Economic Environment - 5 takeaways from summer 2025

The summer of 2025 was not marked by a particular crisis on the markets, unlike what has happened in recent years. Nevertheless, a number of important events have occurred that could affect the coming quarters. Here we summarize 5 points to remember for the future.

Published on 3 September 2025

Head of Research and Strategy, CPRAM

Senior Strategist , CPRAM

Strategist, CPRAM

Trade war: already a new tariff schedule

The trade war was obviously one of the hot topics of the summer of 2025. And, as has been observed since the return of Donald Trump, the summer period has been marked by many (and often surprising) announcements and multiple reversals.

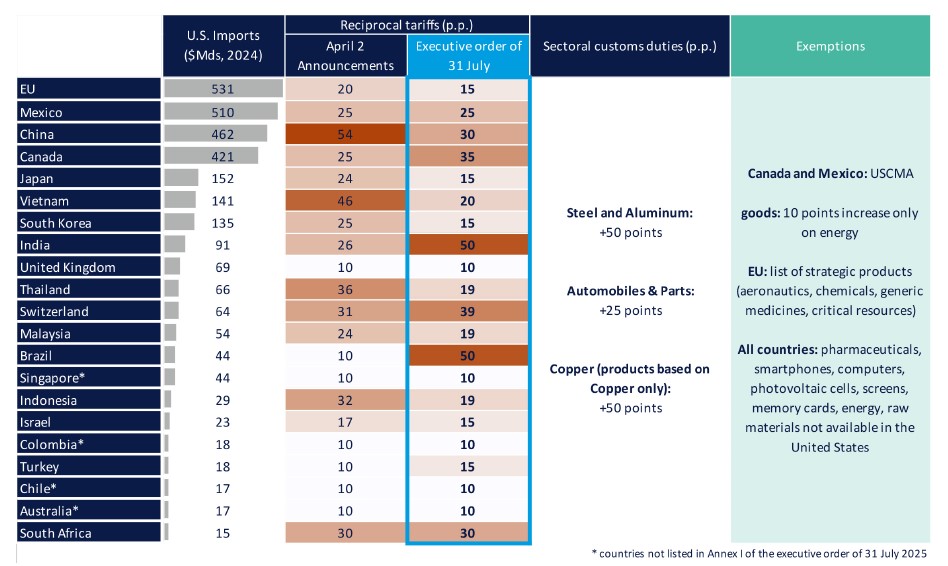

After extending the negotiation period, Trump finally signed an executive order on July 31 adjusting the level of the "reciprocal" tariffs announced on April 2 at the "Liberation Day" ceremony. Despite the trade agreements concluded at the last minute with their main partners (the EU, Japan and South Korea in particular), the level of customs duties applied by the United States has been revised upwards overall. Excluding China, the Peterson Institute now estimates the average level of tariffs on US imports at 20.4%, compared to 3% previously. The extremely rapid growth in customs revenues, which are expected to total $300 billion in 2025 according to Scott Bessent, testifies to this paradigm shift.

The trade agreement concluded between the EU and the United States at the end of July provides for customs duties of up to 15% on most European products. The joint declaration of 21 August specifies the provisions. As of 1 September, generic pharmaceutical products and their components, aeronautics, and certain natural resources benefit from a special most-favoured-nation (MFN) tariff regime. Cars and their components will see their customs duties reduced from 27.5% to 15%. The EU has refused the US administration's requests to review its digital regulations, but Donald Trump returned to the attack on 25 August, complaining that the European digital regulation unfairly targeted American multinationals. This included threats to restrict exports of U.S. advanced technology and semiconductors, and to raise tariffs in retaliation for digital services taxes on U.S. companies. Ultimately, while the trade agreement of 27 July avoids the scenario of a full-blown trade war, US trade policy will nevertheless remain a factor of uncertainty for the European economy.

As far as China is concerned, the truce has finally been extended in order to continue negotiations and lead to a potential meeting between Presidents Trump and Xi by the end of the year. While both parties are showing goodwill (in particular through the lifting of the respective restrictions on chips and rare earths), Chinese products remain heavily penalised by the new US trade policy: customs duties now at 58%, anti-circumvention measures, removal of the "de minimis" exemption on low-value parcels, etc. Beijing seems less isolated than before, because Trump's position has hardened significantly vis-à-vis other major economies in the South. This is particularly the case in Brazil (due to the prosecution of Jair Bolsonaro), India (due to its links with Russia) and South Africa. The BRICS are therefore largely targeted.

The last few weeks seem to be painting the contours of a new backdrop and have thus made it possible to partially remove the extreme uncertainty that caused the markets to fall in the spring. However, the trade war led by the US administration is certainly far from over, and several announcements of sectoral customs duties are expected, for example on pharmaceutical products and furniture. Moreover, its effects on the global economy are only just beginning to be noticeable.

In Europe, the ECB begins a pause, peace negotiations in Ukraine resume and the political situation becomes more uncertain in France

After 7 consecutive rate cuts, the ECB kept its key rates unchanged on 24 July, leaving the deposit rate at 2%, which is roughly in line with the ECB's estimate of the level of the neutral rate for the euro zone. Christine Lagarde explained that the episode of high inflation triggered by the war in Ukraine was now behind us (the last three inflation figures were at or slightly below) and she described the ECB's new positioning as "wait and watch", thus giving herself time to assess the impact of the new trade measures on the European economy to decide on a possible new move. However, the fact that the ECB believes that risks to the European economy remain bearish leaves the door open for another rate cut later in 2025.

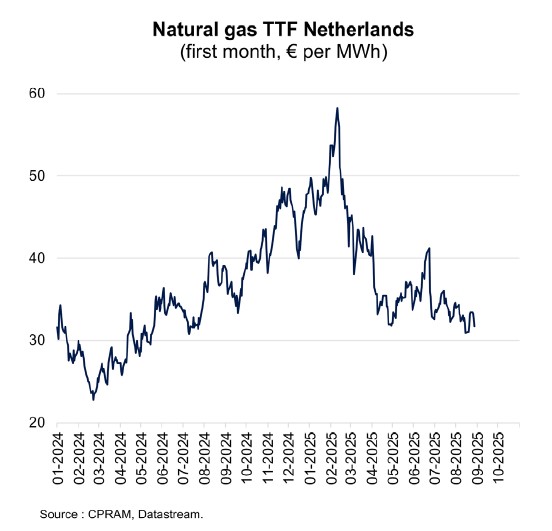

In addition, the summer of 2025 was marked by the intensification of discussions for a ceasefire agreement between Ukraine and Russia, which led to a meeting between Putin and Trump on August 15 in Alaska. Russia has so far refused to make concessions on the annexation of occupied territories and security guarantees to Ukraine. However, the intensification of discussions on the diplomatic front contributed to a new episode of falling European gas prices in August. The gas TTF reached €30.9/MWH on 15 August, its lowest level since May 2024. A more significant drop in energy prices is a positive element for the European economy and for the energy-intensive sectors in particular, chemicals, construction, automotive, metallurgy, etc. By the way, it is remarkable that the Eurozone manufacturing PMI returned to expansion territory in August for the first time in more than 3 years. Conversely, European defence stocks, which have had an exceptional stock market performance in recent years, had a more bumpy run in August and profit-taking.

Finally, French Prime Minister François Bayrou announced on 24 August that he was holding his government accountable during a vote of confidence on 8 September on the preparation of the 2026 budget. October budget discussions for 2026 were likely to revive the political risk of the fall of the Bayrou government during parliamentary discussions from mid-October, which appears earlier than expected. The probability of a fall of the Bayrou government now seems high and could lead either to the establishment of a minority technical government or to early parliamentary elections. The France-Germany spread has widened and its volatility is expected to remain high in the coming weeks. The prospect of a general election could lead to additional tensions on the spread.

Fed: Donald Trump's big project...

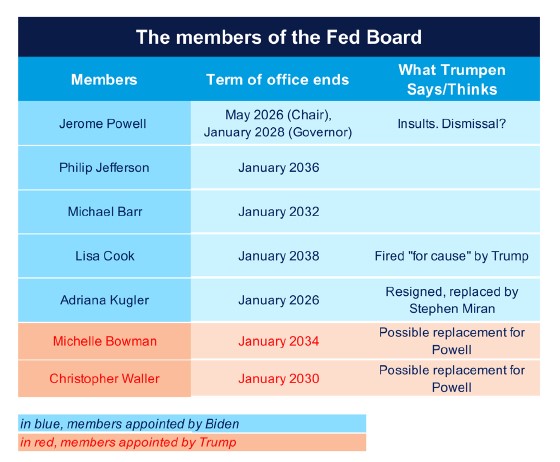

If the summer has been particularly hot for one institution, it is the Fed. No, the Fed has not lowered its key rates, which remain at 4.25%/4.50%, but it is clearly at the center of attention with the major reshaping of the institution undertaken by Donald Trump.

Dissatisfied with the Fed's monetary status since December 2024, Donald Trump seems determined to drastically change the composition of the Fed's Board. It should be remembered that the Board is made up of 7 members, who are appointed by the president before being confirmed by the Senate. First, Trump has cast doubt on whether he can fire Jerome Powell. He exerted strong pressure on him by coming to inspect the renovation work of the Fed while a Republican congresswoman asked the Department of Justice to investigate the budget overruns of this project. Public talk of possible replacements for Powell has been recurrent. Following the resignation of Board member Adriana Kugler on August 1, Trump appointed Stephen Miran (not yet confirmed), who is expected to support rate cuts. Finally, Trump fired board member Lisa Cook on August 25 for alleged irregularities in her mortgage applications. Even if this decision is expected to be challenged by the person concerned, the Board could quickly have more members appointed by Trump than by Biden.

In the shorter term, the Fed's policy will be greatly affected by developments in the US labour market. While the job reports of May and June were correct, the July one radically changed the situation by indicating that job creation had, in fact, been only 35,000 per month over the last 3 months (2nd highest monthly revisions over the last 40 years!). In his speech at the Jackson Hole conference, Jerome Powell opened the door to a rate cut in September, saying that "downside risks to jobs" had increased and could translate into "much higher layoffs and higher unemployment." A very interesting point is that Powell also explicitly says that the Fed's central scenario is that tariffs will only have a temporary effect on inflation, with a "one-off" increase in the price level: there is a clear prioritization of the objective of full employment over that of price stability. We can therefore envisage a series of key rate cuts.

In the United States, a stock market summer dominated by tech

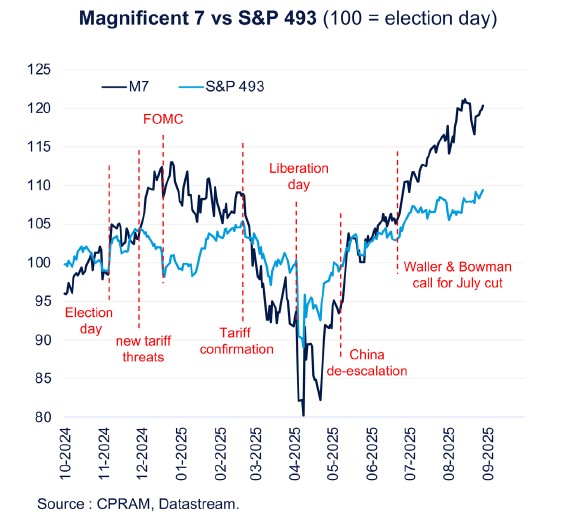

The S&P 500 rose 4.3% in July and August, reaching a new all-time high on August 14. However, it is important to note that this index has risen mainly thanks to mega- caps: in aggregate, the "Magnificent 7" have risen by 8% while the rest of the index has only risen by 2.5%. Their share in the S&P 500 has returned to 35%, the highest level on record.

This difference in performance is largely explained by the fact that the profits of the "Magnificent 7" continue to grow at a rate of close to 30% per year while those of the other companies in the index are only growing at a rate of about 6% per year. Their share of total profits for S&P 500 companies is now 26%, up from just 15% at the beginning of 2023. Such an accumulation of profits has simply never been seen in recent decades.

Once again, the public cloud giants raised their forecasts for capital investment in the deployment of artificial intelligence-related infrastructure in Q2 releases, propelling the semiconductor sector to the top of the sector performance over the summer. On the software side, the observation calls for more nuance: the publication of GPT-5 by OpenAI has revived concerns about the ability of AI to make traditional software solutions obsolete. Since the beginning of the year, the sector has recorded a median performance of between -3% and -4%.

That being said, the positive stock market momentum of the tech giants was disrupted in mid-August by the publication of an MIT report on the use of generative AI by companies ("State of AI in business 2025") showing that they are still struggling to increase their profitability with this technology. While the report does say that generative AI can improve individual productivity, it indicates that companies generally do not yet have the right approach to take advantage of it. This report, along with scattered valuation statements, caused tech stocks to fall slightly while the rest of the stock market continued to rise. Jerome Powell's more dovish speech at Jackson Hole, however, stabilized the tech sector on the stock market. This has also benefited small caps, with the Russell 2000 performing much better in July/August than the S&P 500 and the Nasdaq.

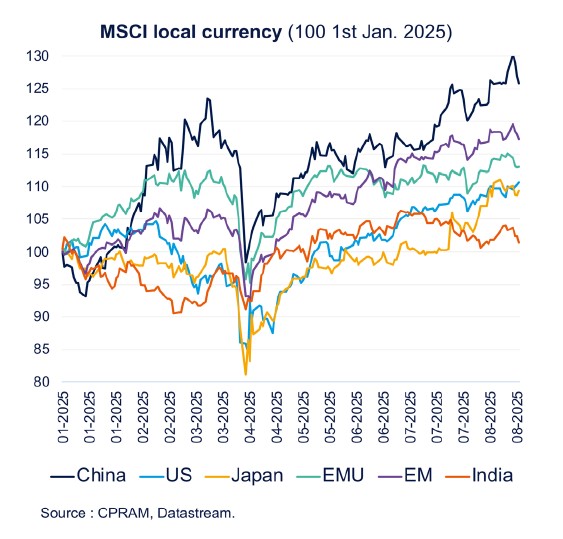

In addition, geographically, it is worth mentioning the very good performance of Chinese equities during the summer of 2025, with the anticipation of additional support measures (see later in the text) and of Japanese equities with the US-Japan trade agreement and the depreciation of the yen. On the other hand, Indian equities were penalised by the sharp increase in customs duties decided against India.

China: the economy shows new signs of slowing down

After being driven by foreign trade in the first half of the year, China's economy has recently shown clear signs of slowing down. While the NBS explains this dip in particular by climatic events (floods and heat peaks), the trade war is certainly not for nothing. These developments seemed to remobilise the authorities, who have remained very wait-and-see in recent months.

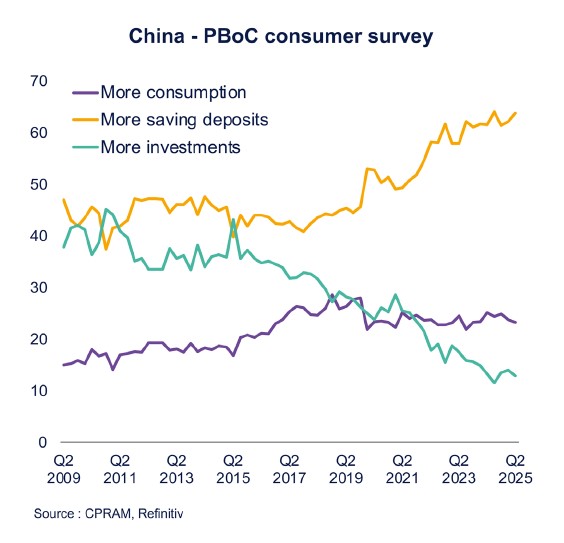

Already mixed in June, China's macroeconomic figures for July clearly sent a negative signal. The latest PMIs thus show the weakness of activity: the "production", "new orders" and "exports" components have started to fall again, while employment remains very deteriorating and expectations at low levels. Against the backdrop of the trade war, the search for new outlets is fuelling deflationary pressures: in July, the CPI was still stagnating around 0% and the PPI was down -3.6% year-on-year. The contraction in bank loans in July - a first since 2005 - also signals that demand has run out of fuel. Household morale remains at an all-time low, according to the PBoC survey. Particularly worried about the employment situation, the majority of them remain inclined to save (64% according to a recent PBoC survey) rather than to consume or invest. Although still stimulated by subsidy programs, consumption has stalled. Retail sales have fallen over the last 2 months and the previous figures have been revised down sharply. Worse, property prices have fallen again after a short-term stabilization.

Beyond these alarming findings, the good news is that Beijing seems to be taking the measure of the situation. In July, the Politburo set the tone by maintaining a pro- growth tone and insisting on the need to rebalance China's industrial policy and strengthen support for the "new productive forces" dear to Xi Jinping. The fight against increased competition (described as "enormous waste of social resources" by the CCP at the beginning of July) and overcapacity in certain sectors took on a new dimension during the summer through the "anti- involution" campaign and is expected to gain in scope. In line with the guidelines at the beginning of the year, the authorities have also announced measures to stimulate consumption - in particular through an increase in household disposable income. Some are linked to structural issues (birth bonus, tuition fees, seniors with disabilities), while others are of a transitory nature, such as subsidies on new bank loans. While these announcements seem smaller in scope compared to the current (and future) issues facing the Chinese economy, they nevertheless acknowledge the continued support of the authorities - a necessary if not sufficient condition and they have enabled the Chinese equity market to achieve the best performance during the summer of 2025.