain has been experiencing a growth rate consistently higher than that of the eurozone as a whole.

Spain largely escaped the energy crisis

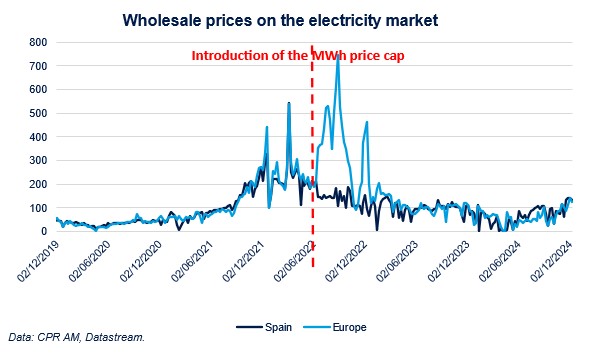

The country has been less exposed to the war in Ukraine and the resulting increase in gas and electricity costs than other European countries. Indeed, Spain and Portugal have requested an exemption from the electricity price-setting rule from the European Union due to delays in integrating the Iberian Peninsula into the rest of the European network.

Thanks to the "gas cap" at €40/MWh, Spain was able to cap the price of gas used in electricity production from June 2022. Therefore, it did not experience the price spikes in gas and electricity that the rest of Europe experienced at the end of 2022 and the beginning of 2023.

The country has benefited from the European recovery plan and the energy crisis to adopt ambitious objectives for the development of renewable energies, with the creation of solar and wind parks in sparsely populated central Spain. In 2023, the country produced over 50% of its electricity from renewable energy sources. Spain now positions itself as the second largest producer of solar and wind energy in Europe, behind Germany.

In September, the government adopted a new objective to increase the share of renewable energies in electricity production from 74% to 81% by 2030.

An inflation peak upstream of the eurozone

Spain experienced its peak inflation at 10.8% in July 2022, several months before the peak in the eurozone. Disinflation was faster due to the "inflation" measures that directly targeted energy and inflation prices. Household consumption took time to recover to pre-Covid levels but has proven to be more dynamic than in the rest of the eurozone since the beginning of 2023.

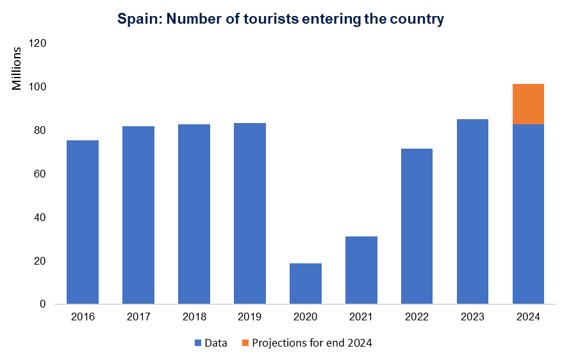

The tourism sector is breaking records

The tourism sector is key to the Spanish economy. In 2023, the tourism sector generated revenues amounting to over €180 billion, representing 12.8% of the Spanish GDP. It contributed to nearly 70% of the growth in 2023.

It employs 2.7 million employees, accounting for 12.6% of the active population, and has significantly contributed to recent job creation with nearly 100,000 positions created in 2023, representing 17% of the total job creations for the year. At the same time, the quality of employment has greatly improved with the disappearance of task-based contracts and the reduction of temporary employment (from 34% in 2019 to 8% in 2023), in favor of permanent contracts (from 64% in 2019 to 90% in 2023).

In 2024, the country reached new records in terms of foreign tourist arrivals and number of overnight stays. The sector anticipates a significant increase in revenues, exceeding €200 billion for the year 2024.

In recent years, the sector has faced "tourismophobia" from a portion of the population that experiences the inconveniences associated with mass tourism. In this context, a new challenge lies in improving its growth model by aiming for higher quality: greater added value of stays, higher visitor revenues, better distribution of tourist flows throughout the year and across different regions...

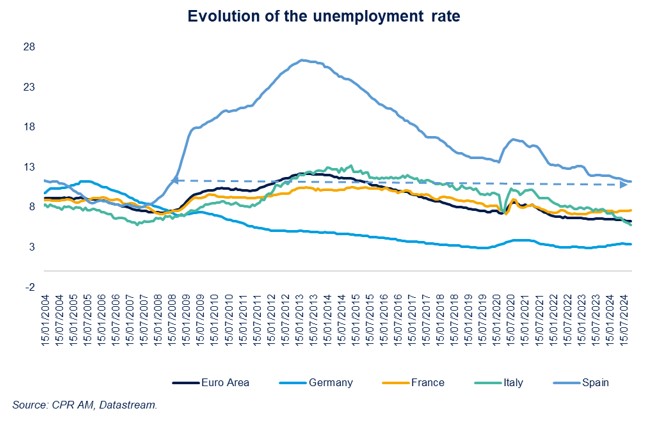

A clear improvement in the job market even though unemployment remains high

Even though Spain still has one of the highest unemployment rates in the eurozone (11.2% in October 2024 compared to 6.3% for the eurozone), the labor market has significantly improved in recent years. The labor market reform of 2021 has helped reduce the share of temporary contracts in favor of permanent contracts. The share of temporary contracts has thus decreased from 25.6% at the end of 2021 to 15.7% at the beginning of 2024, in line with the European average.

Furthermore, it should be noted that the Covid crisis did not impact this favorable trend thanks to the extensive use of partial unemployment (ERTE). The unemployment rate has thus returned to its 2008 level in 2024 and labor market participation has greatly increased.

A diversified industry

Like most European countries, Spain has faced a significant deindustrialization movement. The share of industry (excluding construction) in total value added has thus decreased almost continuously from the late 1980s to 2020, dropping from 20% to less than 14%. Despite a strong improvement in the value added of the sector between 2019 and 2022, reaching a peak of 16% of GDP, it has returned to around 14% in 2024. Spain is well below the European average (17%).

The non-construction industry employed 2.9 million people in the second quarter of 2024, and its workforce has been growing significantly compared to the low point recorded in 2014.

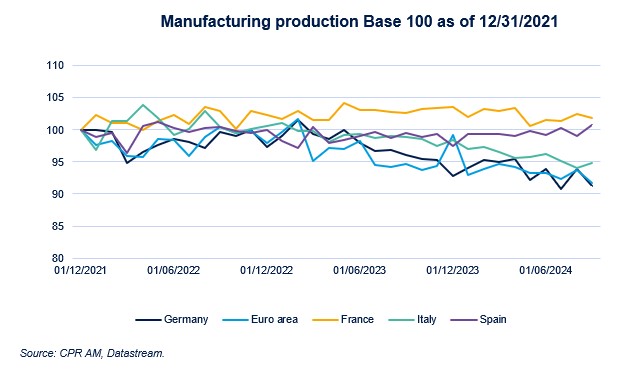

Since 2022, European industrial activity has decreased by nearly 10% due to a combination of several unfavorable factors, including rising energy prices hindering competitiveness and declining demand. Spain stands out in this landscape with production that has remained stable over the period.

The Spanish industrial fabric is distinguished by its diversification, with a strong representation of the production of consumer goods, agri-food and textiles in particular, followed by the automotive and transportation equipment sectors, and then pharmaceuticals and chemicals. With 2.2 million vehicles produced in 2022, Spain is the second largest automobile producer in Europe (13 million) after Germany (3.7 million).

One third of industrial sector sales are made through exports, with a large portion going to the European Union (65%). Export sales are particularly important in the automotive sector and other transportation equipment (almost 70% in 2022), as well as in pharmaceuticals (56%) or machinery and equipment (51%).

Investment plans

Spain is one of the major beneficiaries of the European Recovery Plan. It has been allocated €80 billion in grants and €83 billion in loans, which represents 11.1% of its GDP. Spain has already received €48 billion in grants in four installments and €340 million in loans. It has just requested a fifth installment.

The Spanish Recovery, Transformation, and Resilience Plan (España Puede) aimed to support the country's digital and climate transformation by increasing public and private investments (PERTE) in sectors with high growth potential.

In 2021, it was complemented by the Spain 2050 Plan, which presents the national strategy for the year 2050. It revolves around 9 major themes with 200 specific objectives. The goal is to increase investments to bridge the gaps that Spain still has compared to Europe in certain areas. Among the major challenges that Spain must confront are climate neutrality, reducing inequalities, increasing productivity, improving education and training levels, population aging, balanced territorial development, improving quality of life, and adapting the labor market.

Public finances

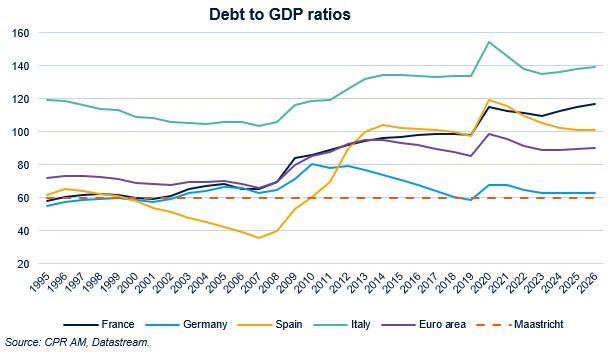

The Spanish public debt remains high (102% of GDP in 2024), but the country has almost returned to its pre-Covid debt level (98%), whereas it had peaked at 120% in 2020. Furthermore, the Debt/GDP ratio has stabilized, which is not the case for French and Italian debts. In its June 2024 Article IV on Spain, the IMF praised the continuous improvement of public finances and the authorities' commitment to budget discipline, despite the difficult political context.

The budget deficit is expected to reach 3% in 2024, down from 3.5% in 2023, thanks to the gradual withdrawal of "inflation" measures (reduction in fuel prices, reduction in electricity taxes, reduction in VAT on everyday consumer products). In its medium-term structural plan, Spain has requested an extension of the adjustment period from 4 to 7 years and plans to reduce the public deficit from 3.0% of GDP in 2024 to 0.8% of GDP in 2031, and the public debt from 102.5% of GDP in 2024 to 90.6% of GDP in 2031.

In exchange for this extension, Spain has committed to additional investments and reforms, particularly in the areas of immigration, housing, and improving the business climate. In November, the Spanish parliament approved the extension for an additional 3 years of the exceptional tax on banks implemented in 2022 on the 2022 and 2023 results. However, the tax that also affected energy companies for these two years was not extended. It allowed the state to collect €3 billion per year.

Challenges of the Spanish economy

If Spain has experienced strong growth in recent years, several vulnerability factors remain.

Firstly, a level of unemployment that remains well above the eurozone average despite the recent improvement in the labor market. Secondly, a high level of public debt, limiting budgetary leeway as European recovery plan resources will decrease in the coming years.

The low productivity of its network of small businesses, particularly in the agricultural sector, is one of the structural weaknesses highlighted by the IMF, as well as difficulties in housing accessibility.

Furthermore, the risk of political instability is high, with a minority government since November 2023 that can only pass reforms and budgets with the support of small regional parties.

The country is also one of the most vulnerable to the effects of climate change in Europe. In 2023, the government announced a plan of €12 billion for the country to cope with the more frequent and intense droughts it experiences. The October 2024 DANA phenomenon shows that the country is also vulnerable to extreme weather events that can have a significant impact on activity. The Bank of Spain estimates that the floods in late October 2024 should cost Spain 0.2% of GDP in the fourth quarter of 2024.

The latest business surveys anticipate sustained activity growth, surpassing that of the other three main economies in the eurozone by the end of 2024. A slowdown in growth is expected for 2025, mainly due to a negative contribution from foreign trade. Indeed, exports of tourism-related services have limited marginal growth capacity, overcapacity has been created in certain exporting sectors, and imports of consumer goods are increasing. While the outlook appears slightly less favorable for the Spanish economy today, it should be noted that it has positively surprised expectations several times in recent years.