Hydrogen

Why invest in hydrogen?

The climate emergency has brought forth strong commitments on a global scale to decarbonise our economies by 2050.

To to limit CO2 emissions, we have no other choice than to limit our use of fossil fuels. Such decarbonation will require electrifying the economy.

Hydrogen looks like one way to do so.

Decarbonated hydrogen – which is generated from renewable energies – is a solution now being studied worldwide.

By 2050, it could help reduce emissions in sectors such as heavy industry and transport, where it is difficult or not cost-effective to replace fossil fuels with electricity.

To meet the need to electrify the economy, a solution must be found to the problem of intermittency in renewable energies, that is, the power they produce is not necessarily available at the time, or at the place, it is needed.

To mitigate intermittency, hydrogen can be used as an energy vector:

- to store and transport renewable electricity produced intermittently; and

- to replace sources of carbonated energy in hard-to-decarbonate

industries.

Investing today in the hydrogen industry means supporting:

- a global awareness of the climate challenge;

- major advances and innovations in hydrogen technologies and components;

- the steady decline in cost of producing hydrogen; and

- solid financial support from public- and private-sector players.

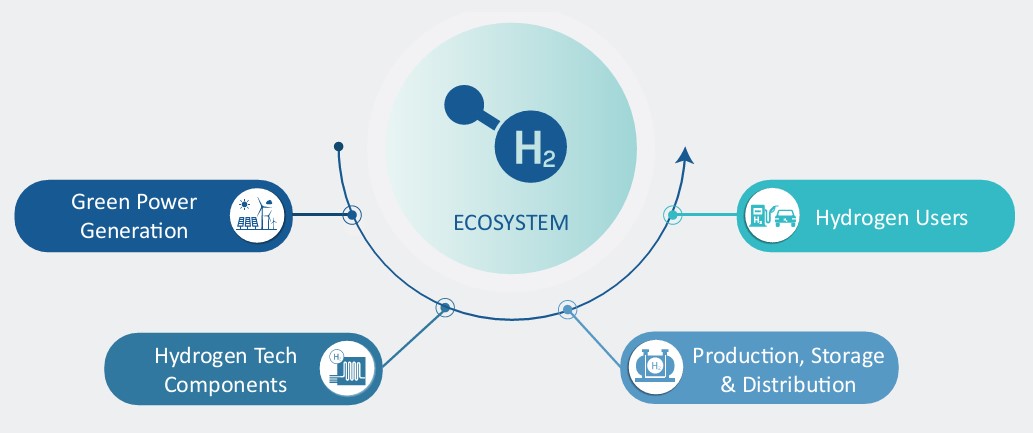

A four-dimensional investment universe covering the entire value chain

Our approach

Our strategy aims to support the transition towards the large-scale production and deployment of hydrogen.

To cover all of this emerging thematic, our investment universe addresses the entire hydrogen value chain around four dimensions.

- The first pillar – renewable energy production – covers producers of renewable energies (solar, onshore wind and offshore wind), which supply the electricity on which hydrogen production will be based.

- The second pillar – technologies & components – seeks to finance companies that develop the technologies used to produced decarbonated hydrogen from water electrolysis and renewable power. During the transition phase, decarbonation of hydrogen production through carbon capture is worth a look.

- The third pillar – production, storage and distribution – covers established hydrogen companies, including gas companies, manufacturers, agro-chemical companies, transporters, etc., which already use carbonated hydrogen and must adjust their business models to meet the decarbonation targets.

- And the fourth pillar – end users – is expanding gradually as the cost of hydrogen declines and as solutions such as transport expand.

Our investment strategy takes a responsible approach by excluding companies with the poorest records or that encounter ESG controversies.

Moreover, our strategy targets greater carbon intensity than its investment universe. This is still high as companies active in these thematics have historically had high carbon intensity, particularly in the manufacturing and utilities sectors. It is by acting on these companies’ emissions that the carbon intensity of economic activity will be reduced significantly by 2050.

The main risks incurred by this strategy are the risk of loss of capital, equity risk, interest-rate risk, credit risk, and exchange rate risk. To find out more about the fund’s risk profile, please refer to its legal documentation.