European defense

An investment strategy aimed at financing the development and modernization of European defense capabilities while benefiting from the long-term growth potential of the defense sector.

Why invest in European defense ?

Strategic autonomy has become a major priority for Europe, in the face of global challenges, just like the energy transition or the mastery of digital technologies. The war in Ukraine and the strategic realignment of the United States, in particular, have accelerated Europe's desire to strengthen its military independence.

With 800 billion euros, the Rearm Europe / Readiness 2030 plan marks a turning point due to its scale and scope. This aligns with the EU's desire to strengthen its sovereignty in key areas, similar to the post-Covid recovery plan (Next Generation EU).

The objective is twofold: to fill an investment gap estimated at 1.8 trillion euros, in relation to NATO recommendations, since the end of the Cold War, and to prepare Europe to defend itself autonomously, without relying on the United States.

At the national level, some countries like Germany and France have also strengthened their budgetary policies and support for this sector, which is once again considered strategic.

The defense industry positions itself as a vector of progress. Indeed, innovations in the defense sector often have spillover effects in our daily lives. The same goes for drones, largely developed by defense players, which now find various uses, ranging from delivery to photography.

A four-dimension investment universe covering the entire defense value chain

Our approach

The strategy aims to contribute to the development of Europe's defense capabilities by investing in companies active in sectors that have a direct or indirect link to the entire defense value chain.

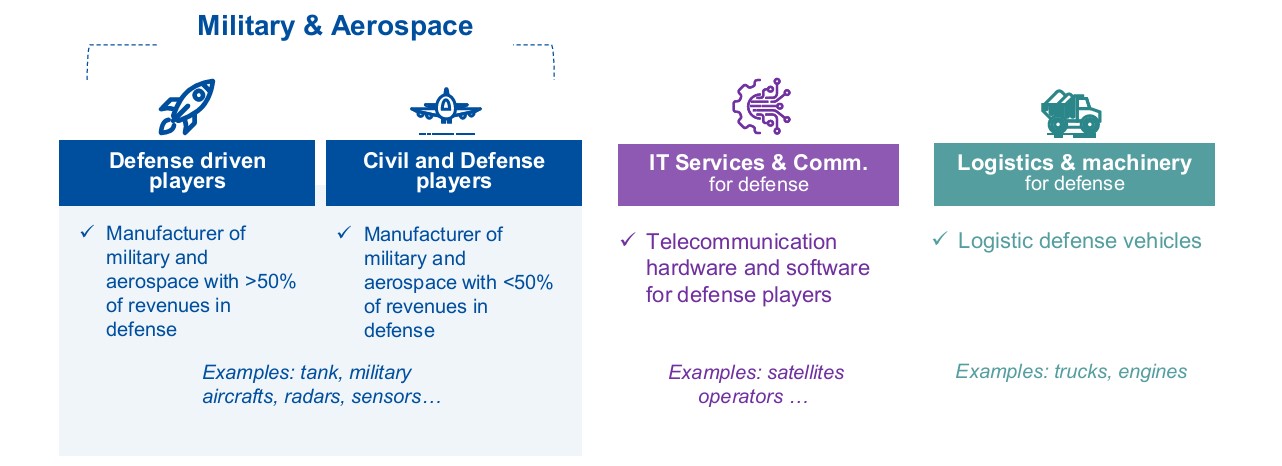

In order to cover all the stakeholders in the theme, the management team has established 4 pillars:

- Specialized defense actors: companies whose revenue is primarily related to defense.

- Civil and defense sector actors: companies mainly dedicated to civil activities but with a portion of their revenue linked to defense.

- Information and communication services for defense.

- Logistics and machinery for defense.

To enter this sector, companies must have their registered office in a member state of the European Union – or in another state that is part of the agreement on the European Economic Area (EEA).

The investment process incorporates a responsible approach through environmental, social, and governance (ESG) criteria and aims to achieve a better rating than its benchmark universe. Furthermore, in accordance with our policy of normative and sectoral exclusions, the strategy does not invest in issuers generating more than 5% of their revenue related to unconventional weapons, depleted uranium weapons, or nuclear weapons.

The main risks associated with this strategy are the risk of capital loss, counterparty risk, market and equity risk (including the risk related to small-cap stocks and emerging markets), liquidity risk, performance risk compared to an equity market benchmark, and risks related to responsible investing. It is advisable to refer to the fund's legal documentation for detailed information on its risk profile.