Disruption

Disruption as an investment thematic consists in selecting companies identified as “disruptive” through their ability to take their place as dominant players, regardless of the sector in which they operate.

Why invest in disruption?

Disruption reshuffles the cards. Disruptive innovations upset the established order by transforming an existing or new market. Disruptive companies do so by offering simpler, more practical or less expensive solutions and manage to get consumers to adopt the massively.

Historically, disruption has been an intangible phenomenon, a barely perceptible trend in which changes are spread out over 100 or 150 years and that are not perceived by the same generation.

History has witnessed many disruptive innovations, such as the plough, the printing press, penicillin, the light bulb, the airplane, television, etc

The latest major innovations, such as the Internet, the Internet of things, robotics, autonomous cars, 3D printing, Artificial Intelligence, stand out in having proliferated at an unprecedented pace and with profound disruptions to our lifestyles, consumer choices and jobs.

While technological innovation is its main mover, this exponential acceleration is also being driven by a combination of other factors, including globalised trade, demographic trends, and environmental challenges.

Investing today in the world of tomorrow

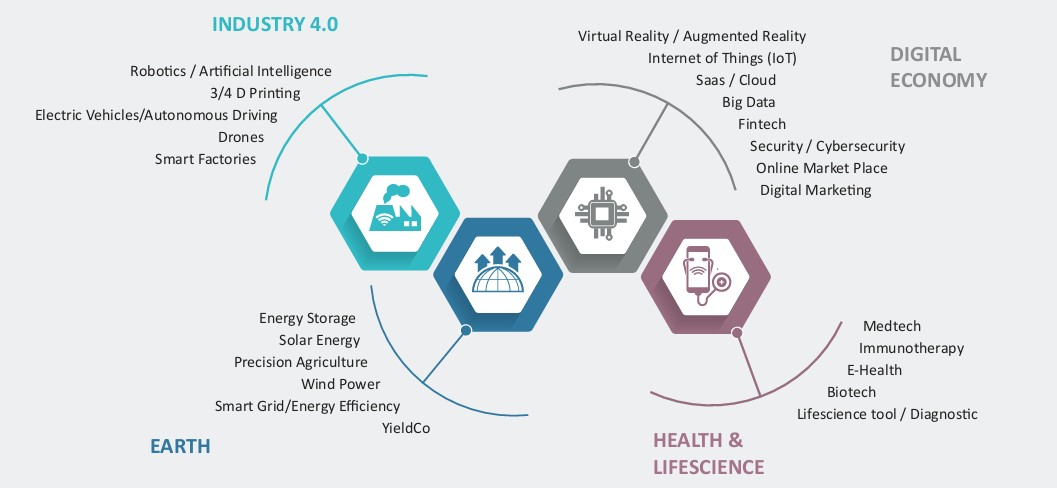

A glance at our disruptive ecosystem

Our approach

Disruption is showing up in all economic sectors. That’s why our investment universe takes a multi-sector approach that takes in the entire ecosystem surrounding the thematic and its growth potential.

Our approach addresses disruption in four dimensions:

The digital economy: sharing knowledge, saving time, reducing costs, and bringing people together. The digital economy is redrawing the contours of our economies and sectors. Digital technologies such as the internet, applications or the cloud are transforming consumer expectations and giving rise to new needs: purchasing habits, expectations regarding services, etc. For companies, this means better operational efficiency, but also addressing new markets and new customers.

Industry 4.0: efficient, smart and connected production and distribution. Industry 4.0 embodies a modern industrial revolution where industrial assets (factories, machines, cars, etc.) become intelligent and connected in real time. Automation and robotization enable the creation of autonomous production environments, optimize manufacturing processes, and enhance safety while increasing productivity.

- Healthcare & Life Sciences: enhanced medical research to improve the quality of life and prolong life expectancy. The Health and Life Sciences dimension has experienced many disruptions in recent years. The advent of artificial intelligence and new technologies underpin innovation in the sector and enable accelerated development of research (molecules, gene therapies) or new products in Medtech. These new technologies provide a better understanding of different pathologies, improve patient care and quality of life, while reducing healthcare costs.

- Planet: regenerating natural resources and generating green energies. The world is facing major challenges: climate change, loss of biodiversity or waste treatment are all challenges to be met in the fight against global warming. The global economy is consuming more and more natural resources and the energy crisis we are going through is a perfect example. To meet these needs, innovative companies are developing and bringing with them much-needed innovations.

To be exhaustive and to diversify the profile of portfolio stocks, the investment universe of 700 shares includes both companies that are purely disruptive and those that have adjusted their business models to the new market configuration.

The main risks incurred by this strategy are the risk of loss of capital, equity risk, interest-rate risk, credit risk, and exchange rate risk. To find out more about the fund’s risk profile, please refer to its legal documentation.